Economy to see muted recovery in 2025

Will smaller rotis at roadside eateries return to their previous regular size next year? Will a Tk 500 note again fill up the shopping bag holding kitchen items? Or, will several lakh graduates, who have been poring over newspaper recruitment advertisements, finally get their jobs in 2025?

Unfortunately, economists cannot say for sure whether 2025 will be better than the previous year, or worse than the current state.

Rather, they turn to politicians for answers about the extent of political certainty in the new year.

But why are economists unable to answer questions relating to their own field?

One reason, they say, is that the interim government's reform spirit has somewhat lost steam in the economic arena.

As political agendas now occupy a large chunk of reform efforts, economists believe the economic recovery in 2025 could be muted compared to what was expected after the political changeover in August 2024.

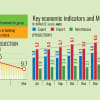

However, the International Monetary Fund (IMF), a multilateral lender overseeing reforms and subsequent corrections to the country's macroeconomic gauges since the approval of its $4.7 billion package in January 2023, sees a brighter future for Bangladesh.

"From next fiscal year [FY 2025-26], we expect everything, the growth momentum, to start transitioning, rebounding to better days Bangladesh used to have in the past," said IMF mission chief Chris Papageorgiou in the third week of December 2024.

Despite having several disagreements, both the IMF and Bangladeshi economists agree on the need for political stability to drive recovery.

But the reality differs. The latter part of 2024 saw various political parties and groups take to the streets with different demands.

Against this backdrop, Chief Adviser of the interim government Professor Muhammad Yunus hinted in a speech that the next national elections might be held at the end of 2025 or the beginning of 2026, albeit after essential reforms are carried out.

Although the government has taken several reform initiatives for the economy, consolidated steps are yet to be seen, according to economists.

And, these efforts are not bearing any effective result, they said.

For instance, the central bank raised policy rates five times in 2024 to curb inflationary pressure, but there is no concrete initiative to sort out issues plaguing the kitchen market supply chain.

The Awami League government has left power, but extortion still remains a cause of rising goods costs, admitted Finance Adviser Salehuddin Ahmed. "The long-time powerful government is no longer in power, but unnecessary middlemen in the market are still there."

Therefore, raising interest rates and reducing duties on imported goods is not effectively reducing current double-digit inflation, which has been hovering above 9 percent since March 2023.

Central bank Governor Ahsan H Mansur expressed hope that the inflation rate would decrease to 7 percent by June 2025, and 5 percent by fiscal year 2025-26.

Zahid Hussain, a former lead economist of the World Bank's Dhaka office, said reducing food inflation is a key challenge, while non-food inflation has already started to decline due to the Bangladesh Bank's contractionary policy.

Inflation rose to 11.38 percent in November, the highest in four months. Food inflation soared to 13.80 percent, up from 12.66 percent a month ago.

Non-food prices edged up to 9.39 percent from 9.34 percent the previous month, according to the Bangladesh Bureau of Statistics (BBS).

If Boro production and other agricultural production met expectations, import activities were not disrupted, and big conglomerates did not create problems, food inflation could decrease, Hossain said.

However, there is little hope for a good macroeconomic situation in the coming year, according to the economist. "The political situation remains uncertain."

Besides, the bureaucracy is not fully functional yet. Normalcy has not returned to many institutions, even though top bosses have been changed, he said.

Hossain said there is a positive sign in the foreign exchange reserve outlook as remittances have increased following reforms in the exchange rate and controls on capital flight.

In the July-November period of FY25, remittance earnings stood at $11.13 billion, a 26.4 percent increase from $8.80 billion in the same period of the last fiscal year, according to the Bangladesh Bank.

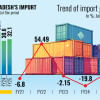

He said that there is some relief as the current account deficit has reduced and the financial account surplus has improved due to higher exports and remittances.

"However, the overall balance still has a significant deficit, but it is expected to see some improvement in the balance of payments as the SOFR [Secured Overnight Financing Rate] has dropped."

According to Hossain, external challenges remain, as a potential increase in tariffs by the US could impact exports.

Regarding GDP growth, he said that achieving a growth rate above 3-4 percent may not be possible. If this can be achieved, it would be a good outcome.

"A political resolution, which does not necessarily indicate holding an election, could improve the GDP growth rate," said the economist.

He believes that without a political resolution, political uncertainty will drag on, creating an unfavourable environment for private investment.

Professor Selim Raihan, executive director at the South Asian Network on Economic Modeling (SANEM), said uncertainty prevails in economic management. Besides, an uncertain political atmosphere and a slack law and order situation is leading to confusion among businesses.

Overall, a rapid economic recovery is uncertain as the business climate has not improved remarkably. Besides, the cost of finance has risen due to the central bank's reduction in money supply to control inflation, said Prof Raihan.

He said other measures to reduce inflation, such as kitchen market management, are not appropriate.

Meanwhile, the government's focus on economic recovery has somewhat fizzled out, with attention shifting towards political stability, even though the interim government has taken several steps to address the economy's primary crisis.

"I don't see the economy recovering soon, nor will inflation be tamed. Political priorities are taking precedence over economic ones," he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments