Foreign loan repayment surges 44% in Jul-Apr

Bangladesh's foreign debt servicing surged 44 percent year-on-year to around $3 billion because of the interest payments, which are spiralling thanks to rising borrowing from high-interest sources and increasing use of foreign loans.

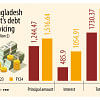

In July-April of 2023-24, the government paid $2.81 billion as principal and interests, which was $1.95 billion in the same period of the previous year, according to the data released yesterday by the Economic Relations Division (ERD).

During the 10-month period, around $1.15 billion was returned as interest, up from $569 million in the identical period of 2022-23. The principal amount repayment rose 20 percent to $1.66 billion.

In the local currency, the government had to pay Tk 30,923 crore, which included around Tk 12,626 crore as principal, in July-April. It was Tk 19,248 crore in the same period of FY23.

The government's foreign aid use was up 6 percent year-on-year to $6.28 billion.

Japan gave the highest $1.66 billion while $1.5 billion came from the Asian Development Bank, $1.05 billion from the World Bank, $857 million from Russia, $361 million from China, and $242 million from India.

Foreign aid commitments increased by 36 percent to $7.6 billion. The ADB has pledged to lend $2.69 billion, Japan has committed $2.04 billion, and the World Bank has said it would provide $1.42 billion.

According to an ERD report, the country now has to borrow at the costlier market-based rates to cover the development spending.

The interest rate risk is high when the debt portfolio is dominated by market-based rates because the volume of the payment is based on the vagaries of the global economy.

The cost of foreign loans has been on the rise as interest rates have shot up globally. The rates for market-based loans have also increased significantly, an ERD official said.

In the next few years, debt servicing will be a major issue, and Bangladesh should be careful in managing the debt repayment and try its best to earn more through export and remittance, according to analysts.

Besides, the government needs to demonstrate zero tolerance on capital flight, which often takes place through hundi.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments