How mobile money is reshaping financial inclusion in Bangladesh

In recent years, Bangladesh has seen tremendous growth in digitalization, which is gradually changing the shape of the country's socioeconomic parameters and propelling it into the digital age.

The industry has evolved into a one-stop solution for all kinds of transactions, from sending and receiving money to paying utility, transit, education, medical, and retail expenditures. This invention has boosted financial inclusion.

As a key driver, the Mobile Financial Services (MFS) operators are helping to develop Bangladesh into a digital economy. It has successfully brought a substantial number of previously unbanked poor populations into the formal banking system. These populations, residing in both rural and urban areas, were long denied access to traditional banking services.

In 2012, Dutch Bangla Bank Limited pioneered mobile banking services in the country, marking the beginning of a decade-long journey. The central bank also started issuing licenses for MFS to boost the financial inclusion of all.

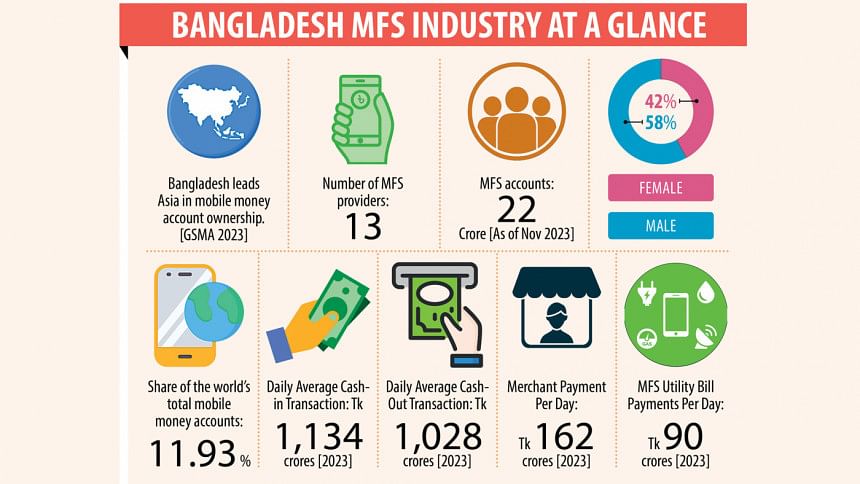

Currently, 10 banks and 3 subsidiary companies are providing MFS as an alternative payment channel. The MFS providers include Rocket, bKash, MYCash, Islami Bank mCash, Trust Axiata pay (tap), FSIBL FirstPay SureCash, Upay, OK Wallet, Rupali Bank SureCash, TeleCash, Islamic Wallet, Meghna Pay, and Nagad.

The launch of Bangladesh's first National Financial Inclusion Strategy 2021-2026 is a major step towards achieving financial inclusion for all.

As per the latest insights from a2i, the multinational digital organization founded by the Government of Bangladesh, financial inclusion has risen from 31 percent to 50 percent. As of November 2023, the MFS accounts stood at 22 crores with 13 MFS providers in Bangladesh, a country with a population of 17 crores, as many individuals maintain multiple MFS accounts.

However, this MFS account was 8.43 crores in 2019, an increase of 160 percent over the four years, according to Bangladesh Bank. Rural people, including a significant number of women, have played a pivotal role in driving the growth of MFS.

The government's decision to distribute cash through MFS as part of its social safety net programs and stimulus packages broadens the scope of the formal financial system to include more unbanked people. The use of MFS in the education sector has expanded during the pandemic, ranging from salary disbursement to college admission and tuition costs.

The number of remittances received through MFS has grown during the past four years. Bangladesh has launched its first instantaneous cross-border remittance service powered by blockchain technology.

"MFS is certainly working well. The increasing number of users, number of deposits, and money transferred through MFS bear testimony to this," said Dr Atiur Rahman, Former Governor of the Bangladesh Bank, saying the future of financial inclusion will have to be mostly digital.

"And MFS is definitely among the top tools of digital financial inclusion for both rural and urban economic activities," he said. "This is especially true of countries like Bangladesh where economic activities are dominated by informality. Nearly 80 percent of the economy of Bangladesh is still informal. We have come a long way since the inception of MFS in the country."

Rahman said MFS is primarily being used as a solution for transferring money. "It is high time we ensured further effective use of MFS."

MFS providers need to work with financiers (Banks, NBFIs, and MFIs) to provide loans, insurance services, and innovative savings schemes", he suggested. Some pilot initiatives have already been implemented and they have generated mostly promising results. The contribution of MFS in bringing remittance is also evolving faster.

However, Rahman said it must also be acknowledged that MFS in Bangladesh is yet to deliver on its full potential.

"Key issues to be addressed to realize the potential include- ensuring fair competitive market, effective regulation, enhanced interoperability, and above all digital financial literacy."

"There is no doubt that MFS has been a remarkable force in improving financial inclusion in the country by shaping the payment behavior," said Professor Ahsan Habib of the Bangladesh Institute of Bank Management. However, the time has come to consider quality aspects of financial inclusion. "We need multiple forces and products to enhance deposit inclusion, loan access, and insurance inclusion for realizing completeness", he added.

Tanvir A Mishuk, Managing Director of Nagad, the MFS Operator of the Postal Department, said people are now using mobile phones to send money to family members, recharge their mobile phones, pay utility bills, insurance premiums, EMI payments, and many more.

"Now, we are trying to bring the unbanked population into the fold of financial inclusion and ensure all financial services on a single platform", he said.

Another MFS service provider, bKash, also brings various facilities and has introduced widespread payment facilities all over the country with a huge merchant network of around 6 lakh merchants, according to its officials.

"BKash is relentlessly contributing to building a cashless ecosystem with the guidance and policy support of the regulator, Bangladesh Bank", they said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments