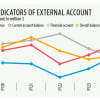

Financial account deficit swells as outflows intensify

The deficit in the financial account of Bangladesh widened further in July-November as international currency outflows continued unabated amidst the drastic fall in trade credits and short-term loans, central bank figures showed.

It comes despite a 20 percent fall in imports in the first five months of 2023-24 while exports receipts rose at a snail's pace, loan payments outpaced fresh credits, and the gap in the trade credit grew larger.

The financial account, a key component of a country's balance of payments (BoP), records transactions that involve financial assets and liabilities and that take place between residents and non-residents.

It covers claims or liabilities related to foreign direct investments, medium and long-term loans, trade credits, net aid flows, portfolio investments, and reserve assets.

Figures from the Bangladesh Bank showed that the deficit in the financial account stood at $5.39 billion in the five-month period of FY24, which was $4.03 billion in July-October.

The situation was a stark reversal from the identical period of the last financial year when the financial account was in surplus at $1.26 billion. But the apparently sound health in the financial account could not be maintained at the end of 2022-23 as foreign currency outflows outpaced inflows.

Consequently, in FY23, the financial account was $2.1 billion in deficit, in contrast to a $15.5 billion surplus a year earlier.

Md Habibur Rahman, chief economist at the BB, said a decline in the flow of short-term loans in the banking sector widened the deficit in the financial account.

The financial account witnessed an outflow of 0.5 percent of gross domestic product (GDP) in FY23, compared to inflows historically averaging about 2.5 percent of GDP, signaling capital flight, according to the International Monetary Fund (IMF).

The financial account experienced a sharp reversal owing to faster than anticipated global monetary tightening, lower than estimated project finance disbursements, significant delays in repatriation of export proceeds, decline in trade credit and private external credit inflows and higher repayments than new loans owing to a spike in global financing costs, the IMF said.

The same situation appeared to have persisted in FY24.

For example, the trade deficit, which takes place when imports surpass exports, narrowed to $4.76 billion in July-November, against $11.82 billion during the same period last year.

Exports rose 1.19 percent year-on-year to $20.96 billion whereas imports plunged 20.94 percent to $25.72 billion.

The deficit in trade credit, the difference between export shipments and export receipts, rose nearly five-fold to $5.38 billion in July-November from last financial year's $1.09 billion. It was $3.73 billion negative in July-October.

The lower export receipts raised eyebrows in recent times as the foreign currency reserves are not picking up owing to the phenomenon.

Unrealised export proceeds -- the difference between export shipments and realised export proceeds -- increased to $9.6 billion amounting to 2.1 percent of GDP in FY23, according to the IMF.

Foreign fund disbursements declined 14 percent in July-November.

Gross FDI inflow declined 14.50 percent to $1.85 billion, while the net portfolio investment stood at $37 million negative, up from $16 million during the five-month period of FY23.

Investment by non-resident Bangladeshis slipped 2.04 percent to $48 million.

Net aid flows improved to $1.05 billion in July-November from $901 million in July-October. It was $1.67 billion in the first five months of FY23.

Medium and long-term loans from the external sector declined 20.70 percent to $1.87 billion. On the other hand, repayments rose 20.5 percent to $823 million.

It comes as central banks globally have unleashed the steepest series of interest-rate increases in decades during their two-year drive to tame inflation—and they may not be done yet, according to a writeup of the IMF in October.

Central banks have raised rates by about 400 basis points on average in advanced economies since late 2021, and around 650 basis points in emerging market economies. As a result, frontier and low-income countries are having a harder time borrowing in hard currencies like the euro, yen, US dollar and UK pound.

Mustafa Kamal Mujeri, executive director at the Institute for Inclusive Finance and Development, said the country has been seeing dis-equilibrium in the external sector for months although the Bangladesh Bank and the government are trying to address the issue.

"If the problems persist, there will be adverse effects on economic growth, employment and poverty."

The former BB chief economist says to the central bank's discouragement and the falling capacity of businesses and industries caused imports to decline. So, the trade deficit declined though exports did not grow that much.

But Bangladesh is an import-dependent economy and it buys essential commodities, raw materials and other inputs to make products for international markets and to feed a nation of 17 crore people. Therefore, exports may be affected if imports suffer, he said.

The IMF said the financial account is expected to improve, including through timely repatriation of export proceeds.

The balance will rise to 0.5 percent of GDP in June this year from a negative 0.5 percent a year ago. It is projected to accelerate to 4 percent in FY25 and 4.6 percent in FY26.

The IMF said amid an unprecedented reversal of the financial account, the overall BoP has deteriorated, leading to a continuous decline in foreign exchange reserves.

"Recent developments have underscored the need to expedite long-standing structural reforms to put the economy on an inclusive and green growth path."

Md Deen Islam, associate professor of the department of economics at the University of Dhaka, said the improvement in trade deficit reflects the lag impact of the significant exchange rate depreciation observed in late 2022.

Consequently, Bangladesh is projected to achieve a surplus in the current account balance for the first time in the last three years, with the overall deficit decreasing from $6 billion to $4.9 billion. This reduction holds both short-term and long-term implications, he said.

"In the short term, it is expected to contribute to exchange rate stabilisation, alleviating inflationary pressures."

Additionally, an enhanced balance of payments, coupled with a market-determined foreign exchange rate, has the potential to bolster the confidence of foreign investors, who were unsettled by exchange rate volatility in the previous year, leading to a notable deficit in the financial account, he said.

He said the anticipated improvements in both the current and the financial accounts suggest a positive trajectory for the foreign exchange reserve position in the near future.

"However, it is crucial for Bangladesh to strike a balance in managing the exchange rate, allowing sufficient market flexibility. Otherwise, the gains in the current account could be short-lived and potentially result in a larger deficit in the financial account."

BB's Habibur Rahman said: "As the interest rate in Bangladesh's financial sector is rising and the chances of further interest rate hike in the West are low, I hope the situation will improve soon."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments