Changing landscape of mobile money in Bangladesh

A transformative shift emerged over a decade since the inception of Mobile Financial Services (MFS) in Bangladesh, initially confined to fund transfers. In recent years, the landscape of MFS has been changing with providers introducing digital credit and money-saving features through mobile applications. This evolution marks a significant departure from the earlier limited utility of MFS, highlighting a broader and more sophisticated financial ecosystem.

The integration of digital credit and savings options underscores the sector's adaptability and its pivotal role in fostering financial inclusivity, promising a dynamic future for the financial landscape in Bangladesh. Although the share of payment services is rising significantly, fund transfers still rule the roost in the MFS sector. The share of money transfers stood at 86 percent out of all transactions recorded at Tk 10, 75,990 crores in 2022. Four years ago, it was 93 percent of all transactions involving Tk 442,090 crores.

In 2022, the use of MFS for merchant payments, salary disbursements, government cash transfers to people, utility bill payments, talk-time purchases, and other usages accounted for more than 10 percent of all transactions.

"Starting as only a money transfer tool, Mobile Financial Services have now evolved into a platform of different services tailored to people's various needs," Tanvir A Mishuk, Founder and Managing Director of Nagad Ltd.

Platforms like bKash and Nagad have enabled widespread financial inclusion by providing accessible and convenient digital services, such as bill payments, and savings. However, the pace of the growth of the different payment segments under the MFS services has greatly outnumbered that of the fund transfer.

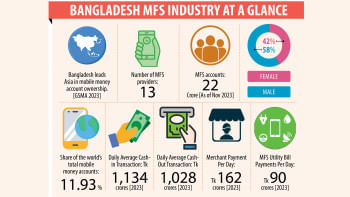

For example, the transaction of daily average cash-in grew by 149 percent to Tk 1,134 crores in 2023 from Tk 456 crores in 2019. During the same period, the merchant payment was increased by 853 percent to Tk 162 crores per day in 2023 from Tk 17 crores per day in 2019.

Similarly, the daily average transaction of the cash-out service went up by 135 percent to Tk 1028 crores in 2023 from Tk 437 crores in 2019. On the other hand, utility bill payments ballooned to Tk 90 crores per day in 2023 from Tk 14 in 2019—a staggering 536 percent increase.

bKash has been a trailblazer in introducing innovative digital financial services in Bangladesh. The platform offers various bill payment services, including utility bills, internet bills, and mobile phone recharges. This convenience has simplified everyday financial transactions for users. It has expanded its services to enable users to make payments at various merchants, allowing for cashless transactions at shops, restaurants, and other retail outlets.

bKash has collaborated with international partners to facilitate cross-border remittances, providing a streamlined and cost-effective way for Bangladeshi expatriates to send money home. bKash pioneered digital nano loans and savings accounts through MFS, promoting financial inclusion and allowing users to access credit and savings services.

bKash also introduced utility bill payment, ticket payment, government services and educational fee payment, insurance premium payment, government-to-person payment, salary disbursement of RMG and other organizations, and others.

To strengthen the digital payment ecosystem, bKash has ensured a solid integration with banks and NBFIs where customers can easily bring money to their wallets.

In a statement to The Daily Star, bKash mentioned that digital payments through MFS providers have experienced significant growth in Bangladesh, driven by the payment ecosystem and the fast-changing behavior of customers.

bKash is diving deep into building the ecosystem with diversified payment solutions and driving customers to adopt digital payments. It has enabled new ways of payment like QR codes, paying bills, and online payment collection systems.

Anyone now can make a payment by scanning the QR code in the bKash app at large and small retail stores and can pay various utility bills and fees through Pay Bill options. With the online payment solution, entrepreneurs can seamlessly collect payments from bKash customers on both web and mobile platforms as informed by bKash. According to bKash, increasing digital literacy, adequacy of affordable internet and smartphones, and awareness are the major names towards widespread adoption of digital payments.

The government and the regulator, Bangladesh Bank, can take the lead initiatives to promote and implement cashless payments gradually in all sectors by improving payment infrastructure, integration with different services, and offering incentives to encourage all to build a solid digital payment ecosystem.

Mishuk from Nagad Ltd. specified that five years back MFS services were limited only to cash-in and cash-out transactions, but merchant payments alone have now reached about Tk 6,000 crores a month, while monthly utility bill payments and private sector salary disbursements amount to more than Tk 3,000 crores each. Besides, government payments and disbursements through MFS have also marked a sharp rise.

"We are experiencing such a transformative shift from traditional transactions to more advanced payment services because our customers enjoy more comfort and convenience while they use the MFS platform that caters to their changing needs. And, I count that only because of new technology adopting helps Nagad and the industry to move forward," mentioned Mishuk.

He also added that Nagad is at present more focused on providing a comprehensive financial experience in the form of the country's first full-fledged digital bank, which aligns with the future of digital finance.

Asked about what needs to be done to increase the MFS payment for different products and services, he informed, "As an MFS, Nagad has done its best to reach out to people in different parts of the country and popularize digital payments for various products and services.

"But we have limitations…" he added. "To further promote MFS payments all over the country, we also need to educate people living in remote villages about the benefits and comfort of using MFS services for diverse transactions apart from cash-in and cash-out. We also should encourage more businesses to accept MFS payments by easily onboarding them."

A Z M Fouz Ullah Chowdhury, Head of Digital Financial Services at Meghna Bank Ltd., said, "We aim to expand our network by leveraging our existing customer base, encompassing both corporate and individual clients, along with partner organizations. This strategic focus, a central aspect of Meghnapay, will facilitate our reach to every corner of Bangladesh easily and effectively, utilizing the existing client base."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments