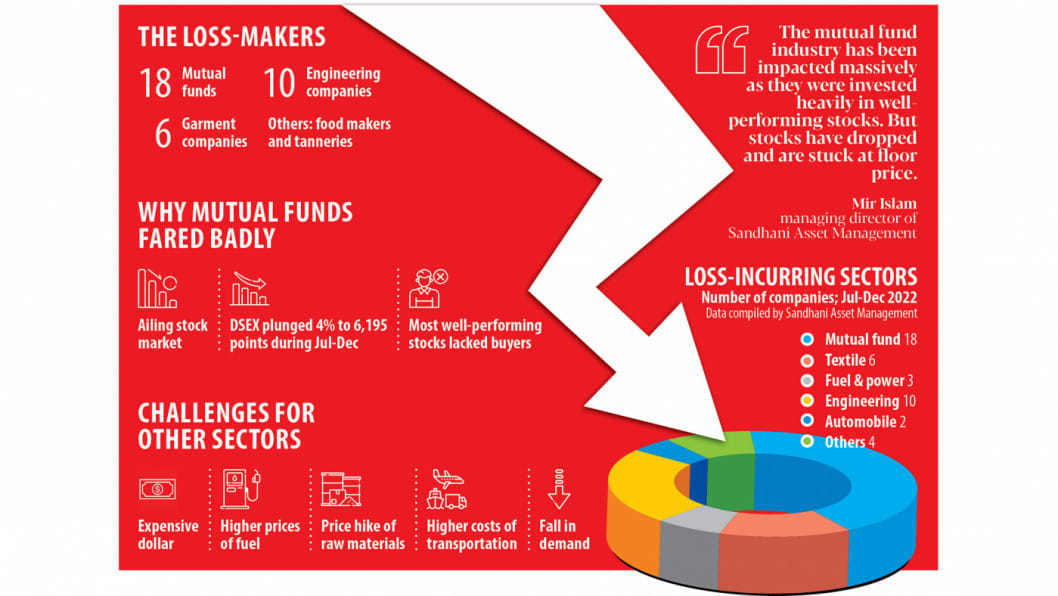

Economic crisis sends 43 listed firms, mutual funds into losses

At least 43 listed companies and mutual funds fell to losses in July to December of the ongoing financial year after reporting profits in the identical half a year ago.

A massive depreciation of the local currency against the American greenback, higher prices of raw materials and fuel, and lower sales amid escalated inflationary pressure have been blamed by the companies for the loss.

Some 218 companies listed on the Dhaka Stock Exchange (DSE) have published their financial report for the first half of 2022-23. Of them, 43 firms reported fresh losses, according to the data compiled by Sandhani Asset Management.

Among the companies, 18 are mutual funds, 10 firms are from engineering sector, six are from garment industries, and three are from the power sector. There are also food makers and tanneries.

Owing to the current economic volatility, big names such as ACI, GPH Ispat, Runner Automobiles, and BSRM Ltd incurred losses in July-December.

For example, GPH Ispat, a steel maker, posted Tk 84.79 crore loss in the first half of FY23, way down from a profit of Tk 94.93 crore in the July-December of FY22.

BSRM Ltd, the country's largest steel manufacturer, reported a loss of Tk 110.18 crore for July-December, reversing from a profit of Tk 242.15 crore in the first half of FY22.

Other companies that also suffered losses in the two quarters compared to a year ago include Legacy Footwear, Apex Tannery, Safko Spinning Mills, Prime Textile Spinning Mills, Rahim Textile Mills, and Golden Harvest Agro Industries.

Twenty-two companies remained in the red.

"This is a combined effect of Covid-19 and the global commodity crisis, the Russia-Ukraine war, the depreciation of the local currency, higher prices of raw materials and the fall in demand," said Anis A Khan, an executive member of the Bangladesh Association of Publicly Listed Companies.

No sooner had the severe impacts of the coronavirus pandemic gone away than the global economy was handed a fresh blow after the war broke out in February last year.

The conflict hit the already battered global supply chains. As a result, a global energy crisis surfaced and the global commodity market turned volatile.

Bangladesh's economy was not spared as an unprecedented import cost in the last fiscal year meant the foreign exchange reserve came under pressure. The strain has continued in the current financial year as well.

So, the foreign exchange reserves dropped 19 per cent to $33.83 billion in the first half of FY23, Bangladesh Bank data showed.

As a result, companies have been experiencing persisting difficulty in importing capital machinery and raw materials. On top of that, the local currency depreciated to a large extent so raw material prices also went up, said Khan, also a former managing director of Mutual Trust Bank.

The taka weakened by about 14.5 per cent in July-December of FY23 because of US dollar shortages. Since the war began, the currency has lost its value by about 25 per cent, making imports expensive.

As the war-induced crisis drags on, most of the companies felt the pinch in recent quarters. In fact, around 70 per cent of the listed companies in Bangladesh either suffered losses or witnessed lower profits in the July to December period.

"Some of them saw fresh losses while some logged lower profits. This is a cascading effect," Khan said.

"Consumption fell amid the high inflationary pressure. As a result, the profits of all the companies were impacted."

In Bangladesh, inflation has stayed at an elevated level since the conflict began.

The Consumer Price Index was up 8.71 per cent in December and the trend is expected to continue throughout the fiscal year since the war-induced bottlenecks show no sign of going away.

The mutual fund industry has been impacted massively in the first half of the fiscal year as they were invested heavily in well-performing stocks. But the stocks have dropped and are stuck at the floor price, said Mir Islam, managing director of Sandhani Asset Management Ltd.

Mutual funds pool money from investors to channel them into securities such as stocks and bonds. Depending on the profits earned, investors are paid dividends.

At the end of July, the Bangladesh Securities and Exchange Commission (BSEC) set the floor price of every stock to halt their fall amidst global economic uncertainty.

In December, the regulatory measure was lifted for 169 companies, mostly small capital-based firms that have attracted insignificant investments from mutual funds.

Most of the mutual funds had to keep a huge provision against the unrealised losses stemming from the lower prices of the stocks they have invested into, so their profit was hit, Islam said.

The DSEX, the benchmark index of the Dhaka Stock Exchange, dropped 4 per cent in July-December, data from the premier bourse of the country showed.

The companies that are more import-dependent such as garment manufacturers bore the brunt of the costlier US dollar since the latter has made procurement of raw materials from international markets expensive.

In August, the government raised the prices of diesel and kerosene by 42.5 per cent. Petrol price saw a 51.16 per cent jump and octane became dearer by 51.68 per cent. The moves have driven up both energy bills and transportation costs, thus the overall cost of production.

Now, most companies are trying to follow austerity measures to keep their head above water and hoping that the situation would improve soon, said Khan.

But it remains to be seen whether their hope would translate into reality since the war-induced uncertainty is still there, said an analyst.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments