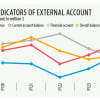

Financial account deficit keeps widening

Bangladesh's financial account deficit is still widening, signaling that the pressure on the foreign exchange regime will continue in the upcoming days.

During July to February of this fiscal year, the financial account of the balance of payments (BoP) showed a deficit of $8.36 billion, up from a deficit of $2.32 billion in the same period in FY23, as per the latest data from the Bangladesh Bank.

The financial account covers claims or liabilities to non-residents concerning financial assets. Its components include foreign direct investment, medium and long-term loans, trade credit, net aid flows, portfolio investments, and reserve assets.

It stood at a deficit of $7.78 billion during the July to January period of FY24, BB data showed.

Industry insiders said that reduced short-term foreign borrowing by the private sector and declining balances in nostro accounts maintained by commercial banks with foreign banks were to blame for the growing deficit.

The financial account deficit persisted during July to February largely because the 'other investment (net)' segment of the BoP stood at $9.40 billion in the negative. It was $3.37 billion in the negative in the same period a year earlier.

In contrast, the gross flow of foreign direct investment rose only 1.55 percent to $3.14 billion. The net portfolio investment was $77 million in the negative during the period, up from $47 million in the negative in the same period last year.

Fahmida Khatun, executive director of the Centre for Policy Dialogue (CPD), told The Daily Star that payments outpaced income, which is why the financial account was still in negative territory.

She added that foreign loans to the private sector continue to fall, which indicates that investment is stagnant, which raises concerns about an impact on employment.

A recent World Bank report said that the current account deficit narrowed in FY23 and showed a surplus in the first seven months of FY24, driven by import suppression measures.

However, the financial account deficit persisted due to increasing outflows of trade credit and other short-term loans, it said.

The trade deficit, which takes place when the value of imports surpasses that of exports, narrowed to $4.62 billion during July to February this year. It stood at $13.35 billion in the same period of last year.

In the eight-month period, exports were up 3.76 percent year-on-year while imports dropped 15.36 percent.

Import payments have fallen mainly due to austerity measures put in place by the government and the central bank to stop the depletion of the forex reserves, which have fallen by 25 percent in the last year.

The current account balance returned to positive territory and climbed to $4.76 billion in the eight months of this fiscal year after standing at negative $3.45 billion in the same period of last fiscal year.

The country's overall balance was $4.43 billion in the negative in July to February of FY24, which was at $7.94 billion in the negative compared to the same period in the previous year, as per BB data.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments