No respite for workers as wage growth stays behind inflation

Mrinal Biswas, a resident of Botiaghata upazila in Khulna, doesn't find job opportunities every day. And when the 62-year-old fisheries worker is lucky to be employed, he earns Tk 500 per day.

Thus, Biswas, who toils for hatcheries, worked 16 days last month, thus earning Tk 8,000.

"But it is tough to maintain a family of five with the income," he said.

"The price of everything has increased, but our income didn't increase at the same pace. In fact, our income hasn't increased for more than one year."

Bashudeb Mojumder, a day worker in the south-western district, echoed Biswas.

"Day-labourers who don't have agriculture land or other earning sources are finding it difficult to maintain a minimum standard of living," he said.

Biswas and Mojumder are among the hundreds of thousands unskilled and low-skilled workers in Bangladesh who are struggling to make ends meet owing to persistently high inflation and lower wage growth.

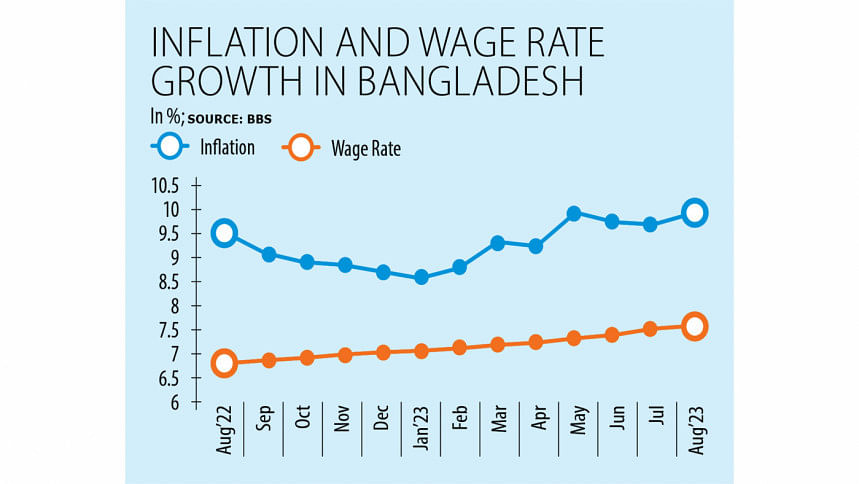

The wage grew 7.58 percent for low and unskilled workers in August, which was 2.34 percentage points below the inflation rate of 9.92 percent in the month, data from the Bangladesh Bureau of Statistics (BBS) showed.

This means the wage growth has been behind the inflation rate for the past 19 months.

The Wage Rate Index of the national statistical agency takes into account the wages of informal sector workers across 44 occupations in the agriculture, industry and service sectors who get their payments on a daily basis.

The overall wage rate for workers in the industrial and service sectors has declined while it increased in the agriculture sector.

Division-wise, the wage rate in Dhaka, Chattogram, Rajshahi, Sylhet and Mymensingh divisions went up. On the other hand, it decreased in Rangpur and Barishal while the rate remained stable in Khulna.

Analysts say the widening gap between the inflation rate and the wage growth rate is forcing low-income and unskilled workers to cut consumption amid falling real incomes and the rising cost of living.

"It's an alarming situation. The higher inflation is putting pressure on the real income of the low-income people," said MM Akash, a former chairman of the economics department at the University of Dhaka.

He said the real income of workers has decreased significantly since the wage growth did not keep pace with higher inflation.

As per the BBS's Food Index, the cost of food increased by 20 percent in the past one year to August while the wage rate went up by just 11 percent, said Prof Akash.

So, low-income groups are now compelled to cut down the intake of nutritious food as well as non-food items, he said.

"We have not seen such a price increase since 2010. It's a unique situation."

According to the noted economist, the lingering effect of the coronavirus pandemic, the price hike of fuel globally, internal market failures, deficit financing and a lack of synchronised fiscal and monetary policies are all making the recovery from the war-induced crisis slow.

"We should learn from Sri Lanka on how to tackle such a crisis and turn around quickly. Otherwise, we will have to face both political and economic instability."

He suggested the government take urgent measures, especially those involving fiscal and monetary policies and expand the safety net programmes.

"Reining the inflation is the key challenge now," said Mustafa K Mujeri, executive director of the Institute for Inclusive Finance and Development.

He said the rate of inflation is growing fast in Bangladesh whereas countries such as Sri Lanka have brought it under control.

He said food prices in the global market have reached a moderate stage, but the situation is different in Bangladesh.

"As a result, there has not been much scope to blame global factors for the higher inflation in Bangladesh."

The former economist of the central bank urged the government to focus on domestic factors, including market management and monetary policies, to curb higher prices.

Mujeri said the local market has become unstable suddenly as some unscrupulous traders are trying to make unusual profits. This type of situation creates pressure on low-income people who usually spend 70 to 80 percent of their income on food items.

He warns if the government does not rein in inflation soon, the lower-income groups will not survive long.

He suggested the government strengthen the existing social protection schemes as temporary measures to give some relief to them.

Rizwanul Islam, a former special adviser of the International Labour Office in Geneva, said as increases in money wages have been falling behind price increases, the real wages have been falling.

"This has been happening for over a year now. No action to address this important issue has come to my attention."

He said given the nature of the current inflation, conventional instruments like monetary policy alone can't fight it. Other measures, especially to ease and regulate the supply of essentials, are urgently needed.

"Market imperfections and foul play in a monopolistic/oligopolistic market have long been pointed out as a major factor behind the recent inflation. It's a pity that very little is being done to moderate this monstrous shock."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments