DSE welcomes budget but investors don’t

The Dhaka Stock Exchange (DSE) welcomed the proposed national budget for fiscal 2024-25 even though certain measures could further deteriorate investor confidence as the market has been facing a bear-run for the past four months.

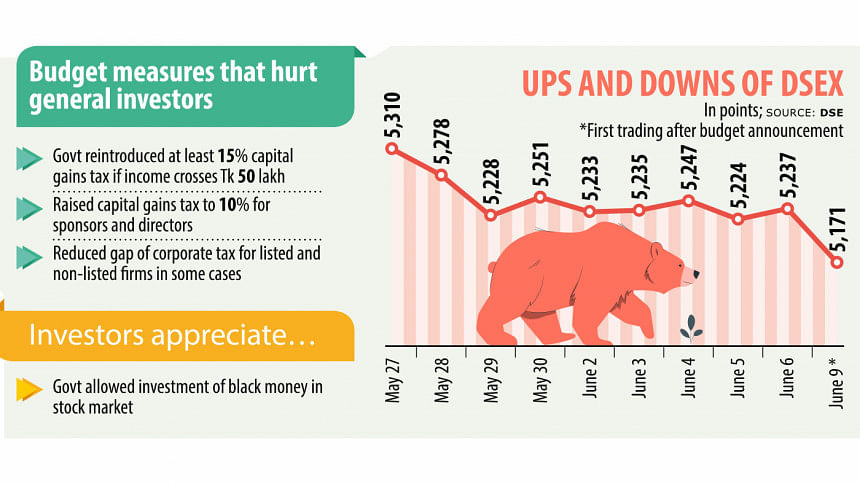

For example, the National Board of Revenue (NBR) has proposed reintroducing a tax measure for large investors and reducing the corporate tax gap between listed and non-listed companies in some cases.

The one positive for investors is that the government included a provision that would allow the use of undisclosed income for purchasing stocks by paying 15 percent tax.

However, the move could have little effect on revitalising the market in the past as it was seen that black money holders do not prefer parking funds in stocks when the amnesty was in place.

This is because the stock market is a riskier investment compared to bank deposits or real estate, according to experts.

Still, the country's premier bourse issued a press release on June 7 welcoming the budget, saying that it would guide the economy towards enhanced development and productivity.

However, the DSE did not mention anything about the government's decision to reinstate capital gains tax of at least 15 percent on investors' income of more than Tk 50 lakh.

After the measure was announced, most market analysts urged the government not to impose it for now as they fear it will hurt the market further amid the ongoing bear-run.

Yesterday, the first trading day since the proposed budget was unveiled last Thursday, the DSE's benchmark index DSEX plunged by 1.25 percent to a 38-month low of 5,171 points.

Similarly, the DSES, an index that represents Shariah-compliant companies, dropped by 1.4 percent to 1,120 points while the DS30, comprising blue-chip stocks, declined by 1.21 percent to 1,835 points.

A top official of a stock brokerage said the capital gains tax will impact large investors.

So, these investors are now shaky about keeping their funds in the market, which is already risky to invest in. And although small investors will not be impacted by the capital gain tax, the selling pressure from large investors may affect them, the official added.

"We are not against the capital gain tax, but this is not the right time as it will spread a negative sentiment among investors while the market has been suffering for the last four years," said Md Saiful Islam, president of the DSE Brokers Association of Bangladesh.

The situation has only intensified in recent months as major market indices have been falling continuously. So, the move may fuel the negative sentiment among investors, he added.

The benchmark index of the DSE dropped by more than 17 percent, or 1,000 points, over the past three months, DSE data showed.

But even if the tax is reinstated, the tax-free limit on capital gains should be at least Tk 1 crore.

Besides, the NBR needs to clarify whether it will allow investors to adjust previous capital losses with their capital gains when calculating the tax due, Islam said.

He also expressed disappointment with the DSE for not playing a proper role in supporting the market.

"Since independent directors are running the stock exchange, the DSE is not playing its role properly in favour of stock investors and brokerage houses," Islam said.

"In most cases, the DSE does not talk in favour of investors when it should. Rather, it remains silent and tries to please the government," he added.

Against this backdrop, Islam urged the DSE to act for the interest of investors as their funds have been being squeezed for months on end.

Prof Hafiz Md Hasan Babu, chairman of the DSE, did not respond to phone calls or text messages for a comment on the issue by the time this report was filed.

Turnover, an indicator of the volume of shares traded, nosedived by 34 percent to Tk 357 crore yesterday as the market saw a scarcity of buyers.

Among the stocks traded, 33 advanced, 340 declined and 19 remained unchanged.

The decline of Square Pharmaceuticals dragged down the DSEX the most, with the company's reduced share value draining six points alone. Meanwhile, Beximco Pharmaceuticals followed suit with its shares claiming four points, according to LankaBangla Securities.

Preferring anonymity, a top official of the DSE said although the imposition of capital gains tax will not impact general investors, they are panicked by the move for fears that large investors will shift their funds to the money market instead.

As the yield rate of treasury bonds is above 12 percent and may rise further, large investors have less incentive to keep funds in the equity market, which is full of risks of fund erosion.

So, the capital gains tax will further disincentivise them from keeping fund in the stock market.

Pointing to how this fear is logical, the official said the market has been falling for the past few months due to huge selling pressure from foreign investors.

"Now if large investors come to the queue, then the stock market indices will be hammered massively," the official added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments