A Cashless Day with Mobile Money

In the hustle and bustle of my life as a university student juggling academics with a part-time job, one ordinary day took an unexpected turn. Rushing to catch the bus, I realized I had left my wallet behind. A stroke of luck revealed some cash hidden in my bag, sparking a curious thought – could I manage an entire day without using any hard cash?

The experiment commenced as I tried to pay my bus fare through a seamless, cashless Mobile Financial Services (MFS) transfer. Despite my inquiry, the conductor, appearing uninterested, insisted on cash. Undeterred, I later hailed a rickshaw, pondering if the rickshawala would accept digital payment. To my disappointment, he declined, indicating that not everyone was open to embracing digital transactions.

As the day progressed, I ventured into exploring every facet of my transactions through mobile money. Starting from having lunch at a local eatery to purchasing books for my brother and settling my internet bill, the convenience of digital transactions became increasingly apparent. The simplicity of Mobile Financial Services allowed me to seamlessly navigate through various facets of daily life, challenging my initial skepticism and proving that it has indeed become a comprehensive solution for a wide array of financial transactions.

However, a poignant moment at a roadside tea stall brought me back to the tangible world. The elderly shopkeeper, set in his ways, preferred hard cash and was unfamiliar with MFS technology beyond making and receiving calls on his phone. This served as a reminder that despite the pervasive influence of digital transactions, there are segments of society that still adhere to traditional methods.

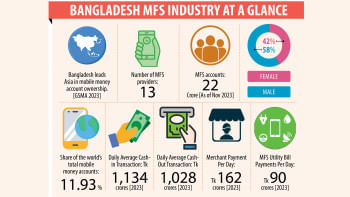

This brief encounter also highlighted a bridge between generations, with the older generation yet to fully embrace the digital era. It underscored the evolving nature of technology adoption, particularly in a country like Bangladesh where progress is often swift but not uniform.

Beyond personal anecdotes, experts recommend a comprehensive government plan to further enhance financial inclusion. This emphasized on a focused approach on financial and digital literacy training.

In conclusion, my day without cash served as a microcosm of Bangladesh's evolving financial landscape. The journey highlighted not only the progress made but also the persistent challenges. As technology continues to redefine the way we transact, the nation's inevitable move toward a cashless future brings about transformative changes, echoing in the experiences of individuals navigating this evolving landscape. The comprehensive coverage of a large number of my transactions through mobile money showcased its potential to be a game-changer, reshaping the way we conduct our financial affairs.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments