Inflation eases to single digits in January

Inflation in Bangladesh eased for the second consecutive month in January, driven by stable food prices due mainly to an abundant supply of winter vegetables to the local market.

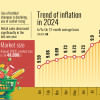

The country's Consumer Price Index fell to 9.94 percent in January from 10.89 percent in December, according to data released by the Bangladesh Bureau of Statistics (BBS) yesterday.

Food inflation saw a notable decline, dropping to 10.72 percent in January from 12.92 percent in December. This reduction comes as an influx of seasonal vegetables helped stabilise prices, providing relief to consumers.

However, non-food inflation edged up slightly, rising to 9.32 percent in January from 9.26 percent in December, indicating continued price pressures in other sectors.

Consumer Price Index fell to 9.94 percent in January from 10.89 percent in December

In November, overall inflation stood at 11.38 percent, marking the second-highest level in the last 14 years.

Although overall inflation has been declining for the last few months, consumers in Bangladesh have been struggling with persistent inflationary pressures over the past two years, with inflation remaining above 9 percent since March 2023.

In this context, Finance Adviser Salehuddin Ahmed said yesterday that the country's inflation is expected to decline to a tolerable level within the next three months.

"We will take several measures in February, March, and April to curb inflation," he said after a meeting of the Cabinet Committee on Government Purchase at the Secretariat in Dhaka.

"If inflation can be brought down to 6 percent to 7 percent by June, the interim government will consider it satisfactory."

The 12-month annual average inflation rose to 10.34 percent in January from 9.59 percent a year earlier, according to official data.

"This [decline] was driven notably by an improvement in food production—especially seasonal vegetables—which is reflected in the drop in food inflation," said Ashikur Rahman, principal economist at the Policy Research Institute of Bangladesh.

Furthermore, given that imports picked up substantially in December, there is a likelihood that supply chain disruptions are gradually easing, which should aid in managing inflation, he said.

"However, this level of inflation is still very high and is causing hardship for people with fixed incomes or those living below the poverty line," Rahman added.

Accordingly, Bangladesh Bank needs to remain committed to a contractionary monetary policy, while the interim government must ensure that supply chain disruptions are avoided in the future by addressing issues related to law and order, collusion in the commodity market, and extortion in the transportation sector, Rahman suggested.

The finance adviser emphasised that inflation cannot be reduced overnight and requires coordinated efforts.

"We have held discussions with Bangladesh Bank and commercial banks. They have assured us that the required US dollars will be made available to facilitate imports of fuel, fertiliser, rice, and edible oil," he said.

The commerce ministry is also engaging with business leaders to stabilise prices, he added.

Meanwhile, inflation had outpaced wage growth for 36 months until this January, despite wages increasing gradually since January 2021.

As a result, many low-income and unskilled workers in Bangladesh's agriculture, industrial, and service sectors have been compelled to reduce their consumption, as rising inflation has eroded their real incomes over the past three years.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments