Foreign Loan: Repayment crosses $4b for first time

Foreign loan repayment, which was hovering around $3 billion since fiscal 2012-13, crossed the $4 billion-mark for the first time last fiscal year on the back of high interest payments and short-term loans in the power and energy sector.

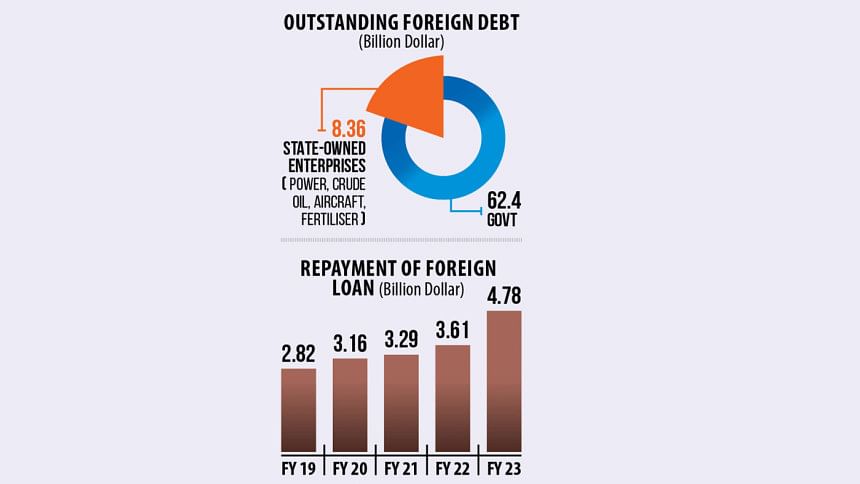

In fiscal 2022-23, foreign loan repayment stood at $4.78 billion, up 32.8 percent year-on-year, according to the Economic Relations Division.

The repayment increased $1.18 billion from fiscal 2021-22. In previous years, the repayments increased between $100-$400 million.

Going forward, the repayments are expected to increase further because of exchange rate volatility and the possibility of LIBOR/SOFR and EURIBOR rates ticking up, the ERD said in its latest report.

Of the repayment amount last fiscal year, $2.67 billion was thanks to the government's loans and $2.11 billion was for the state-owned enterprises' borrowing.

Both the segment's loans increased by 32 percent, but the state-owned enterprises' increase is substantial as its total outstanding debt is only $8 billion. The government's total outstanding foreign loan is $62.4 billion.

As of June last year, the total public sector outstanding debt is $70.8 billion.

The state-owned enterprises took short-term loans in this fiscal year, whose interest rate is more than long-term loans, said finance ministry officials. As a result, the repayment amount went up.

"Even two years ago, the interest rate was below 1 percent on such loans. Now, it is more than 8 percent," they said.

Of the repayment amount, the interest payment was $1.3 billion, up 99.23 percent year-on-year, the ERD report showed.

The highest loan was repaid against short-term loans taken to import crude oil: $1.12 billion, which is an increase of 40 percent from the previous fiscal year.

The power sector's loan repayment increased by 27 percent to $679 million.

The government has paid $85 million for loans taken to purchase aircraft earlier, up 49 percent year-on-year increase.

However, the ratio of the government's external debt stock is 15.59 percent of the GDP while the threshold is 40 percent, indicating the foreign loan position is in the safe territory, the ERD report said.

The ratio of debt service to revenue and grant will cross 100 percent this fiscal year, said Zahid Hussain, former lead economist of the World Bank's Dhaka office, citing a recent report of the International Monetary Fund.

"It does not mean that there is no concern."

There are two main concerns now in the current context of historically low revenue collection and ongoing dollar crisis.

"The loan repayment pressure is still heavy and we can't see the pathway to get rid of the situation," he said, while calling for increasing the revenue collection and the foreign currency reserves.

Besides, the government should try to get low-cost foreign loans in the future, Hussain added.

The ERD report -- titled "Flow of External Resources" -- said few loans have recently been mobilised at variable interest rates.

"The interest rate risk is high when the variable interest rate-dominated debt portfolio exists," it added.

Though the report acknowledged the interest-related risks, it said all the other indicators are below the level of threshold.

"According to the present classification by the World Bank, Bangladesh is categorised as a 'less indebted' country."

Though the Bangladesh Bank has taken several initiatives, the foreign currency reserve has been declining in the last one and a half years.

As of February 14, foreign currency reserves stood at $19.9 billion.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments