Interbank lending rate goes past 9% cap for liquidity crunch

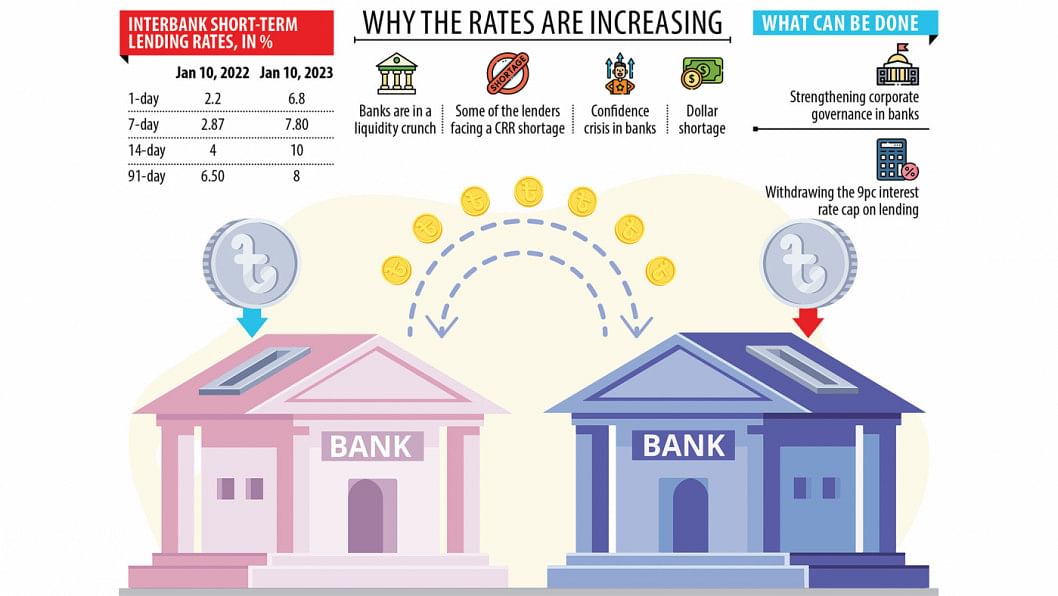

Cash-strapped banks are borrowing from cash-rich lenders paying more than 9 per cent in interest rate, which is above a cap set by the central bank, as an unprecedented liquidity crunch has hit the banking sector of Bangladesh.

Some lenders have recently faced a cash reserve ratio (CRR) shortage, forcing them to secure funds at a higher interest rate from others.

For example, a bank yesterday took a loan amounting to Tk 15 crore, the maturity of which is 14 days, at a 10 per cent interest rate. A similar loan would cost 4 per cent a year earlier.

Another lender obtained a loan of Tk 120 crore at 9.25 per cent interest on Monday, with a repayment period of 90 days. The lending rate was 4.25 per cent the year before.

Banks turn to the interbank money market for short-term funds in order to meet their day-to-day financial needs.

"The existing liquidity crunch in the banking sector is unprecedented," said Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh.

The interest rate in the interbank money market in Bangladesh usually shoots up in the run-up to Eid-ul-Fitr and Eid-ul-Azha, the two largest religious festivals for Muslims in Bangladesh, as people withdraw funds from the banking system to meet a rise in expenses.

"Banks are now facing such a situation and there is no sign that the rates would go down soon. Our banking sector hardly faces such turbulence in the money market," said Mansur, also a former economist of the International Monetary Fund.

Some banks are now in trouble stemming from the liquidity shortage, creating a shortfall in their CRR, which is a portion of a bank's deposits that it must keep in liquid cash with the central bank to protect depositors' interest.

In Bangladesh, the CRR is 4 per cent.

Under such a situation, banks are now trying to mobilise funds desperately to maintain their required CRR. Otherwise, they will face penalties.

The BB has recently injected a large volume of funds into some cash-strapped banks, helping them maintain the CRR.

In addition, the central bank has injected around $7.50 billion into the banking sector to help banks clear import bills amid a shortage of dollars. Banks have bought the greenback in exchange for the taka which has dried up the liquidity base.

The central bank has been offering deferral support for loan repayment since 2020, helping borrowers tackle the business slowdown emanating from the coronavirus pandemic. But banks have not got back their most funds from borrowers on time owing to the facility, which has contributed to deepening the liquidity crunch.

"The higher interest rate in the interbank money market will erode the profit base of banks to a large extent," said Mansur.

In Bangladesh, banks are not allowed to charge more than 9 per cent in interest on loans except for credit cards, as the central bank has maintained the ceiling since April 2020.

The BB has recently told banks verbally that they can set a maximum of 12 per cent interest on retail loans. But, the majority of them are yet to implement the instruction since the central bank has not issued any official order to this effect.

Mansur suggested the central bank withdraw the interest rate cap immediately as such a move will help banks raise the interest rates on loans and deposits.

Although some banks have imposed lending rates between 7 per cent and 7.5 per cent to mobilise deposits, the rates are not working largely as a section of depositors are not keen to park their funds with banks because of the recent spate of scams in the banking sector and the higher inflation rate.

Inflation surged to a 10-year high of 9.52 per cent in August before easing to 8.71 per cent in December, which has rendered the deposit rate negative.

Sizable private sector credit off-take, falling deposit growth on the back of negative real interest rates on deposits and increased bank spending on the US dollar somewhat squeezed up the banking system liquidity, said the BB in a report recently.

If the interest rate cap is withdrawn, banks will be able to set higher interest rates on deposits, thus attracting funds. Similarly, the initiative will push up the interest rate on loans, which will ensure the profitability of banks.

"If the inflow of the US dollar increases, the ongoing liquidity shortage will ease," Mansur said.

Syed Mahbubur Rahman, managing director of Mutual Trust Bank, says that the interest rates in the interbank money market are going up almost every day.

"This is not a normal phenomenon. It is difficult for banks to make a profit due to the liquidity stress."

Rahman said the imposition of the 9-per cent interest rate cap has helped small borrowers receive loans smoothly. "Time has come to reconsider it given the ongoing situation."

A central bank official says that the central bank had earlier verbally instructed banks not to impose more than a 9 per cent interest rate in the interbank money market.

"But the situation is different now, so the central bank is not raising any objection to this end."

A managing director of a bank says that ensuring corporate governance in the banking sector is essential to restore the confidence of depositors.

"The central bank should take strict measures against delinquent borrowers to improve the financial health of banks."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments