Wage growth slows after 30 months

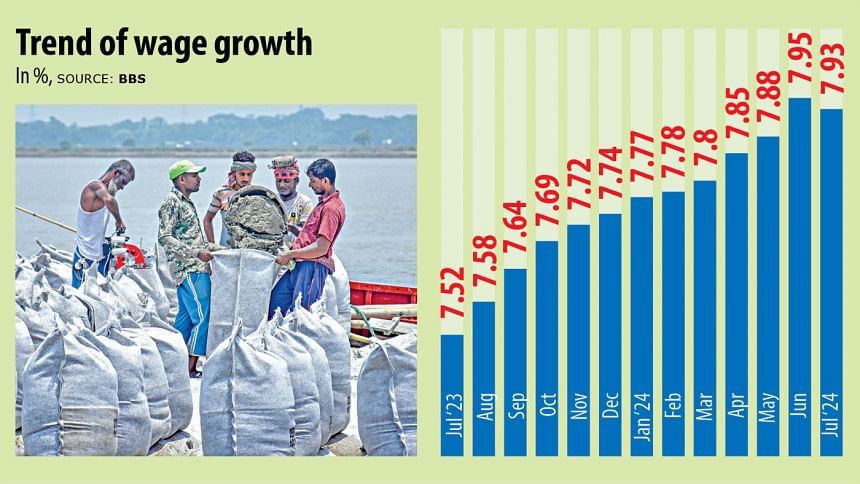

Wage growth in Bangladesh fell slightly last month after climbing for 30 months since January 2022, according to official data.

As a result, the gap between the inflation rate and wage growth hit 3.73 percentage points, the highest in at least a decade.

The wage growth of low-paid and unskilled workers declined to 7.93 percent in July while overall inflation was 11.66 percent, showed the Wage Rate Index (WRI) of the Bangladesh Bureau of Statistics (BBS).

Annual inflation hit a 12-year high of 9.73 percent in FY24 and although wage growth has been slowly climbing since July 2021, it has been outpaced by rising prices for the past 30 months, according to data.

The widening gap has forced many low-income and unskilled workers to cut consumption in the face of falling real incomes.

"The trend of high inflation and declining wage growth has jointly pushed low-and-limited-income groups to the wall," said Mustafa K Mujeri, executive director of the Institute for Inclusive Finance and Development.

"When high inflation persists for a long time, it will definitely impact the poverty rate and food intake habits," he added.

High inflation, particularly food inflation, has affected the purchasing power of low-income people and forced them to cut back on nutritional foods.

This also reduces coping strategies and gradually narrows opportunities for low-income and low-skilled people, Mujeri said.

In July, Bangladesh's worsening economic crisis spun off a price shock, with food inflation crossing 14 percent for the first time in 13 years.

Food inflation hovered above 9 percent since May 2023 and exceeded 9.5 percent in each month of FY24 except February.

The overall wage growth for workers in the agriculture sector decreased to 8.21 percent in July from 8.33 percent the month prior.

Meanwhile, the industrial sector witnessed wage growth of 7.52 percent, up from 7.42 percent. However, the service sector saw a sharp decline in wage growth from 8.50 percent in June to 8.27 percent.

Professor Mustafizur Rahman, a distinguished fellow at the Centre for Policy Dialogue (CPD), said living standards have declined due to high food inflation.

"Informal sector workers, especially those in urban areas, are the worst victims," he added.

The WRI considers the wages of informal workers, who get paid on a daily basis, across 63 occupations in the agriculture, industry and service sectors.

Division-wise, wage growth rose in Rajshahi, Rangpur, Sylhet, Barishal, Mymensingh and Khulna. On the other hand, it decreased in Dhaka and Chattogram.

Regarding persisting inflation, Mujeri said the former government could not reduce inflation with its monetary policy as it failed to implement the right measures at the right time.

"Implementing a contractionary monetary policy is not enough to fight inflation. There is a need to integrate multiple policies here," he added.

Mujeri, a former chief economist of the Bangladesh Bank, said there is no alternative to ensuring sufficient production in order to stabilise the market.

Monzur Hossain, a research director at the Bangladesh Institute of Development Studies, said it is important for the interim government to restore the confidence of businesses, particularly those involved with the previous regime.

This is because a swift return to normal operations is key to curbing inflation.

The situation is yet to return to normalcy after Sheikh Hasina fled to India on August 5 as many pro-government businesses are fearing political violence.

"Therefore, it is important to take confidence-building measures among these businesses," Hossain said.

"It is also important for the government to help increase competition by identifying and curtailing the activities of syndicates in the market."

In addition, monetary policy measures need to be revisited, he added. "We need an immediate assessment of the rising policy rate and its impact on the market," he added.

The Bangladesh Bank has fixed the policy rate at 8.50 percent, keeping it unchanged from the last monetary policy statement for the July-December period.

"This policy rate should not increase anymore as it may affect businesses," Hossain said.

Rahman suggested that the interim government focus on market stabilisation through good governance and take short and mid-term initiatives to this end soon.

Rahman also underlined the need to ensure accuracy in BBS data so policymakers can take the right steps.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments