Inflation rockets to eight-year high

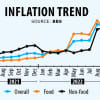

Inflation surged to an eight-year high of 7.42 per cent in May, driven by a hike in food costs, underscoring the plight a majority of the population in Bangladesh is currently experiencing, official figures showed yesterday.

Last month's sharp rise in the Consumer Price Index (CPI) was more than one percentage point higher than in April, when it stood at 6.29 per cent, according to data released yesterday by the Bangladesh Bureau of Statistics (BBS).

The price increase is the sharpest since May 2014 when it surged to 7.48 per cent.

In Bangladesh, inflation has been rising since October owing to accelerated costs for commodities globally amid lingering supply chain disruptions and the Russia-Ukraine war.

The adjustment of the fuel price in November and the edible oil prices this year in line with international rates and the depreciation of the local currency that has made imports expensive are among the factors that have contributed to the higher price pressure.

Food inflation rocketed to 8.3 per cent, an increase of more than 2 percentage points from April's 6.23 per cent and also the highest since May 2014 -- led by increased prices of rice, wheat, pulses, fish, beef, and cooking oil.

"Such sharp increases in rice price during the boro harvest month is indicative of either a production shortfall relative to what was expected and/or increased profiteering in the supply chain," said Zahid Hussain, an economist.

"Credibility of rice production statistics has been an issue for a while and now the market prices appear to be confirming the suspicions. We also heard allegations of price gouging by millers and stockers."

Non-food inflation declined to 6.08 per cent from 6.39 per cent a month ago, reflecting the people's tightening of belts amid higher food expenses.

The price increase is hurting rural households more compared to urban consumers.

General inflation in rural areas shot to 7.94 per cent from 6.59 per cent in April, while food inflation accelerated to 8.84 per cent compared to 6.64 per cent a month ago.

In urban areas, general inflation was up nearly one percentage point to 6.49 per cent in May. Food inflation went up to 7.08 per cent.

Bangladesh is not the only country that is experiencing higher inflation.

A Pew Research Center analysis of data from 44 advanced economies finds that, in nearly all of them, consumer prices have risen substantially since pre-pandemic times.

In 37 of these 44 nations, the average annual inflation rate in the first quarter of 2022 was at least twice what it was in the first quarter of 2020, as Covid-19 was beginning its deadly spread.

Inflation has probably not reached its peak yet.

"The slower non-food inflation in May is unlikely to be sustained as the impact of the exchange rate depreciation in May and June begin to percolate going forward," said Hussain.

"We are also hearing about an impending increase in electricity and petroleum prices. This will fuel the inflationary fire even more together with an expansionary fiscal policy, increased duties on many imported consumer items, and, of late, early floods."

The spike in inflation is reversing the gains in poverty reduction from the depth reached during the pandemic in 2020 and the first half of 2021. Lower-income households, whose food expenditure accounts for a major portion of their consumption basket, are struggling to make their ends meet.

The proposed FY23 budget is short on making provisions for supporting the poor and low-income households in coping with the inflationary whiplash.

"Inflation management, not GDP growth, should be central to macroeconomic management under the prevailing circumstances," said Hussain, a former lead economist of the World Bank's Dhaka office.

He argues that both monetary and fiscal responses are needed to manage inflation better.

"The increase in the repo rate is weightless when the lending rate is capped. The latter is the policy rate for all practical purposes. It needs significant upward adjustment, if not removal."

The lingering higher prices in Bangladesh mean that the government is set to miss its inflation target for the third year running in the outgoing fiscal year.

It had set a 5.3 per cent average inflation target at the beginning of FY22. It has been revised upwards to 5.7 per cent.

The CPI averaged 5.99 per cent during the July-May period, data from the BBS showed.

The government has set a 5.6 per cent inflation target for FY23, starting on July 1, although a number of local economists and even the International Monetary Fund are expecting the price pressure to persist for a longer period.

According to the Centre for Policy Dialogue, inflationary pressure will hamper a sustainable and inclusive recovery from the coronavirus pandemic, since the real purchasing power of many people will decline, causing further inequality.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments