How far have fiscal measures promoted industrialisation?

The government is likely to extend tax exemptions for the information technology sector for three more years as the current phase of concessions ends on June 30.

Finance Minister Abul Hassan Mahmood Ali is likely to announce the extension today when he unveils his as well as the new government's first budget.

The IT sector has been enjoying the tax break for several years. It is one of the many sectors that have been allowed tax and VAT exemptions as well as concessional import duties as the government looks to spur industrialisation, create jobs for the millions of youths joining the workforce each year, and accelerate economic growth.

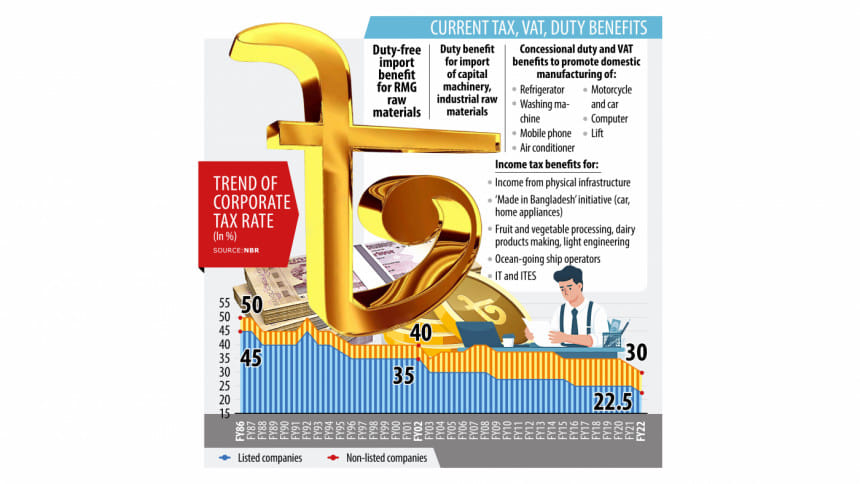

For example, the corporate income tax has halved over the past four decades.

However, questions remain whether the generous tax treatments as well as overall fiscal policies have drawn investments and facilitated manufacturing growth.

Economists and businesses have been affirmative.

Sadiq Ahmed, vice-chairman of the Policy Research Institute (PRI) of Bangladesh, said the fiscal policy has contributed to the boom of the readymade garment sector, which in turn generated jobs directly and supported the development of backward linkages and yarn and fabric textile enterprises, indirectly.

"The decision to allow duty-free imports of all RMG inputs through the bonded warehouse system was instrumental in driving the growth of garment production and exports."

The apparel sector began its journey more than 40 years ago with earnings standing at $31.5 million in the fiscal year of 1983-84, which accounted for only 3.8 percent of the total earnings from the export sector.

Today, it is the biggest foreign currency earner in the country and fetched 84 percent of the $55.5 billion generated from the sales of merchandise in the last fiscal year of 2022-23.

Bangladesh is also the second-largest supplier of apparel in the world, only behind China. It is the biggest employer as well.

"The fiscal policy has wide-ranging impacts on several dimensions of the economy -- investment, industrialisation, job creation, economic growth, and poverty reduction," said Zaidi Sattar, chairman of the PRI.

"It is a pivotal component of Bangladesh's policy stance for development."

He said overall, the fiscal policy has been vital in driving economic progress in the past and would remain the pivotal macroeconomic policy instrument to support future investment, industrialisation, and job creation.

Syed M Tanvir, managing director at Pacific Jeans, one of the largest garment exporters in Bangladesh, said the tax and duty measures helped the garment sector expand.

"The duty-free import benefit of fabric and accessories has been a timely step."

Sadiq Ahmed called for extending similar support to non-RMG exports combined with a market-based exchange rate.

"A selective and timebound use of tax incentives and subsidies can also provide support to the growth of other promising export-oriented industries."

The NBR provides the opportunity to import a large portion of capital machinery, and industrial raw materials at reduced import tariffs. Besides, it offers special duty, VAT and tax benefits to promote industrialisation in export processing zones, economic zones, and high-tech parks.

"Several years ago, Bangladesh was dependent on imported home appliances. The tax benefits have supported the growth of domestic manufacturing of televisions, refrigerators, air conditioners, and mobile phones. Now, such imports have reduced," said an official of the NBR.

Ashraf Ahmed, president of the Dhaka Chamber of Commerce and Industry, also said over the last few decades, tax policy support has been one of the key factors for industrialisation and job creation.

Experts and businesspeople also highlighted the challenges linked with the current tax and incentive system.

Ashraf Ahmed said the key drawback of the tax policy regime is the lack of a long-term roadmap and guidance.

Tanvir of Pacific Jeans said the NBR should not change tax and other policies frequently with a view to giving a predictable environment to businesses.

M Masrur Reaz, chairman of the Policy Exchange of Bangladesh, points out that the country is yet to offer a fully conducive tax environment for businesses and investors.

"In the absence of rationalisation of the exemptions, the avoidable tax expenditure has caused the state to lose significant revenues."

Prof Mustafizur Rahman, a distinguished fellow at the Centre for Policy Dialogue, said it is a good sign that the government has protected domestic industries and helped them become competitive.

Now, it will have to review the existing tax benefits and incentives since the country will not be able to continue direct subsidies and cash support once Bangladesh becomes a developing nation in 2026.

"Now, it is time to set priorities and phase out exemptions," added Rahman.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments