Financial account deficit goes past $2b

The deficit in Bangladesh's financial account widened further in the first nine months of the ongoing fiscal year, an indication that the current instability in the foreign exchange market will continue in the coming months.

A financial account is a component of a country's balance of payments (BoP) that covers claims or liabilities to non-residents concerning financial assets. Its components include foreign direct investment, medium and long-term loans, trade credit, net aid flows, portfolio investment, and reserve assets.

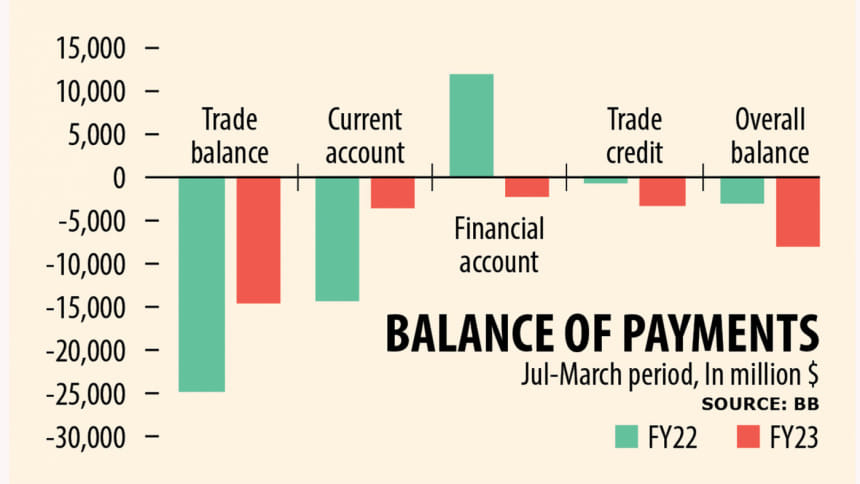

Between July and March of 2022-23, the financial account registered a deficit of $2.21 billion in contrast to a surplus of $11.92 billion a year ago, data from the Bangladesh Bank showed. The deficit was $1.97 billion in July-February.

Historically the financial account of Bangladesh has experienced a surplus almost every year.

For example, it was $944 million in FY16, $4.25 billion in FY17, $9.01 billion in FY18, $5.13 billion in FY19, $7.54 billion in FY20, $14.07 billion in FY21, and $13.67 billion in FY22, according to the World Bank data.

Economists say although the deficits in both trade and the current account narrowed substantially between July and March, the foreign exchange reserves will continue to face stress in the days ahead owing to the large deficit in the financial account.

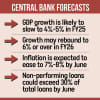

The reserves stood at $30.36 billion on Tuesday in contrast to $42.20 billion in May last year, a decrease of 28 per cent year-on-year.

Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh, says that the large deficit in the financial account means the country is facing a shortage of US dollars.

The central bank has already curbed imports to some extent, but the move has not been sufficient to stop the erosion of the reserve level.

Due to a 12.33 per cent fall in imports, the trade deficit declined 41.6 per cent year-on-year to $14.61 billion in July-March.

But remittances, the cheapest source of US dollars for Bangladesh, declined in April heavily, compounding further pressure on the foreign exchange regime.

Money transferred by migrant workers declined 16.27 per cent year-on-year to $1.68 billion in April. The flow, however, was up 2.36 per cent to $17.71 billion in the first 10 months of 2022-23.

The deficit in the current account, which records a nation's transactions with the rest of the world, stood at $4.64 billion between July and March, down 75 per cent from a year ago.

The two positive developments have failed to offset the negative impacts emanating from the deficit in the financial account.

Mansur said: "Many foreign lenders are showing reluctance to give out loans to local businesses, putting an adverse impact on the financial account."

For instance, trade credit, a major part of the financial account, registered a deficit of $3.2 billion in July-March compared to a deficit of $672 million a year ago.

"Macroeconomic stability is highly important to strengthen the confidence of foreigners. If we are unable to do so, foreign entities and individuals will neither invest nor lend to the country," Mansur said.

Mustafizur Rahman, a distinguished fellow at the Centre for Policy Dialogue, says that the deficit in the financial account is not a good thing for the economy.

"The government should emphasise implementing foreign-funded projects so that it can mobilise foreign loans in an efficient manner. If we can secure foreign loans, the deficit in the financial account will narrow."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments