Revenue collection accelerates in January

The pace of revenue collections quickened in January, driven by increased receipts from income tax as the deadline for filing personal income and wealth statements for the current fiscal year ended last month.

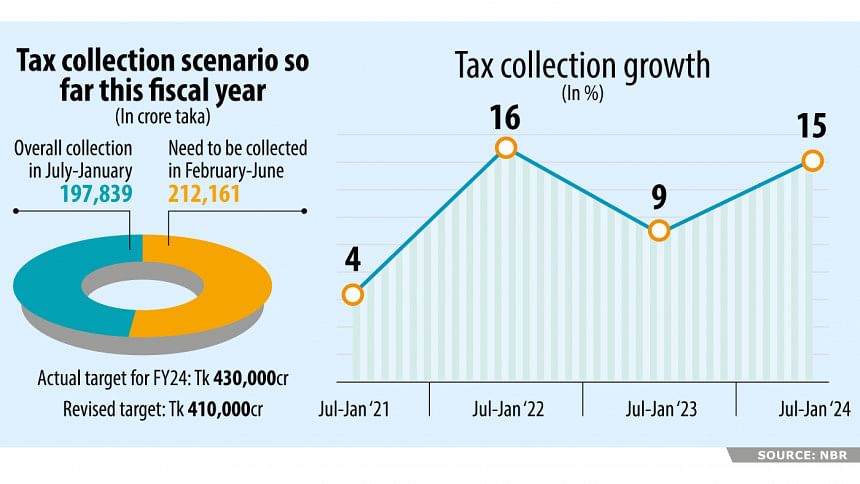

Provisional data from the National Board of Revenue (NBR) showed that all of its three wings -- customs, value-added tax (VAT), and income tax -- collected 15 percent higher tax year-on-year in the July-January period of the fiscal year 2023-24, amounting to Tk 197,839 crore.

Yet, the tax administration fell short of its target for the period by Tk 17,750 crore even after the government trimmed the collection target by 4.5 percent.

The NBR has a revised tax collection goal of Tk 410,000 crore for FY24. It managed to log 48 percent of the target in the seven months to January.

"It appears that the revised tax collection target for the whole year will not be achieved although there is a growing pressure on the side of public expenditure due to higher inflation and decelerating value of the taka against the US dollar and other foreign currencies," said Towfiqul Islam Khan, a senior research fellow of the Centre for Policy Dialogue.

A constrained revenue collection means the fiscal space will be limited for the government.

"The government should make judicious choices in having the right priorities in terms of public expenditure," he added.

"The budget will need to be revised in a realistic manner. Most importantly, the value for money needs to be ensured without exception. Indeed, good governance in both mobilising revenue and public money spending should be of utmost priority."

Income and travel tax registered an 18 percent growth to Tk 63,074 crore in July-January compared to the previous year, NBR data showed.

VAT collection – the biggest source of revenue for the government – climbed 16 percent to Tk 77,224 crore.

An official of the NBR said increased consumer prices, or inflation, boosted the receipts of VAT, the indirect tax paid by consumers, in the first seven months of the fiscal year.

However, the growth of revenue by customs from import and export was the lowest as foreign currency shortages continued to keep purchases from external markets down.

Overall imports slumped nearly 20 percent year-on-year to $30.5 billion in July-December of 2023-24, according to Bangladesh Bank data.

The customs wing recorded nearly 10 percent growth to Tk 57,540 crore in July-January, according to the NBR data.

Muhammad Shahadat Hossain Siddiquee, professor of economics at the University of Dhaka, said the revenue collection was lagging behind the target.

He said the deficit per month stood at more than Tk 2,500 crore on average, and it would total around Tk 30,000 crore at the end of FY24.

"Falling behind the target highlights the ineffectiveness of the authorities engaged in revenue collection."

However, Prof Siddiquee said, it is optimistic in a sense.

"Based on the current economic condition, especially in terms of imports and economic growth, revenue collection is satisfactory."

Bangladesh has been going through one of its worst economic crises in recent decades because of the lingering impacts of the coronavirus pandemic and the Russia-Ukraine war.

"To fulfill the target, the overall revenue collection needs to be increased by 30 percent, which seems unfeasible," Siddiquee said.

Siddiquee said the government had set an ambitious target as part of the International Monetary Fund's (IMF) loan condition, which is to increase the tax-to-GDP ratio by 0.5 percent in FY24.

He said the IMF had revised down the annual target for the government by Tk 20,000 crore.

"Still, it seems a major challenge to achieve the revised target, which will, in turn, definitely put an extra burden on the public."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments