Govt's debt servicing for foreign loans surges 49%

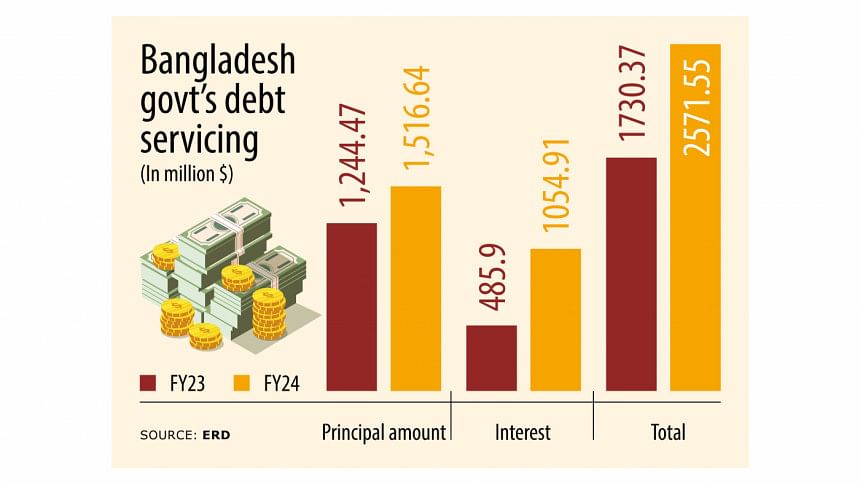

Bangladesh's foreign debt servicing surged by 49 percent, driven by spiralling interest payments, which crossed the $1 billion mark for the first time.

This increase is a result of the country's rising borrowing from high-interest sources.

In the July-March period of fiscal year 2023-24, the government paid $1.05 billion in interest, which is 117 percent higher than the $485 million it paid during the same period a year ago.

Overall, debt servicing soared by 49 percent to $2.57 billion in the July-March period of FY24, compared to the same period a year ago.

This data was released by the Economic Relations Division (ERD) yesterday.

During the same period, the repayment of the principal amount of foreign loans rose by 22 percent year-on-year to $1.5 billion.

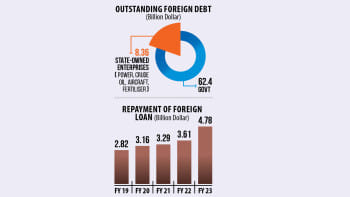

The pressure on loan servicing is rising as the government increased borrowing to finance large infrastructure projects such as the Dhaka Metro Rail, Matarbari Coal Power Plant, and Rooppur Nuclear Power Plant, funded by bilateral and multilateral sources.

As of December 2023, the external debt of the Bangladesh government stood at $79.6 billion. This figure was approximately 13.7 percent of the nation's Gross Domestic Product in the fiscal year 2022-23.

In recent years, the government has borrowed a good amount of money from multilateral agencies, largely to help the economy navigate the crises caused by the Covid-19 pandemic and Russia-Ukraine war.

Officials have stated that loans taken from foreign sources now have a shorter grace period. Additionally, interest rates are now tied to the global reference rate -- the Secured Overnight Financing Rate (SOFR). This rate replaced the London Interbank Offered Rate (Libor) last year.

In recent times, the SOFR has seen an increase.

Official data revealed that Bangladesh paid $935 million in interest payments in FY23, nearly double the $491 million paid a year prior.

The latest data from the Economic Relations Division (ERD) showed that the overall commitment from foreign lenders grew by 135 percent year on year to $7.2 billion in the July-March period of FY24.

However, disbursement only increased 5 percent year-on-year to $5.6 billion in the nine months to the end of March 24.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments