Major currencies getting stronger against taka

Almost all major foreign currencies like the European Union's euro, British pound sterling, Chinese renminbi, Japanese yen and Indian rupee are following in the footsteps of the US dollar in becoming stronger against the local currency.

The inter-bank selling rate for each US dollar stood at Tk 109.50 last Thursday, up from Tk 95 exactly a year back. For each euro, it was Tk 119.66, up from Tk 95.15 in the previous year.

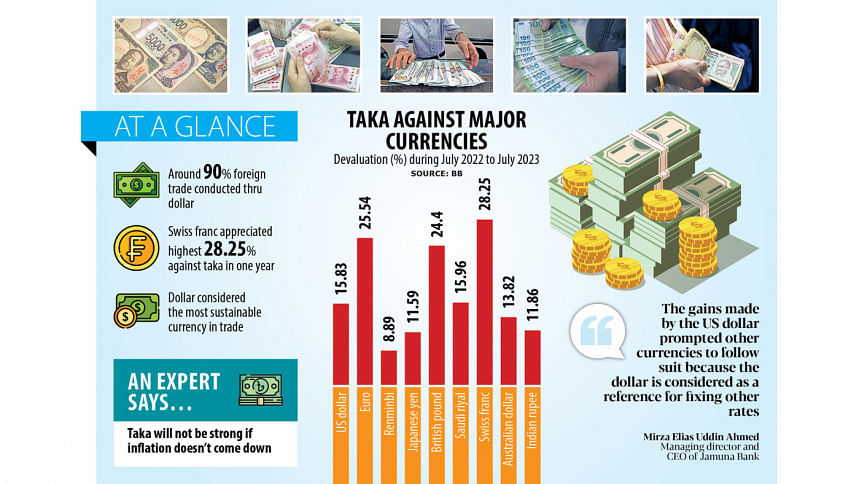

Till July of this year, the Swiss franc made the highest appreciation of 28.25 percent year-on-year against the taka.

It was followed by the euro (25.54 percent), pound sterling (24.4 percent), Saudi riyal (15.96 percent), US dollar (15.83 percent), Australian dollar (13.82 percent), Indian rupee (11.86 percent), yen (11.59 percent) and renminbi (8.89 percent).

Till July of this year, the Swiss franc made the highest appreciation of 28.25 percent year-on-year against the taka.

Around 90 percent of foreign trade is conducted through the US dollar while the remaining 10 percent through other foreign currencies, bankers said.

Although the use of other foreign currencies continues to rise, the growth is not very high, they said.

The US dollar is considered to be the most sustainable foreign currency in foreign trade, Mirza Elias Uddin Ahmed, managing director and CEO of Jamuna Bank, told The Daily Star.

Unlike the US dollar, the values of other foreign currencies make very quick transitions against the local currency. That is why the US dollar is a more trusted currency, said the banker.

The gains made by the US dollar prompted other currencies to follow suit because the US dollar is considered as a reference for fixing other rates, he pointed out.

"We, however, are also conducting foreign trade through other currencies such as euro, pound and renminbi considering the cross-currency rate," said Ahmed.

The taka has weakened against almost all the foreign currencies mainly due to supplies being slow against high demand, said Mohammad Ali, managing director and CEO of Pubali Bank.

"Our import payment is higher than the export earnings, which created the shortage of foreign currencies," he said, adding, "We have to find new export markets to increase the foreign currency earnings."

"Almost all the currencies were devalued against the US dollar, that is why our local currency has weakened against the foreign currencies," said Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh.

"It is very concerning that our local currency has weakened sharply due to skyrocketing inflation and interest rate in lending being low," he said.

The taka will not be able to become stronger against the foreign currencies if inflation does not reduce, said the economist.

Inflation in Bangladesh stood at 9.69 percent in July, as per the Bangladesh Bureau of Statistics (BBS).

In May, it was at an 11-year high of 9.94 percent.

Demand for other foreign currencies is continuing to rise but the US dollar is still dominating foreign trade, said a senior central bank official.

The number of tradeable foreign currencies have also increased, he added.

Bangladesh Bank in September of last year said local banks would be able to maintain accounts in Chinese yuan or renminbi with their corresponding lenders or branches abroad so as to help local businesses settle transactions for foreign trade using the currency.

The BB official said the government issued a gazette notification in March 2014 declaring the Chinese yuan or renminbi as a convertible currency, a currency that can easily be exchanged for the currency of another country.

In July of this year, Bangladesh and India rolled out a cross-border trade settlement mechanism involving the rupee.

As per a government notification, local businesses are allowed to settle their foreign trade by using eight foreign currencies – the US dollar, Canadian dollar, Australian dollar, Singapore dollar, euro, British pound sterling, Swiss franc and Chinese yuan or renminbi.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments