Falling cotton price failing to cheer exporters

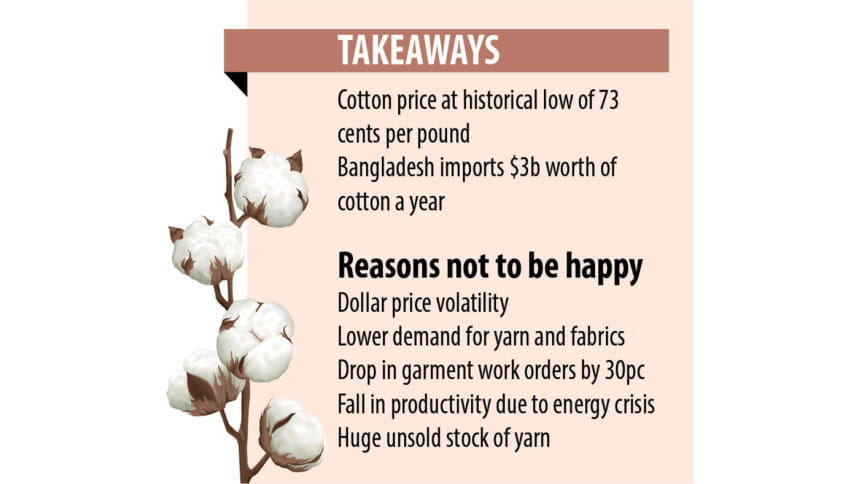

Although cotton prices have declined sharply in the international futures markets, spinners and garment exporters in Bangladesh are not feeling elated owing to the dearer US dollar, the energy crisis and the fall in demand for finished goods.

Apparel manufacturers are also receiving fewer orders from international buyers amid the slide in demand from consumers buckling under deep inflationary pains caused by the Russia-Ukraine war.

Usually, millers, spinners, traders and users brim with joy when the cotton price drops even by a few cents in the international markets since Bangladesh is a net cotton-importing country. And less than 2 per cent of the country's total cotton requirement is met through domestic production.

But this time, cotton prices have plummeted almost by $1 per pound in the global markets.

The white fibre was sold between 73 US cents and 74 US cents per pound in the international futures market in the last one month, down 22 per cent from 92 cents and 95 cents in September.

The price is far below than $1.2 to $1.3 per pound seen in March, April, May and June, as the outbreak of the war in February turned the international market volatile.

"We can't take the advantage of the lower cotton price for two reasons: the dollar crisis and the lower gas pressure," said Md Masud Rana, managing director of Gazipur-based Asia Composite Mills, which uses 40,000 tonnes of cotton a year.

His production fell 50 per cent in the last three months because of a lower pressure of gas caused by the suspension of the purchase of liquefied natural gas from the international market and inadequate domestic production.

Rana is even ready to sell the yarn at a lower price if he can run the mills at full capacity.

This year, he will not be able to use the same quantity of cotton because of the energy crisis.

"It is bad luck for Bangladesh that local spinners are not able to take the advantage of the lower cotton price," said the entrepreneur.

Local spinners say they are sitting on piles of unsold yarn made from cotton imported earlier at a higher price.

Like Rana, most spinners are failing to make the most of the reduction in the price of the white fibre.

"Already cotton import has started declining," said Mohammad Ali Khokon, president of the Bangladesh Textile Mills Association.

"The stockpiling of unsold old yarn has reached five lakh tonnes over the last two months because of a lower demand from garment manufacturers."

During peak times, local spinners can sell 1.20 crore kgs of yarn a day to export-oriented garment factories alone. Owing to the lower demand, they can sell 80 lakh kgs of yarn daily presently.

A stronger US dollar, driven by declining foreign currency reserves, is also hitting spinners.

A few months ago, spinners could buy a US dollar for Tk 83-Tk 85. Now, the same American greenback is costing them Tk 107.

"So, importers are going slow now," Khokon added.

Similarly, apparel exporters are not being able to benefit from the lower cotton prices as orders for the March-May season have slumped by 30 per cent.

Orders are declining as higher inflation has squeezed the buying capacity of European consumers, according to both Mohammad Hatem, executive president of the Bangladesh Knitwear Manufacturers and Exporters Association and Md Shahidullah Azim, vice-president of the Bangladesh Garment Manufacturers and Exporters Association.

Now everything is depending on the war and the supply of energy domestically, they said.

Currently, the widely consumed 30-carded yarn is being sold between $3.55 and $3.60 per kg in Bangladesh. It was $5.25-$5.30 in March and April.

The United States Department of Agriculture (USDA) recently forecast that cotton imports would reach 8.9 million bales in the marketing year of 2022-23, up 7.2 per cent from 2021-22.

"Cotton import may decline because of a lower demand for yarn and fabrics from garment exporters," said Monsoor Ahmed, additional director of the BTMA.

Had the previous trend continued, the import of cotton would have crossed 10 million tonnes at the end of 2022, he said.

Importers who have already booked cotton at $1.30-$1.41 per pound are in trouble now since they have to pay a high rate when it comes to settling the letters of credit although the price has gone down, he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments