Power purchase deal expired: Electricity companies feeling the pinch as plants closed

Listed power generation companies of Bangladesh have started to feel the negative impact of the expiry of power purchase agreements with the government.

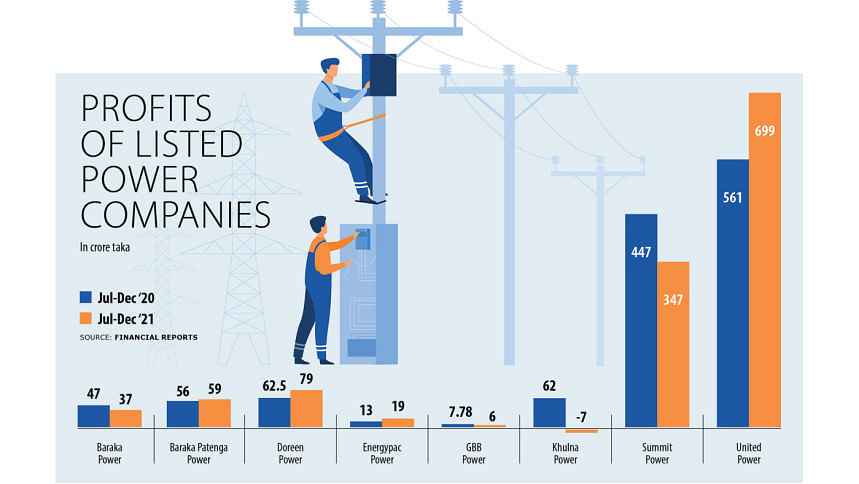

Of the eight listed power companies, four logged higher profits, one incurred a loss and the rest registered lower profits in the first half of the current financial year of 2021-22.

Khulna Power Company Ltd (KPCL) incurred a loss of Tk 7 crore during the period. It had made a profit of Tk 62 crore in the same period a year ago.

KPCL's revenue was zero during the July to December period against Tk 341 crore previously, according to the company's financial reports.

Due to the closure of operation of all of its power plants, no revenue was earned, leading to the losses.

The commercial operation of KPCL-II and KPCL-III has been suspended since the expiry of the tenure of the power purchase agreement in May last year.

The production of KPCL-I stopped in 2018 and no extension was granted since then.

The listed power generation companies are doing the business following a fixed-income model of selling power to the government, and many of them are going to face expiry of the tenure, said Mir Ariful Islam, managing director of Sandhani Asset Management Company.

"So, the share price of some of the companies remains low despite higher earnings," he said, adding that investors should be cautious while making investments and consider the agreement period.

Even if the government extends the tenure, it might be on the basis of the power supplied to the national grid, instead of the generation capacity, so the earnings of the companies will not be much higher, said Ariful.

Some other companies are also heading to the expiry of the agreements.

The profits of Summit Power dropped due to the closure of three plants—Madanganj Power Plant (Unit 1), Chandina Power Plant (Unit 2) and Madhabdi Power Plant (Unit 2).

The profits were down 22 per cent at Tk 347 crore in the first half of 2021-22. The process is underway to have the agreements of the plants renewed, according to the company.

The profits of some companies fell due to the expiry of the agreements, while others observed ups and downs due to business factors, said Mohammed Monirul Islam, chief financial officer of Baraka Patenga Power.

The company's profits rose to Tk 59 crore in the recent six months, against Tk 56 crore during the same period a year ago.

It has a gas-based power plant in Sylhet and its tenure is expected to expire in 2024. "We are hopeful to see an extension," Monirul said.

He says people are now talking about the overcapacity of power generation whereas the situation was the opposite 14 to 15 years ago.

At present, the installed power generation capacity of Bangladesh is 22,066 megawatt. The actual generation was 8,945 megawatts at day and 9,867 megawatts at night on Sunday, according to the data of the Bangladesh Power Development Board.

As per the roadmap of the government, which aims to turn Bangladesh into a developed nation by 2041, the country will need huge power, so the present capacity is aligned with the development vision, said Monirul.

Due to the coronavirus pandemic, the country's industrial growth has slowed, so the overcapacity is looking bigger, he said.

"If the planned economic zones start operations and electric vehicles hit the roads as per the government's plan, the demand for electricity will be much higher."

Among the power generation companies, United Power Generation registered the highest profit of Tk 699 crore in the first half of the financial year. It was Tk 561 crore in the same period of the previous year.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments