Financial account deficit widens to new level

The deficit in the country's financial account widened to touch a new level in the past seven months up to January of the current fiscal year 2023-24, showing that challenges in the economy are far from over, according to an economist.

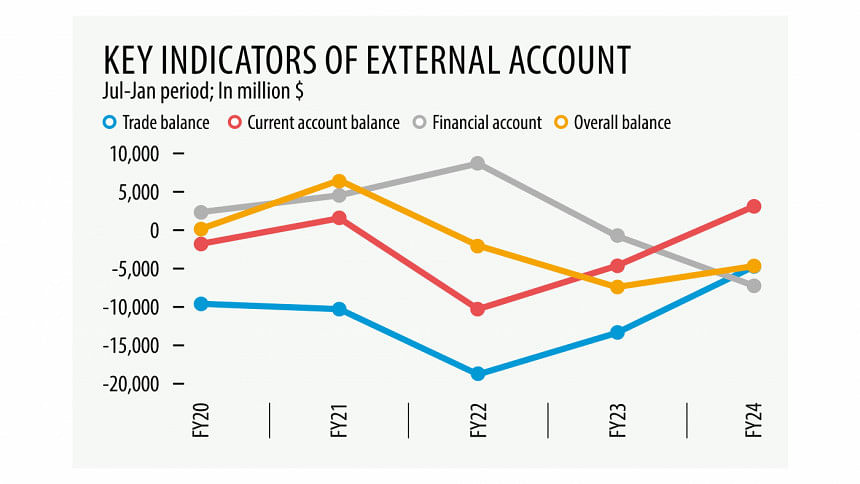

The nation registered a deficit of $7.3 billion in its financial account, a key component of the external account termed as Balance of Payment (BoP), in the July-January period of this fiscal year, which was 9 times higher from year ago, showed data of Bangladesh Bank (BB).

As a result of the widening deficit in the financial account, the country's external account remained in the negative, though there was an improvement in trade deficit, rise in remittance flow and other inflow from services during the period.

The BB data showed that the country's trade deficit fell by more than half to $4.6 billion in the July-January period as exports rose while imports fell.

The trade deficit was $13.39 billion in the July-January period of the year prior.

"This gives a message of both hope and despair," said Zahid Hussain, a former lead economist at The World Bank, Dhaka.

"The increase in remittance inflow gives hope but an 18 percent import fall is not a good omen for the economy because most of the imports of Bangladesh are production driven," he added.

Hussain said that for an economy of around $450 billion, monthly $5 billion imports are not sustainable. Rather, this could fuel inflation because of supply shortage.

"So, managing the balance of payment through import control is not a feasible option," he added.

Data showed that because of reduction in trade deficit and rise in remittance and private transfers, Bangladesh's overall deficit in the BOP declined to $4.68 billion in the first seven months of this fiscal year from $7.38 billion a year ago.

Hussain said BOP has to be positive. But it has been in the negative because of a large deficit in the financial account, which included foreign direct investments, medium and long-term loans, trade credits, net aid flows and portfolio investments.

He said one of the reasons behind the negative financial account is slow realisation of export proceeds against shipment.

"This is because of under-pricing of dollar that exporters get against export. We saw similar problems in case of remittance earlier. But remittance flow improved after remitters were offered higher rates through relaxation of policy. But we have not seen any easing of rules for export earnings," he added.

"Flow of export proceeds would rise if exporters get market-based rates."

Overall, he said, improvements in the current account thanks to increased flow of remittances has reduced unease in the market.

"But BOP deficit persists because of the negative financial account. Overall net inflow is yet to become positive. And without the financial account turning positive, overall availability of dollar will not increase and this will create inflation, depress investment and production," Hussain added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments