Export diversification still in slow lane

Bangladesh's plans aimed at diversifying export baskets are yet to bring about the expected results as the priority sectors are not enjoying most of the benefits promised in the Export Policy for 2021-24, according to entrepreneurs.

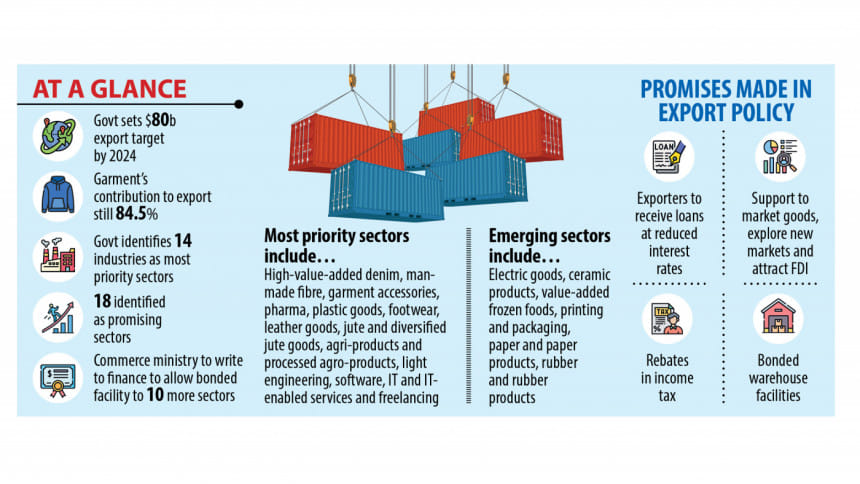

This means the garment sector continues its domination in the national export basket: apparel shipment accounted for 84.50 per cent of the country's overseas sales in the July-March period of the ongoing financial year.

When the government unveiled the new Export Policy, it identified 14 sectors as the most priority ones considering their immense potential.

The sectors included high-value-added denim items, manmade fibres, garment accessories, pharmaceuticals, plastic goods, footwear (leather and non-leather), leather goods, jute and diversified jute goods, agri-products and processed agro-products, fruits and cut flowers, and light engineering products (auto-parts, bicycles, motorcycles and batteries).

In the services sector, software, informational technology and IT-enabled services, and freelancing have been recognised as the most priority sectors.

Eighteen sectors have been named as special emerging sectors, including electric and electric goods; ceramic products; value-added frozen foods; printing and packaging; cut and polished diamond and pieces of jewelry; paper and paper products; rubber and rubber products; woollen goods; handicrafts; and lungis and handloom products.

Tourism and architecture engineering and consultancy services have been named as special emerging sectors as well.

When the policy was made public, the government promised a number of financial and other supports for the sectors to facilitate their growth, with a view to enabling them to contribute to more job creation and industrialisation, thus accelerating economic development.

For instance, the sectors are supposed to receive project loans at reduced interest rates, rebates in income tax, subsidies when it comes to utility bills, and bonded warehouse facilities.

The sectors are expected to get loans at reduced rates and airlines are expected to ship their products on a priority basis. Assistance is to be extended to exporters so that they can market goods, explore new markets and attract foreign direct investment, according to the export policy.

It also said special campaigns will be conducted to raise Bangladesh's exports in Southeast Asian and Latin American nations, while preferential trade agreements will be signed with major trading partners so that the country continues to enjoy duty benefits after it becomes a developing nation from a least-developed country in 2026.

A halal certification authority will be established to tap the opportunities of the $2-trillion global market for Shariah-compliant products.

MA Razzaque, research director of the Policy Research Institute of Bangladesh, says the export policy is not a legally binding document.

"The government may promise a lot in the policy, but many of the pledges might not translate into reality for various reasons," he said, urging the government to formulate an action plan to execute the policy successfully.

Md Saiful Islam, president of the Metropolitan Chamber of Commerce and Industry, thinks if the government wants to export $80 billion worth of goods annually, it needs to diversify products and markets.

"Bangladesh needs to produce hi-tech products like semiconductors to achieve the export goal. This is because a lot of work orders are shifting to other countries from China due to geo-political tensions not only for garment items but also hi-tech products."

The potential of the blue economy needs to be exploited and the bonded warehouse facility needs to be extended to other sectors, he said.

The garment industry enjoys the bonded warehouse facility, which allows apparel manufacturers to import industrial raw materials and capital machinery duty-free to produce products for the western markets.

The government is already looking for alternatives to cash incentives on exports since the country will not be able to pay direct cash assistance to exporters after graduation, according to officials.

Recently, Senior Commerce Secretary Tapan Kanti Ghosh said the commerce ministry has a plan to write to the finance ministry for bringing at least 10 more sectors under the bonded warehouse facility to give a boost to exports from the upcoming fiscal year.

The commerce ministry also plans to incentivise four high potential sectors, except the garment industry, that have already fetched at least $1 billion in export earnings.

"The government will continue the cash incentives for eligible sectors up to 2026 so the export industry remains competitive," Ghosh told The Daily Star over the phone.

AHM Ahsan, vice-chairman of the Export Promotion Bureau (EPB), said a lot of tasks have been completed and some are underway.

The issuance of GSP (generalised system of preferences) certificates for the EU markets has been automated and some internal procedures at the EPB have been digitalised as well, he said.

The commerce ministry is lobbying with other countries to sign free trade agreements (FTAs) and preferential trade agreements (PTAs), according to Ahsan.

"We are hopeful that we will attain our annual export target of $80 billion at the end of 2024," Ahsan said.

Exporters fetched $52.08 billion in 2021-22, the highest in the country's history. This was the first-time overseas sales went past the $50-billion mark.

Mohammad Ali Khokon, president of the Bangladesh Textile Mills Association, said a duty-free facility is given for the import of manmade fibres. "This is a potential sector," he said.

He urged the government to provide a 10 per cent incentive on denim exports to tackle the pressure stemming from the 15.62 per cent duty in the US markets.

Khokon called for issuing orders in line with the export policy so that local exporters benefit from the initiative.

Abdul Kader Khan, a former president of the Bangladesh Garment Accessories and Packaging Manufacturers and Exporters Association, says local accessories makers are capable of meeting almost all the demand in the garment sector.

"And the sector has a lot of potential to grab more global market share."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments