In fragile trust, economy falters

Over the last several years, Ahsan, a rickshaw puller in his 50s, has been eagerly waiting for relief from the high prices of food and other essentials. Days and months have passed, but his pursuit of a better living by escaping the curse of elevated inflation has remained a distant dream.

By this time, the previous Sheikh Hasina government was toppled in a popular mass uprising in August last year and an interim administration took charge in the same month.

But Ahsan's struggle continues, and so does the erosion of his family's living standards, even though inflation eased for the second consecutive month in January.

"I have not seen any real change in my life," he said, while making an assessment of the interim government's six months in power.

"The only thing that has become cheaper is potatoes, but the prices of all other essentials have gone up," said the father of four children.

Ahsan, who does not have a second name, is the sole breadwinner for his six-member family. He earns roughly Tk 700 a day, which is insufficient to cover all essential expenses, including house rent.

"How am I supposed to provide three meals a day for my family with my meagre income?"

The rickshaw puller lives in Kamrangirchar, home to thousands of low-income people reliant on Dhaka, the metropolis that serves as the major engine of Bangladesh's economy.

He said he used to buy rice for less than Tk 50 per kilogramme. Now, like millions of Bangladeshis, he has to pay more than Tk 50 for the food staple.

Besides, people like Ahsan have to pay more for edible oil recently amid reduced supply from refiners. This further deepens the hardships of commoners who have endured over 9 percent inflation for 23 consecutive months till January this year.

Moving on to the bigger macro picture, economists and businesspeople also see uncertainty heavily clouding the economic outlook.

"The economy is yet to emerge from the risks it faced six months ago, though there has been some relief in the form of improvements in certain indicators and containment from further deterioration," said Mustafizur Rahman, a distinguished fellow at the Centre for Policy Dialogue (CPD).

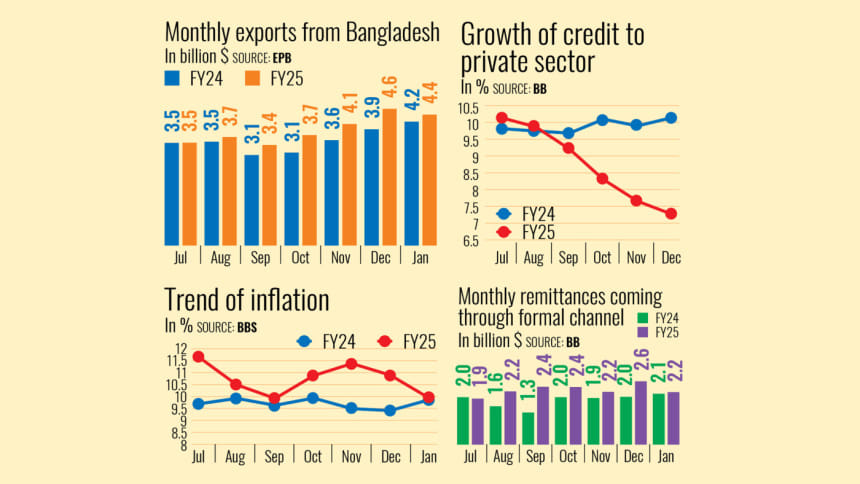

Although inflation eased slightly in December and January, consumer prices still remained elevated. There has been a slowdown in investment and the generation of new jobs.

Over the past several years, private investment has remained stagnant at 23-24 percent of gross domestic product (GDP).

Besides, the recent trend of private sector credit growth offers no light at the end of the tunnel.

For the fifth consecutive month, loan flows to private firms have slowed due to uncertainty in the investment environment following the August political changeover.

In December, private sector credit growth decelerated to 7.28 percent year-on-year -- the slowest since at least 2015, according to data from the Bangladesh Bank.

Rahman, an economist who has closely followed Bangladesh's economy for decades, said the sluggishness drags on. "It appears that the economy has fallen into a vicious cycle," he said.

He cited the authorities' pursuit of a contractionary monetary policy, which has increased the cost of funds, inhibiting private investment.

The government's decision to raise value-added tax (VAT) on nearly 100 goods and services has stoked inflation and further eroded the purchasing power of ordinary citizens. Meanwhile, in the financial sector, default loans have continued to pile up, according to Rahman.

Taskeen Ahmed, president of the Dhaka Chamber of Commerce and Industry (DCCI), said the interim government took up key measures, including easing import restrictions and initiating reforms in critical areas such as banking, taxation and administration, in response to pressing economic challenges.

According to Ahmed, the economy has shown signs of turning around over the past six months, largely because of the resilience of people and the private sector.

"Despite these efforts, persistent challenges hinder progress," he said, citing GDP growth dropping to 1.81 percent in the first quarter of FY25, the lowest in four years, due to slowed investment and industrial stagnation.

Fiscal pressures, including a Tk 58,000 crore revenue shortfall from the target and weak credit growth further strain recovery, he said, adding that high inflation, supply chain disruptions, limited foreign direct investment (FDI) and a rising trend in non-performing loans continue to uncertainties.

"Business confidence is low," said the DCCI president.

Selim Raihan, executive director of the South Asian Network on Economic Modelling (Sanem), said the interim government inherited many economic challenges, including stubbornly high inflation and stagnation in investment.

"We hoped for a recovery. Except for some areas, we have not seen that," he said, noting increased export receipts, remittances and the containment of reserves.

However, he added, "Because of the government's failure to ensure law and order, there is a confidence deficit across the economy. The confidence crisis prevails among both investors and consumers."

He emphasised coordination among government agencies and coherence among advisers to steer the troubled economy and overall socio-political situation towards stabilisation.

"We have rather seen contradictory comments and positions among advisers," he said.

The recent vandalism at Dhanmondi-32 and across the country has had a negative impact, said Raihan.

"There are concerns that the fault lines in the economy may widen if the law and order situation does not improve. Given the current situation, I do not see any prospect for the economy to significantly turn around during the rest of the fiscal year," he concluded.

Mohammad Zaved Akhtar, president of the Foreign Investors' Chamber of Commerce & Industry (FICCI), said the business environment over the past few months has remained challenging due to sustained high inflation, deteriorating law and order and rising energy costs.

He said the devaluation of the local currency has further compounded the situation, increasing cost pressures for companies with foreign currency exposure.

Meanwhile, micro, small, and medium enterprises (MSMEs) are struggling to operate as the cost of funds continues to rise amid climbing interest rates.

"While the reform initiatives undertaken so far offer some hope, what remains missing is any tangible change on the ground," said Akhtar, who is also the chairman and managing director of Unilever Bangladesh, the largest consumer goods maker in the country.

"If we fail to bring about necessary changes, the existing inadequacies will lead to a huge loss of investor confidence in the country," he noted.

To Asif Ibrahim, former president of the DCCI, major economic indicators over the past six months have been somewhat "bittersweet."

He cited improvements in some indicators, such as the current account balance, which turned positive, reaching $1.93 billion by the end of December last year -- an encouraging return from earlier deficits.

"Despite this improvement, concerns remain as private sector investments have declined remarkably due to ongoing uncertainty. If investor confidence is not restored, industrial production may suffer in the coming months," said Ibrahim.

For rickshaw puller Ahsan, the issue remains the same: improving law and order.

As he made his way from the capital's Banglamotor area to Farmgate, his voice carried both exhaustion and helplessness over the chaotic situation on the streets.

"Without a clear direction from the authorities, chaos rules the streets. Every day feels like a struggle, not just to earn a living, but to survive," he said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments