Govt plans to increase non-tax revenue

The government plans to rationalise its administrative fees and increase non-tax revenue (NTR) collection manifold so that overall revenue receipts will be scaled up to finance public expenditure.

As such, an initiative has been taken to set up an online database of all NTR items, detailing the fees, other charges and their date of imposition.

The database has already been shifted to a live server for piloting by six ministries. Based on the outcome, it will be open for operation, the finance ministry said in its Medium Term Macroeconomic Policy Statement (MTMPS) published last week.

The ministry also mentioned a plan to link the database with real-time data through iBAS++, an integrated financial management information system to enable public service delivery by the Bangladesh government.

"This database has opened the scope of adjusting the charges and significantly increasing NTR income from administrative fees," the MTMPS said.

Bangladesh's revenue collection is lower than its potential, hovering below the level of Nepal and India, which have similar economic development, according to the finance ministry.

Low revenue collection may make it increasingly difficult for the government to finance critical public expenditure in infrastructure, health, education, water resource management and social protection.

Hence, the government is implementing various reforms to increase revenue from tax and non-tax sources in the coming years.

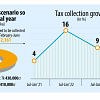

In the last five years, revenue from tax was around 86.8 percent while NTR was 13.2 percent.

And even though NTR grew by an average of 11.9 percent from FY19 to FY23, the report highlighted this growth as volatile.

NTR recorded growth of 69.5 percent in FY20 followed by 34.7 percent in FY21 thanks to idle funds from some state enterprises being transferred to the Treasury Single Account.

NTR declined by 38.9 percent in FY22 before rebounding to 7.62 percent the next year.

The report outlined the government's wish to explore the hidden potential of NTR, with digitalisation being one of the steps to increase it.

"The government is not only focusing on enhanced revenue mobilisation from NTR by raising fees or charges, but also putting its best effort to ensure efficient and satisfactory service delivery."

The finance ministry report also said the government has taken numerous steps to make service delivery systems paperless and minimise human deployment as these are key features for building a Smart Bangladesh by 2041.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments