Pressure mounts as currency outflow intensifies

The pressure on the external sector of Bangladesh has intensified as the financial account deficit widened owing to higher outflows of international currencies compared to inflows.

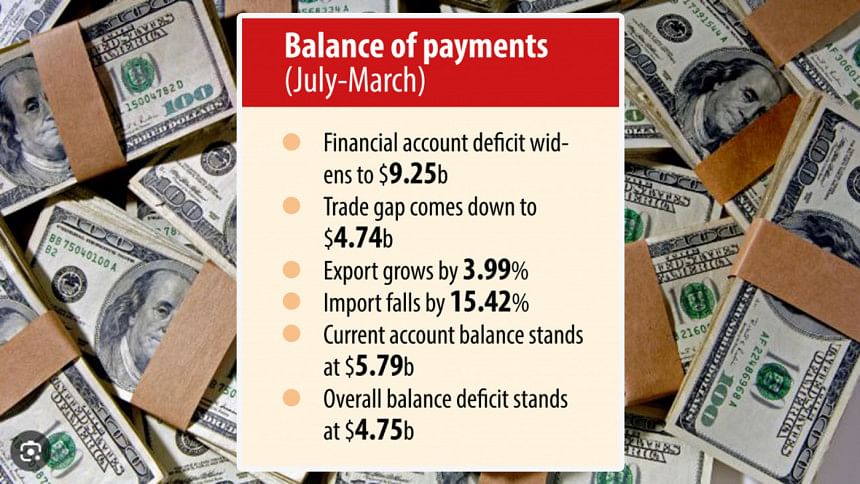

The deficit in the financial account stood at $9.25 billion in July-March of the current fiscal year, Bangladesh Bank data showed. It was $2.92 billion in the first nine months of the previous fiscal year and $8.46 billion in July-February of 2023-24.

The financial account is a key component of a country's balance of payments (BoP) and records transactions that involve financial assets and liabilities and that take place between residents and non-residents.

It covers claims related to foreign direct investments, medium and long-term loans, trade credits, net aid flows, portfolio investments, and reserve assets.

Industry people have identified a lower short-term foreign borrowing by the private sector as the main factor for the deficit.

The short-term foreign debt stood at $11.04 billion in March against $11.07 billion in February and $11.25 billion in January.

The borrowing has fallen as foreign lenders have lost their confidence in Bangladeshi companies as the country's foreign currency reserves keep falling, deepening economic uncertainty, the industry people said.

The reserves slipped below the $19-billion mark on Sunday after the BB settled $1.63 billion worth of import bills for two months through the Asian Clearing Union, an arrangement for settling cross-border transactions among the central banks of Bangladesh, Bhutan, India, Iran, the Maldives, Myanmar, Nepal, Pakistan, and Sri Lanka.

On the day, the gross forex reserves were $18.26 billion. However, the net forex reserves stood at $13.76 billion, said a BB official. Bangladesh will have to maintain an NIR of $14.77 billion in June in line with the condition of the International Monetary Fund (IMF).

The reserves have declined owing to elevated global commodity prices, supply disruptions, a slowdown in external demand, and a shift in remittance back to informal channels. It was $40.7 billion in August 2021.

"The pressure on the forex reserves will ease if the central bank strictly implements its latest decisions on the interest and exchange rates," said Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh.

The economist expects inflation to decrease on the back of the market-based interest rate and the flexible exchange rate. However, remittance will not pick up because of hundi.

The financial account deficit persisted in July-March also because of a $10.39 billion shortage in the "other investment (net)" segment of the BoP.

The trade deficit, which takes place when imports surpass exports, narrowed to $4.74 billion against $14.63 billion during the same period of FY23.

Exports were up 3.99 percent.

Imports dropped 15.42 percent, driven by the austerity measures put in place by the government to stop the depletion of the reserve and the go-slow strategy adopted by industries and businesses when it comes to investment and expansion.

The current account balance returned to the positive territory at $5.79 billion in July-March from a negative $3.29 billion. The overall balance was $4.75 billion negative.

Mansur said the positive current account balance will have to continue to make an improvement from the current economic uncertainty.

Contacted, BB Deputy Governor Md Habibur Rahman said curbing forex reserve depletion is the major focus of the central bank now.

"We have introduced a new exchange rate system named crawling peg to this end," he said, adding that the hike in the exchange rate will help raise export and remittance receipts in the upcoming months.

"Subsequently, the deficit in the financial account will narrow and this will give a boost to the reserves."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments