Financial inclusion evolves with focus on rural Bangladesh

A big driver of this evolution is an expanding network of banking services and mobile financial solutions. However, targeted interventions are needed to address gaps, particularly in rural areas and among women, it recommended.

As per the World Bank's Global Findex Database 2021, 47 percent of individuals aged 15 years and above remain outside the formal financial system in terms of account ownership.

Among adults, the gender gap is particularly evident, with 43.46 percent of women accessing formal financial services compared to 62.86 percent of men.

The scenario is being countered though the expansion of rural banking services, according to Financial Inclusion Report 2023 of Bangladesh Bank.

The report measured access, usage, and quality of services provided by financial service providers as of December 2023.

It stated that of the 11,284 bank branches and 260 finance company outlets nationwide, nearly half are located in rural areas.

Around 80 percent of the 21,601 agent banking outlets in the country are in rural areas, facilitating account creation and financial transactions.

This outreach has resulted in notable rural account ownership, with around 47.11 percent of bank accounts and 55 percent of MFS accounts held by rural residents, according to the report.

Bangladesh's MFS sector, which has over 210 million accounts, is a key driver of financial inclusion. It complements the efforts of microfinance institutions, which serve over 40 million people, predominantly in rural areas.

Of these account holders, 90 percent are women, highlighting the sector's role in empowering female entrepreneurship and household financial management.

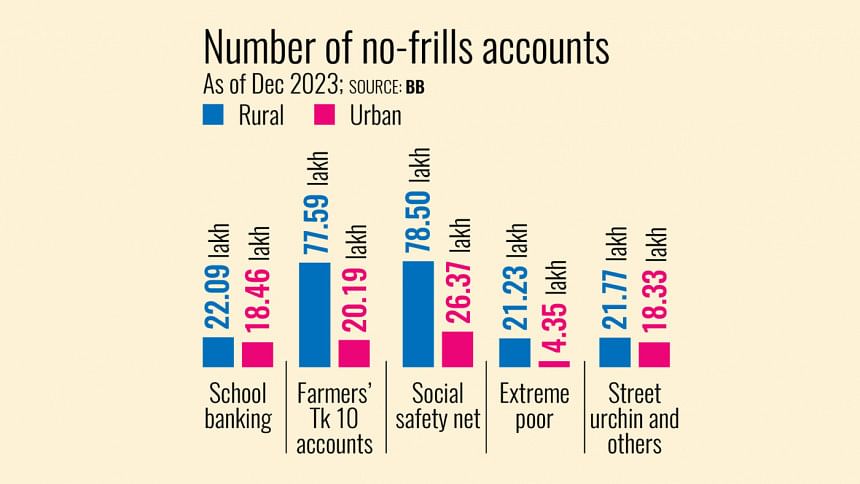

The NFAs, such as Tk 10 accounts for farmers and school banking accounts, play a pivotal role in extending financial services to underserved populations.

As of December 2023, 30.9 million of the NFAs were active, with the leading numbers comprising social safety net accounts and farmers' Tk 10 accounts.

Over 70 percent of these accounts belong to rural customers, underscoring their impact on low-income groups.

School banking accounts, however, remain largely urban-centric, reflecting the need for a more balanced geographical outreach in financial literacy initiatives targeting students.

Despite the progress, challenges remain.

Rural areas often face an overconcentration of banking outlets in specific locations, leaving other regions underserved. Similarly, while account ownership is increasing, active usage and financial literacy continue to be pressing concerns, the report states.

The gender disparity in financial access also underscores the need for robust policies. Initiatives promoting financial literacy, tailored products for women, and incentives for rural financial activity are crucial, it said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments