Our inflation quagmire

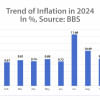

Inflation refuses to budge. Part of the reason may be honest disclosure of what the data is saying. That of course does not help ease the pain, especially for low income families whose earnings growth is well behind the inflation rate. The main culprit is food inflation. Non-food inflation receded to 9.4 percent after peaking at 9.7 percent in August. Food inflation rose to 13.8 percent in November, the highest in the last five years.

Such a steep rise in food inflation cannot be explained by demand side forces. Diagnosing the reasons behind it is made hard by nondisclosure of the key proximate drivers of food inflation in the Bangladesh Bureau of Statistics (BBS) publication. We can guess perhaps rice and vegetables played a big role as floods in August damaged production just as the farmers were getting ready to harvest the crops. But floods alone may not be the full story. Nor are factors such as the exchange rate, which has been fairly stable, or import controls which have been removed.

It is clear that market management has failed despite all the good intentions. Allowing imports and tax reductions have also not yielded the desired results, at least not yet. What is going on? Who is pocketing the benefits? The authorities have limited their efforts to market policing rather than management. Policing is useful for deterring extortion in supply chain. That is not where policing is paying attention.

A question bugging everyone's mind may be why inflation is so resilient despite hikes in the interest rate and a contractionary monetary policy. A contractionary monetary policy came into effect only since August. It usually takes 6 to 12 months for interest rate increases to percolate to reducing inflation. The component of inflation that is supposed to be most sensitive to demand side forces is non-food inflation. In this context, the 30 basis points decline in non-food inflation rate since August should encourage the Bangladesh Bank (BB) to stick to the contractionary stance.

The BB is faced with a "damned if you do and damned if you don't" type of situation. Providing liquidity support to distressed banks to protect their depositors is causing money creation. If it cannot be sterilised, the contractionary stance will be diluted. Time will tell whether the sterilisation through issuance of BB bills will work to the extent desired.

Opportunists may raise their voice to let go of contractionary monetary policy saying it has failed. Such a conclusion is extremely premature. If the fire brigade is unable to extinguish the fire, you don't let it burn, remove the brigade, and pour more oil into the fire. The sensible thing to do is to complement the fire fighters with all other fire extinguishing tools. In the context of food inflation, those other tools are different approaches to market management: policing extortion in supply chains, ensuring competition and preventing collusion in wholesale markets.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments