Repayment to rise 63pc in three years

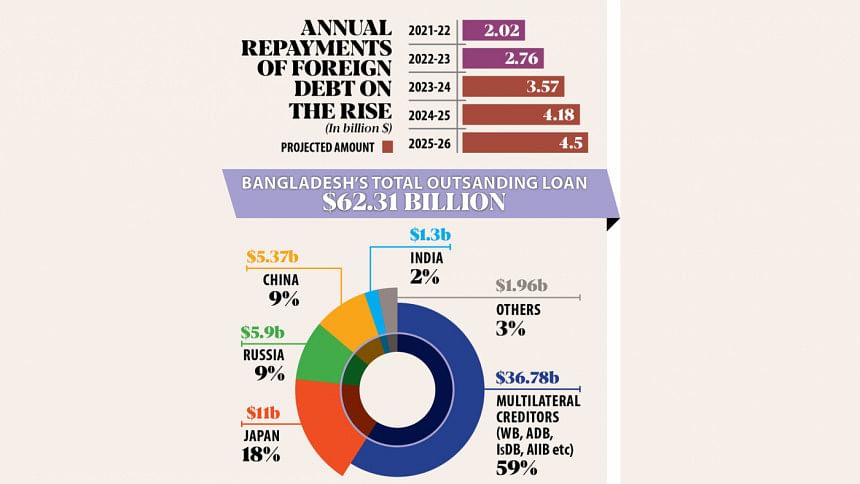

The government's foreign debt repayment is expected to increase as much as 63 percent by fiscal year 2025-2026 from the last financial year, indicating renewed pressure on the country's coffers.

The surge in disbursement of foreign loans and interest payments against them is pushing up the debt servicing requirement.

Foreign debt repayments, including interests, will reach $4.5 billion in 2025-2026, according to a finance ministry projection. In the last fiscal year, the government repaid $2.76 billion.

In the current fiscal year of 2023-24, repayments are likely to cross the budget target of $2.79 billion and will jump by 33.52 percent to $3.57 billion.

Bangladesh has repaid $1.33 billion in the first five months of FY 23-24, up 51.36 percent year-on-year. Of the sum, interest payments surged 136.70 percent to $562 million.

According to the projection, the government is expected to repay $4.18 billion in external loans in 2024-2025.

Bangladesh's foreign debt is still in a comfortable situation but there are some risks which are also mentioned in the IMF's latest debt sustainability report.

Bangladesh's outstanding foreign debt totalled $62.31 billion as of the last fiscal year.

Bangladesh owes 59 percent of the loans to multilateral creditors such as the World Bank and the Asian Development Bank. The rest are owed to bilateral lenders.

The fund release for the mega projects such as the Dhaka Metro Rail, the Matarbari Coal Power Plant, and the Rooppur Nuclear Power Plant has increased in recent times as their implementation has entered the final phase.

Besides, Bangladesh has received sizeable budgetary support in the last three years after development partners accelerated lending to help the economy make a turnaround from the impacts of the coronavirus pandemic.

As a result, the loan repayment is rising.

The repayment of the principal amount begins after the maturity of the loans, whose tenure range from 20 years to 30 years. The interest servicing starts after the disbursement is made.

In the last 15 years, Russia, India and China have emerged as the main lenders for Bangladesh.

At present, the government's loan to Russia stands at about $12 billion, borrowed for the Rooppur Nuclear Power Plant. The construction of one unit of the plant is expected to complete by this year while the other unit is expected to be ready by 2025.

The grace period for the loan ends in 2025-2026.

According to a finance ministry official, the government is now repaying interests against the loan. The interest payments amounted to $330 million in fiscal 22-23.

The repayment for the principal amount will start in 2026-2027, with $531 million expected to be repaid in that year. The amount will be $519 million in 2027-2028 and $507 million in 2028-2029.

After this, the annual repayment will decline gradually.

In the case of the loans from China, Bangladesh is repaying $251 million per year. It will reach $698 million in FY 26-27.

The finance ministry official said most of the government borrowings come from multilateral creditors and are based on concessional terms.

As per the International Monetary Fund (IMF), all but Bangladesh's one external debt indicators are below their thresholds under the most extreme shock, he said.

However, Zahid Hussain, a former lead economist at the World Bank's Dhaka office, said Bangladesh's foreign debt is still at a comfortable situation. But there are some risks that are cited in the IMF's latest debt sustainability report.

According to the economist, if the country's export sector faces a major shock, the dollar liquidity will reduce. "Then, there could be some problems in debt servicing even if the debt remains low."

Another concern for Bangladesh is lower revenue mobilisation. The country has one of the lowest tax-to-GDP ratios in the world.

If the trend persists, debt repayment might appear as a burden because the government will be forced to cut expenses to mitigate debt repayment.

Hussain said in the case of future borrowing, the government should try to secure long-term loans at lower interest rates from multilateral lenders.

"For this, there has to be bankable projects."

If the government goes for commercial loans, the funds should be for the projects that will earn foreign exchanges directly, he said.

"Besides, the projects will have to be completed on time. It will be a burden for the country if the loan repayment starts before the completion of the projects."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments