Gender gap in MFS widens from 3% to 16% in five years

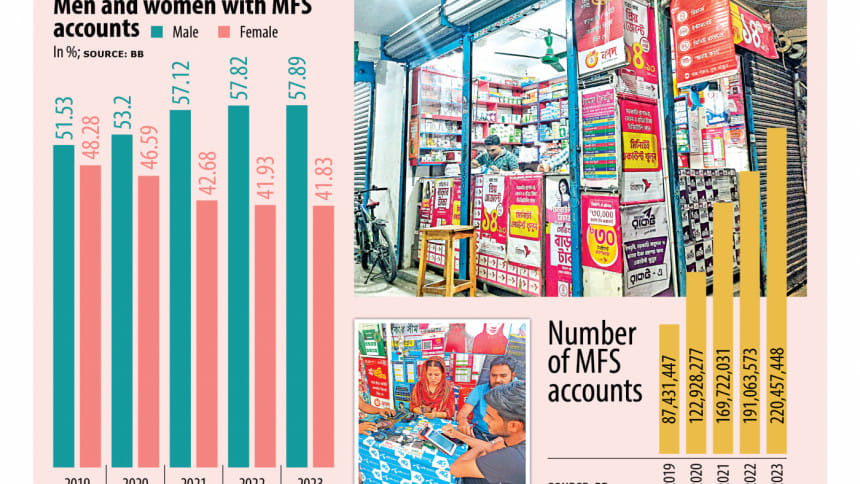

The proportion of women who have mobile financial services (MFS) accounts declined over the past five years despite a sharp growth in the number of MFS accounts in that time, according to Bangladesh Bank data.

Overall, women's account ownership fell by 6.45 percentage points. Women held 48.28 percent of total MFS accounts in December 2019, but that number fell to 41.83 percent in December 2023.

The number of total MFS accounts stood at 22.04 crore as of December last year, up 152 percent from 8.74 crore five years ago, riding on the widespread adoption of mobile-based financial services.

As of December 2023, males had 12.76 crore MFS accounts while females had 9.22 crore.

In the past five years, the number of MFS accounts owned by men increased by 6.36 percentage points. In December 2023, men accounted for 57.89 percent of total MFS accounts compared to 51.53 percent in December 2019.

The central bank data showed that the proportion of MFS accounts owned by men and women stood at 51.53 percent and 48.28 percent respectively in December 2019.

This proportion stood at 57.89 percent and 41.83 percent for men and women respectively in December 2023, illustrating a widening gender gap.

The gap broadened to 16.06 percentage points in December last year from 3.25 percentage points in the same month in 2019, according to the data.

According to experts, women could not take full advantage of the rapid growth in the MFS sector due to lower digital and financial literacy and restricted access to finance compared to males.

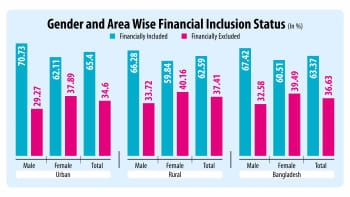

Referring to a new study she co-authored, Sayema Haque Bidisha, a professor of economics at the University of Dhaka, said they found a 35.42 percentage points gender gap in terms of having an MFS account.

At present, 82.58 percent of men have MFS accounts compared to 47.16 percent of women, the study finds. "That is quite huge and consistent," she said.

Prof Bidisha believes low digital literacy among women is one of the key reasons behind the falling proportion of female MFS account-holders.

The financial literacy rate among women is lower than men in most cases, the researcher said, citing the discrimination women confront in accessing digital devices.

Atiur Rahman, a former governor of the Bangladesh Bank, said MFS is being used for smallholder businesses in many cases, where most account-holders are men.

"This is one of the reasons behind the gender gap."

Bangladesh's gender gap in global perspective

According to a report by GSMA, a non-profit organisation that represents mobile network operators worldwide, Bangladesh had the third-highest gender gap in mobile money account ownership in 2022.

The gender gap in Bangladesh stood at 55 percent, only ahead of Pakistan and India, which had a gender gap of 85 percent and 75 percent respectively.

In Bangladesh, men's account ownership increased from 41 percent to 45 percent in 2022 while women's account ownership stayed the same at 20 percent, widening the gender gap, according to the GSMA report titled "State of the Industry Report on Mobile Money 2023".

Similarly, in Pakistan, men's account ownership grew from 19 percent to 26 percent in the past year while women's ownership remained unchanged at 4 percent.

A range of factors, including restrictive social norms and low mobile ownership among women, are key reasons for the persisting gender gap, according to the GSMA report.

GSMA's analysis of the World Bank's Global Findex 2021 reveals that women in lower middle income countries are 28 percent less likely than men to possess a mobile money account.

Women tend to experience barriers to mobile money account ownership more acutely than their male counterparts, including lower awareness, lack of a mobile phone, lower digital skills and more restrictive social norms.

The second greatest barrier is a lack of knowledge and skills, such as not knowing how to use mobile money accounts, difficulties in using a handset, or low literacy, according to the GSMA.

In order to bridge the gender gap, MFS providers should negotiate and collaborate with the government so women can be trained to increase digital literacy and financial literacy at Union Digital Centres across the country, Bidisha added.

"This can play a very important role in bridging the gender gap," she said.

Besides, MFS providers can offer facilities for women, such as providing incentives or discounts for transactions, she said. On the other hand, steps should be taken so that everyone can get a digital device at a cheap rate.

"I think this can be a good strategy. But the main strategy, I think, is to increase financial literacy, and to cut the fear of patriarchalism," she said.

Echoing Bidisha, Atiur Rahman said financial literacy should be increased to reduce the gender gap.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments