Industrial slump leads to GDP growth slide

Bangladesh's gross domestic product is estimated to have grown at a slower pace in the current financial year with the biggest blow stemming from the industrial sector, official figures showed.

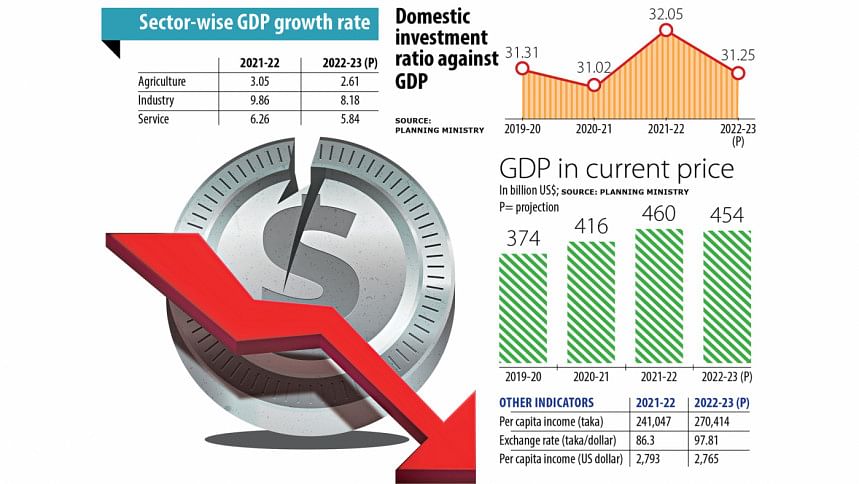

The GDP is estimated to have expanded by 6.03 per cent in the fiscal year ending in June, down from 7.1 per cent in 2021-22, according to the provisional projection of the Bangladesh Bureau of Statistics (BBS).

It comes as the industrial sector has been grappling with a sharp fall in the value of the taka against the US dollar and lower investment, exports and import of raw materials.

The industrial sector's growth dropped by 1.68 percentage points to 8.18 per cent in 2022-23. It was 9.86 per cent a year ago.

The growth of the agriculture sector slipped by 0.44 percentage points to 2.61 per cent and the services sector declined 0.42 percentage points to 5.84 per cent.

The services sector accounts for about 53 per cent of Bangladesh's GDP, while the industrial sector constitutes about 36 per cent and the agriculture sector about 11 per cent.

The BBS projection is based on the performance of the various indicators of the economy in the first half of FY23.

According to Zahid Hussain, a former lead economist of the World Bank's Dhaka office, the data shows a deceleration of growth in all sectors, suggesting the existence of adversities common to all.

"Clearly, these had to do with energy and foreign exchange shortages, which disrupted investment and production."

Bangladesh has been going through an energy crisis since the global energy market took a hit from the outbreak of the Russia-Ukraine war in February last year.

The situation prompted Bangladesh to go for import controls of non-essential and luxury items amid falling foreign currency reserves.

The government also paused the purchase of liquefied natural gas from the international open markets to stop the erosion of the reserves. The import controls affected the import of primary energy, which, in turn, disrupted the production of electricity, leading to nationwide power outages and their consequent adverse effects on production.

The reserve stood at $41.94 billion on May 10 last year but it slipped to $30.34 billion on May 10 this year as import bills surged for higher commodity prices in the global markets, according to the central bank.

Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh, said the industrial sector has been seriously impacted as many factories failed to import adequate raw materials.

"So, their production fell."

Between July and March, the opening and settlement of letters of credit for importing industrial raw materials dropped 31 per cent and 6.68 per cent, respectively, compared to the same period a year ago.

The LC opening and settlement for importing capital machinery dropped 55.88 per cent and 14.93 per cent, respectively. This weighed on export earnings.

Shipments were up 5.38 per cent year-on-year to $45.67 billion in the first 10 months of FY23. It surged 34.38 per cent to a record $52.08 in the entire financial year of 2021-22.

The growth of the manufacturing sector is a key driver of Bangladesh's economy and it usually remains at double-digit.

But Mansur thinks the actual growth in the sector may fall further at the end of the financial year.

The growth in the agricultural sector usually remains low until it sees any bumper harvesting.

While calculating the agriculture sector's contribution to the GDP, the BBS has taken into account the final output of Aush and Aman paddies, and jute in 2022-23. In the case of Boro, wheat and potato, the production figures of the previous year were considered.

Selim Raihan, executive director of the South Asian Network on Economic Modeling, said the economy was in a recovery process but it was impacted because of the price hike globally after the war broke out.

"The supply chain faced disruption, the fuel price was hiked, and the cost of other inputs also went up. As a result, the cost of production rose, hurting the manufacturing sector."

In the current fiscal year so far, the price of diesel and furnace oil has climbed 36 per cent and 37 per cent, respectively. The electricity tariff is up 10.23 per cent.

"Big companies were impacted, but micro, cottage, small and medium enterprises bore the most brunt," said Raihan, also a professor of economics at the University of Dhaka.

The government has projected that the investment-to-GDP ratio would be 31.25 per cent in FY23, down from 32.05 per cent in FY22.

"This shows that the incremental capital-output ratio is now 5.20, which was 4.57 in the previous year. This means the productivity of the investment is becoming lower and the production cost of the manufacturing sector is rising," said Prof Raihan.

"If the ratio keeps rising, entrepreneurs will not feel encouraged to invest. As a result, the GDP growth would be impacted further," he said, urging the government to take steps to reduce costs.

A lower incremental capital-output ratio is preferred as it indicates a country's production is more efficient.

The inability to import due to the forex shortage has affected capacity utilisation as well as capacity expansion, said Zahid Hussain.

"If we continue to believe that the exchange rate, monetary, fiscal and structural policy responses need no major correction, we will be ignoring the lessons from the data at our own peril. It's already late in making course corrections, but better late than never."

Prof Raihan emphasised taking corrective measures.

"It is a good sign that the government is accepting the reality and aligning the growth projection in line with the projections of development partners. It might be helpful in taking better strategy."

In April, the World Bank projected that the GDP growth rate of Bangladesh would be 5.2 per cent in FY23 and the Asian Development Bank's projection was 5.3 per cent.

The IMF has forecast a 5.5 per cent GDP growth.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments