As dollar jumps, old inflation battle to get tougher in new year

After a four-month lull, US dollar prices made an abrupt jump in December, making imports more expensive and pushing up business costs.

Businesspeople and economists said that a further strengthening of the greenback would have a ripple effect on essential prices, further complicating the ongoing battle against inflation.

"The price of all imported essentials will increase shortly due to the rising dollar price," said SM Mujibur Rahman, head of accounts at the industrial conglomerate Meghna Group of Industries (MGI).

Bangladesh has long been struggling to curb inflation, which has remained above 9 percent since March 2023.

To lower the price pressure curve, the central bank has hiked the policy rate five times this year to 10 percent.

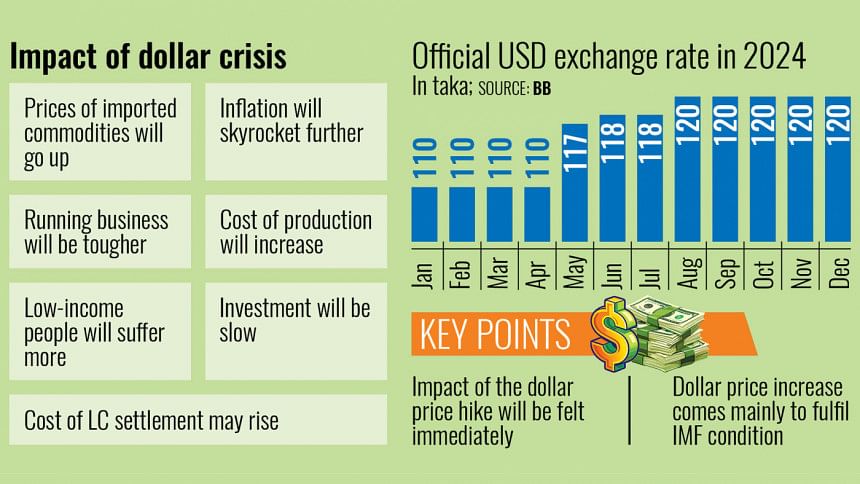

Besides, a crawling peg exchange rate was introduced in May this year, allowing banks to buy and sell US dollars freely within a mid-range of Tk 117.

But Rahman said they are currently opening letters of credit (LCs) at Tk 126 per dollar, while this rate could fluctuate further during settlement.

Bangladesh relies heavily on imports for a wide range of food essentials, including edible oils, lentils, onions, sugar, and spices. These items have been selling roughly 5 percent higher than a year ago.

Usually, poor and middle-income individuals are vulnerable to price increases in widely consumed food items.

To offer the vulnerable groups better protection and stabilise the local market, the government has announced duty and value-added tax (VAT) cuts on many food essentials.

But Rahman said a stronger dollar could undo the impact of these tax cuts.

He estimated that the increase in the dollar rate has led to a 45 percent decline in real income over the past two years.

Echoing similar views of Rahman, Zaved Akhtar, managing director of Unilever Bangladesh, said the sudden and sharp depreciation of Taka would have immediate consequences for businesses and the overall economy.

Since business plans and assumptions depend on currency forecasts, businesses find it challenging, if not impossible, to modify and adapt their strategies in the near term, he said.

"In addition, given our country's import dependency, inflation is now unlikely to abate soon and the cost of operations is likely to rise," he added.

He also said companies with foreign currency exposure will face increased cost exposure.

"Needless to say, micro, small and medium enterprises will find it difficult to run as the cost of funds continues to rise," Akhtar added.

Although the crawling peg allows banks to buy and sell dollars at Tk 120, the actual exchange rate is now between Tk 125 and Tk 127, according to Ferdous Ara Begum, chief executive officer of the private sector think-tank Business Initiative Leading Development (BUILD).

She said the crawling peg has not worked well because banks are running the system differently.

To cushion the dollar jump, she added that the Bangladesh Bank (BB) might need to raise the policy rate again.

Begum said that due to high exchange rates, exporters cannot reap the benefits as they have to open import LCs at higher rates.

She noted that while the BB is trying to address demand-side issues, supply-side issues also need to be addressed properly.

Md Moshiur Rahman Dalim, head of business at Akij Steel and Akij Cement, claimed that pricier dollars would cause the cost of production to rise by at least 2 percent.

According to him, the construction materials manufacturing industry would suffer losses as a result of the recent dollar jump and the already stagnant construction business would face further trouble.

According to Dalim, the steel and cement industries are currently running at only 45 percent of their capacity due to low demand. "Under these conditions, the construction industry will suffer even more."

Monjurul Alam, chief executive officer at Beacon Medicare Ltd, said the drug-making sector would also face trouble due to the further appreciation of the dollar against the local currency.

"Despite a rise in the cost of production due to pricier raw material imports, we will not be able to increase the price of finished products as it requires approval from the Directorate General of Drug Administration," he said.

In addition, we may lose institutional tender sales abroad as competition will increase, he added.

"In this situation, we need strong government support for pharmaceutical companies to survive the competition," he said.

M Masrur Reaz, chairman and chief executive officer of the Policy Exchange of Bangladesh, said the dollar price increased suddenly as the central bank began purchasing dollars to increase its foreign exchange reserves to fulfil the conditions of the International Monetary Fund (IMF).

Besides, the central bank has asked commercial banks to clear their overdue LCs, prompting banks to buy dollars at higher rates.

However, the appreciation of the dollar was unexpected amid stabilised rates over the past 5 to 6 months, commented the economist.

This type of situation immediately affects investment and business in the long-term, he said, adding the midterm impact includes more inflationary pains.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments