Big foreign banks in Bangladesh see profits take a hit

Large foreign banks operating in Bangladesh took a hit in 2021 as their profits plunged due to the impacts of the coronavirus pandemic and the lower interest rate regime.

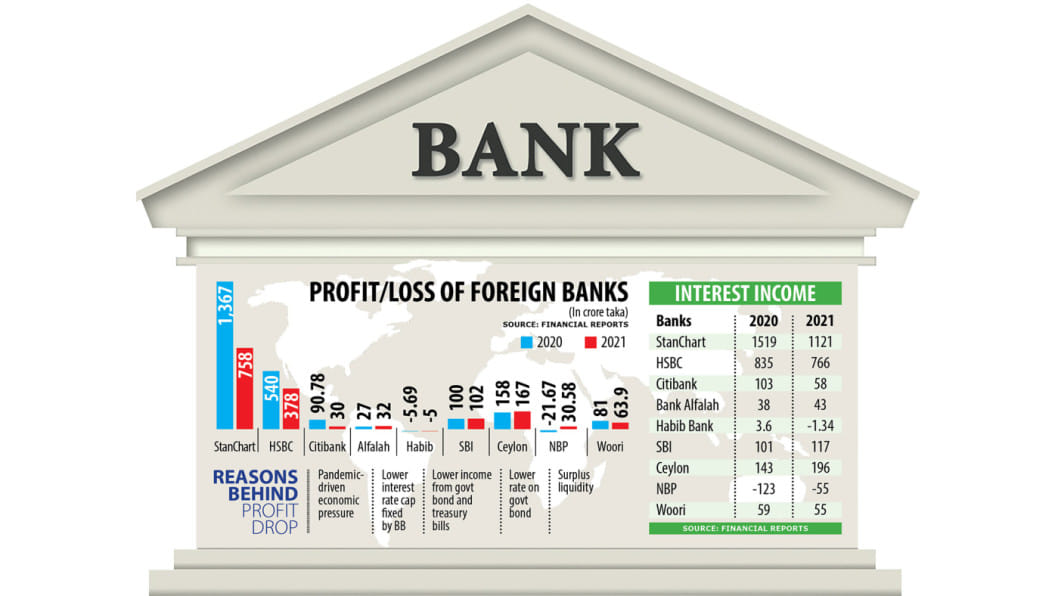

Collective profits for the nine banks fell more than 33 per cent year-on-year to Tk 1,556 crore in 2021. It was Tk 2,336 crore in 2020, showed financial statements of the multinational lenders.

The interest income of five of the nine international banks went down owing to the ceiling on the lending and deposit rates and the moratorium announced by the central bank to give a cushion to businesses pummeled by the countrywide lockdowns and depressed demand.

The banks have been ordered to keep the deposit rate within 6 per cent and the lending rate at 9 per cent since April 1 of 2020 as the government looks to ensure a single-digit interest rate. The cap drastically brought down the interest income for almost all banks in Bangladesh.

The local operations of Standard Chartered, which is headquartered in London, logged profits of Tk 758 crore last year, down 44.5 per cent compared to 2020, when it raked in Tk 1,367 crore, according to its financial statements.

HSBC Bangladesh, another British bank, was also almost in the same situation. Its profits declined 30 per cent to Tk 378.36 crore in the recently concluded year.

Profits of Citibank NA, a US lender, plummeted 66.95 per cent to Tk 30 crore compared to the previous year's Tk 90.78 crore.

Sri Lanka's Commercial Bank of Ceylon, State Bank of India, Bank Alfalah of Pakistan, and the National Bank of Pakistan made higher profits in 2021.

Habib Bank, a Pakistani multinational bank, remained in the red.

Woori Bank witnessed 21 per cent lower profits of Tk 63.9 crore last year, against Tk 81 crore a year ago, according to the financial report of the Korean multinational lender. The net interest income dropped 6 per cent to Tk 55.9 crore.

"The decline in the profits of the foreign banks was not unexpected after such a devastating pandemic since the crisis has hurt almost all businesses," said Shah Md Ahsan Habib, a professor at the Bangladesh Institute of Bank Management.

Although the foreign banks were hit by the business slowdown, they have kept investing in technologies, he noted. "They will reap the benefit of the investment in the future."

In contrast, local banks showed higher profits and provided dividends in 2021, helped by the Bangladesh Bank's relaxed policy that allowed them to count income from unrealised instalments of loans.

"But this is not expected during a crisis," said Habib, adding that as many borrowers did not pay back their loans fully in the last two years, the net interest income of banks fell.

The BB allowed the borrowers to retain their loan status unchanged through the payment of a portion of the loans for two years.

The interest income of Standard Chartered Bangladesh was down 26 per cent to Tk 1,121 crore in 2021. The income from investment fell 31 per cent to Tk 338 crore mainly due to the drop in the interest earnings from government bonds and Treasury bills.

The income from the government bonds and Treasury bills declined to Tk 312 crore from Tk 439 crore a year earlier.

Standard Chartered Bangladesh cut the salary and allowances of its chief executive officer to Tk 4.38 crore from Tk 4.84 crore a year ago, the financial statements showed.

HSBC Bangladesh's net interest income dropped to Tk 766 crore, a fall of 8.24 per cent from Tk 835 crore in the previous year, according to the financial report.

Commissions, exchanges and brokerage charges fetched Tk 461 crore for the bank, up 12 per cent year-on-year, helped by higher earnings for the opening of letters of credits for imports.

The income from the opening of LCs stood at Tk 231 crore, a rise of 27 per cent.

The British lender managed to keep its operating costs almost unchanged: it was Tk 546 crore last year against Tk 544 crore in 2020.

HSBC Bangladesh's CEO saw a pay-cut of 23 per cent to Tk 4.33 crore.

In a statement, the bank says its underlying business was resilient and it is well-positioned for future growth.

"We saw good annual growth in overall assets and liability balances, and we maintained good profitability. We are also proud to have supported the people and businesses of Bangladesh during the pandemic."

Speaking about the fall in profit, the London-based lender said the pandemic impacted all banks and HSBC was no exception.

Standard Chartered Bangladesh says its profits were impacted by the lower income as well as higher loan impairment charges.

"The bank's income performance was adversely impacted by margin compression in both commercial and investment books due to the significant surplus liquidity in the market."

In a statement, the multinational lender says it booked higher impairment charges in 2021 to absorb any loan losses, which may arise post-payment moratorium.

The provisions held by the bank stand at 257 per cent of the required provisions as per Bangladesh Bank guidelines, and the provisions coverage ratio was 135 per cent of non-performing loans.

Despite the higher impairment charges, the bank's capital adequacy ratio remained strong at 23.4 per cent against the market average of 11.22 per cent in September.

"With its strong capital base and surplus liquidity, the bank is well-positioned to grow its business in 2022 and beyond," added Standard Chartered Bangladesh.

The National Bank of Pakistan returned to profits last year.

The profits stood at Tk 30.58 crore, compared to Tk 21.67 crore losses it incurred a year ago.

However, the Karachi-based state-run multinational commercial bank's net interest income was still in the red.

The net interest income was Tk 55 crore in the negative in 2021, an improvement from Tk 123 crore in the negative a year ago.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments