Confidence crisis in financial sector deepens

Bangladesh's financial sector is struggling to win back people's trust mainly due to the deterioration of some key indicators amid a lack of good governance, irregularities and lighter punishment for wrongdoers, according to analysts.

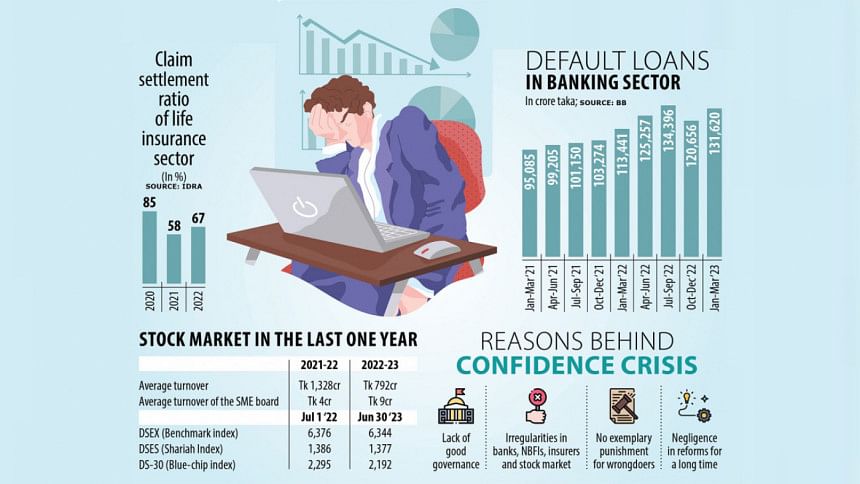

Banks and non-banking financial institutions are facing mounting non-performing loans (NPLs), while the claim settlement ratio in the insurance sector is far below the global average.

Similarly, market capitalisation of the stock market remains at a low level as the number of listed companies is small and investors' participation is falling amid persisting uncertainty.

The financial sector has been in bad shape at a time when Bangladesh plans to become a developed nation by 2041. The situation has prompted analysts to recommend the government focus on putting the financial sector on the right track so that it can contribute properly to the country's development journey.

Zahid Hussain, a former lead economist of the World Bank's Dhaka office, thinks the confidence crisis is stemming mainly from a lack of corporate governance and regulatory governance.

He said the lack of corporate governance is causing a drop in asset quality. For instance, related party loans among the directors of banks are rising day by day but those funds are not extended following due diligence.

"How can people trust that their funds are being utilised professionally and ethically when they see it?"

"Furthermore, when people see that regulators are allowing the non-compliance of financial institutions, the confidence crisis aggravates."

Hussain cited that the central bank recently deferred provision shortfalls worth about Tk 50,000 crore involving 16 banks for a period of up to nine years.

"It encouraged good lenders to get involved in bad practices. If the financial sector keeps suffering from the confidence crisis, it might be a cause for a middle-income trap for Bangladesh."

With the healthy growth of the economy, people's income will rise, which will give them more scope to save.

But Hussain thinks if savers do not keep the funds in banks, stock markets or insurance companies, how will investment be financed.

"So, the government should work on stopping the source of the confidence crisis—lack of governance—in order to help Bangladesh become a developed nation."

Faruq Ahmad Siddiqi, a former chairman of the Bangladesh Securities and Exchange Commission, echoed the same sentiment, saying the whole financial sector is suffering from a confidence crisis mainly due to the lack of good governance.

He thinks in the banking sector, the struggle sometimes comes from mismanagement, indiscipline, irregularities, rescheduling, and default loans.

"Some people have just eaten up the funds of banks so their NPLs rose."

The banking sector is burdened with a higher NPL, which stood at Tk 131,621 crore in March, up 16 per cent from a year earlier, data from the Bangladesh Bank showed.

The NPL accounted for 8.8 per cent of the banking sector's total outstanding loans of Tk 14,96,346 crore.

The insurance sector is not faring well as its settlement ratio against claims has been far below the expected level while the return on investment has been dismal.

"This is evidenced from the low stock price of the listed firms," said Siddiqi.

The claim settlement in the life insurance sector stood at 67 percent in 2022, meaning 33 percent of claims remained unsettled, according to the data of the Insurance Development & Regulatory Authority.

In the non-life insurance sector, the claim settlement ratio was even lower, at 33.44 percent last year.

"As a result, people's trust in the insurance sector has been low," said Md Main Uddin, a professor of the Department of Banking and Insurance at the University of Dhaka.

A floor price has led to the creation of a barren equity market since there are fewer buyers. Both intermediaries and investors are worried about the direction of the market as economic uncertainty shows no sign of disappearing.

Owing to the floor price, which does not exist anywhere in the world, investors are unable to sell their shares, while intermediaries such as brokers and merchant banks are struggling to generate a decent income.

Average turnover at the Dhaka Stock Exchange came down to less than Tk 600 crore in the past one year, way lower than Tk 1,475 crore in the previous year, according to the DSE data.

Of the 397 listed companies, more than 200 have had their stocks stuck at the floor price with no trade taking place over the past year.

The number of beneficiary owners accounts dropped 5 percent to 17.44 lakh over the past year, according to the Central Depository Bangladesh Ltd.

The DSE's market capitalisation-to-GDP ratio is 17 percent, while it is more than 60 percent at the Bombay Stock Exchange, according to the premier exchange of Bangladesh.

Despite their trading debuts, the bond market is still at a nascent stage, Prof Main said.

Siddiqi said corruption is spreading in all aspects of the financial sector because wrong-doers don't receive exemplary punishment. Many embezzlers flee from the country when they see that the government is taking action against them or cases are being filed.

The business sector has been in a difficult situation owing to the dragging impacts of the coronavirus pandemic and the Russia-Ukraine war. However, the former chairman of the BSEC thinks corruption has aggravated the problems in all sectors.

"Today's situation has been the result of negligence in ensuring good governance for a long time."

He warned that if the ills in the financial sector are not addressed on a priority basis, they will hit the economic progress of the country hard in the upcoming years.

Prof Main said although all aspects of the financial sector are facing a confidence crisis, the banking sector is comparatively in a better shape.

He said banks' main problem lies in higher NPLs, but people still have confidence in them and the sector is providing around 85 percent of funds to entrepreneurs.

He calls the confidence crunch in the stock market an old issue because manipulation is rife.

"People don't believe that their funds in the markets are safe."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments