July’s economic data: Dark clouds starting to clear

Inflation bucked its runaway trend in July, becoming the third data point this month after remittance and import to provide some relief to a government on its toes about the direction the economy was taking.

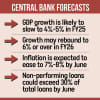

In July, inflation eased marginally to 7.48 percent after hitting a nine-year high of 7.56 percent the previous month, according to data from the Bangladesh Bureau of Statistics.

The rising price of food was largely blamed for the cost of living crisis gripping the poor and the middle-class in recent months and that appears to be calming down, too: food inflation was 8.19 percent in July, down 18 basis points from the previous month.

Food prices dropped more in urban areas than in rural areas: by 27 points to 6.84 percent.

Non-food inflation, which was feared would race ahead for the heavy currency depreciation seen in the past two months, accelerated slightly in July: by 6 basis points to 6.39 percent.

"The price level will be coming down further in the coming months as commodity prices are on the decline in the international market," said Planning Minister MA Mannan yesterday while unveiling July's inflation data.

He went on to credit the government's proactive step in June of allowing private millers to import rice for the drop in food prices, which, in turn, reined in the overall inflation.

The news of the deceleration of inflation, after six consecutive months of increase, comes after the Bangladesh Bank reported that imports have started to contract from June. In July, imports stood at $5.5 billion -- a bill not seen since the throes of the pandemic.

The rising trend of inflation and imports heaved pressure on the country's foreign exchange reserves, posing to become an Achilles heel for the economy.

But remittance, a significant source of foreign currency for the Bangladesh economy, posted a 14-month high of $2.1 billion in July. Exports, the other major source of foreign currency, posted a 15 percent growth last month.

"We will get back to the old course of the economy soon -- we will get the economy back up to speed in a month or two," Finance Minister AHM Mustafa Kamal told reporters after a meeting of the cabinet committee on purchase yesterday.

Economists though remained cautiously optimistic.

Zahid Hussain, a former lead economist of the World Bank's Dhaka office, said: "If the power supply is not normalised, how can you say that the economy will get back on track soon?"

The government has been rationing the electricity supply as part of its austerity measures to preserve the country's foreign exchange reserves, which stood at $39.49 billion on July 27 -- enough to cover just about five months' import bill.

As a result of the power rationing, irrigation of the dry season rice crop boro has been disrupted, which can again cause food inflation.

Hussain, though, acknowledged that the current account deficit, which is the shortfall between the money received by selling products to other countries and the money spent to buy goods and services from other nations, is unlikely to widen further.

In June, the current account deficit stood at $18.7 billion -- the highest in Bangladesh's history.

"But by how much and how fast the current account deficit narrows is hard to say at this point. The international commodity prices are declining but whether the trend sustains remains to be seen," Hussain said.

The pressure on reserves will ease too.

"That came from the current account deficit and that deficit will narrow unless another global disruption comes up. Remittance will increase as some 12 lakh fresh migrant workers left Bangladesh in the last two years. The import bill will drop as the international commodity prices have stabilised."

If the austerity measures are complied with fully and some flexibility is brought in the interest rate, inflation will drop in line with the decline in international commodity prices, Hussain added.

Mustafizur Rahman, distinguished fellow of the Centre for Policy Dialogue, said the ordinary people will not get relief from the precarious state of the economy that soon.

"Since inflation is already at an elevated level, July's drop in inflation will not lessen the pressure on ordinary people. The cumulative effect is still high."

July's inflation means the price level is well above the budgetary target of 5.6 percent for fiscal 2022-23.

"If the trend is sustained, then the pressure will drop on the exchange rate," he said, while advising the government to heighten its monitoring to curb hundi and the practice of mis-invoicing.

But, there were some green shoots in July's data so far.

"We are seeing positive signs. Whether the trend sustains for another 3-4 months remains to be seen. But we will have an idea after another 2-3 months," Rahman added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments