Women far behind men in financial inclusion thru MFS

Despite the rapid expansion of mobile financial services (MFS) in Bangladesh over the past decade, women are lagging far behind men in terms of financial inclusion.

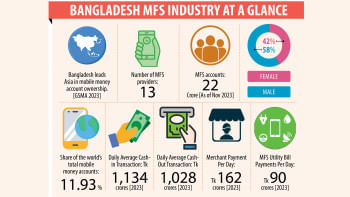

The gender gap between men and women in terms of having an MFS account is 35.42 percentage points, according to a study unveiled yesterday.

At present, 82.58 percent of men have MFS accounts compared to 47.16 percent of women, said the study conducted by a team of researchers led by Ayesha Banu, a professor of women and gender studies at the University of Dhaka.

Lila Rashid, a former executive director of Bangladesh Bank, Sayema Haque Bidisha, a professor of economics at the University of Dhaka, and Mokhlesur Rahman, managing director of the Centre for Research and Development (CRD), co-authored the study, which was presented at an event at the InterContinental Dhaka.

Funded by the Bill and Melinda Gates Foundation, the study surveyed 7,560 individuals in 56 districts.

It found that women also trailed men in terms of financial inclusion in the banking sector: 30.47 percent of women have bank accounts compared to 47.75 percent of men.

However, women are far ahead of men in terms of having accounts with microfinance institutions (MFIs). Some 61.95 percent of women own accounts with MFIs compared to 5.58 percent of men.

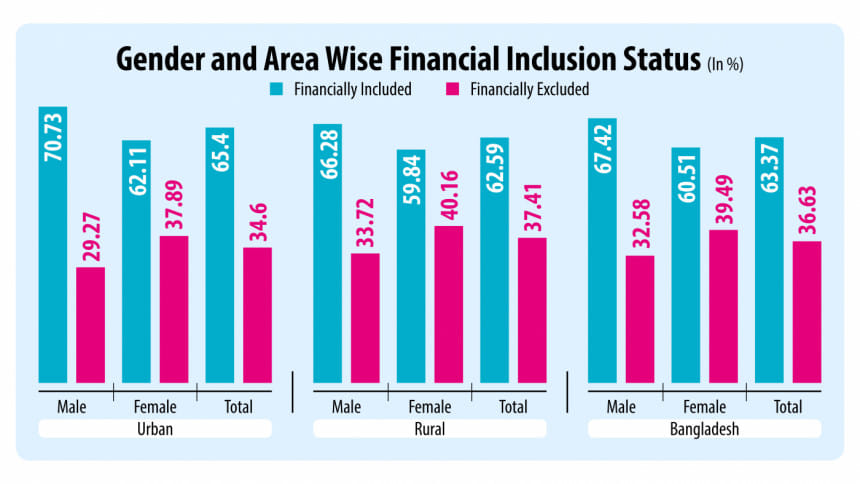

Overall, the gender gap in financial inclusion in Bangladesh is 6.90 percentage points, the study found.

As per the findings, about three-fourths of the gap may be attributed to a host of factors linked to demographics, economic status, education, employment, and marital status, while a quarter remains unexplained.

Prof Bidisha said restrictive gender and social norms significantly impede women's financial inclusion. Women face derogatory remarks and social sanctions rooted in restrictive norms, limiting their roles within and outside the household, she said.

She added that in many cases, bank or MFS accounts were opened under women's names, but were being run by their husbands.

Such norms influence the mindset of financial service providers and recipients, constraining access to core prerequisites of financial inclusion such as asset control and employment opportunities, she added.

"Institutional structures and policy frameworks are likewise influenced by these norms, shaping both their design and implementation."

Despite the myriad hurdles, according to Prof Bidisha, some women attain a certain level of financial inclusion and that proves to be transformative, bringing about changes in their lives and the lives of those around them.

Prof Banu said the gender gap in the financial sector covers layers and depth of inclusion, access, and control of financial products and services, capturing perspectives from both service beneficiaries and providers such as banks and MFS.

She suggested exploring existing policies and identifying gaps and challenges to chart the way towards a more inclusive financial ecosystem.

Atiur Rahman, a former governor of the Bangladesh Bank, said Bangladesh has been providing a gender-responsive budget for the past 15 years or so and the practice is now well-anchored in the budget-making process.

It is heartening to know that this gender-sensitive allocation has increased by about ten-fold over the last fifteen years, he added.

"However, allocations alone may not be enough to bridge the gender gap."

The study recommended a wide range of initiatives, including seeking out data on women's financial inclusion and their access to digital services, ensuring a gender-friendly business environment at banks and gender-friendly terms for loans and other services.

It also suggested the formulation of a detailed action plan to reduce the gender gap, and extending and effectively implementing fiscal incentives for women entrepreneurs.

In addition, capacity-building training, sustained campaigns, and advocacy to raise awareness are also required, it said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments