Private credit growth hits 23-month low

Private sector credit growth has slowed in recent months with banks and borrowers adopting a go-slow strategy amidst economic stress and growing apprehensions of a political crisis centring the upcoming parliamentary elections in January.

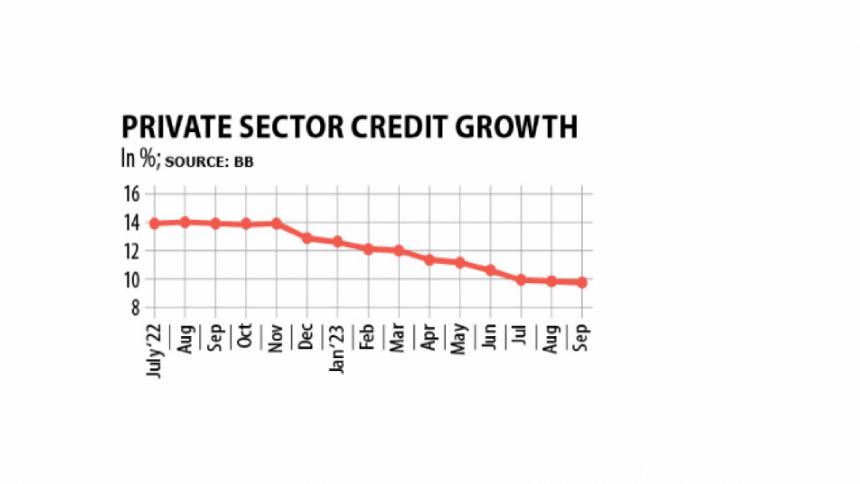

In September, the growth stood at 9.69 percent year-on-year, as per the latest data of Bangladesh Bank.

It was 9.75 percent in the preceding month.

September's figure was the lowest since October 2021 when the growth stood at 9.44 percent.

It was also 1.21 percentage points lower than the BB's target of 10.90 percent set for the first half of fiscal year 2023-24.

However, the BB projects that private sector credit growth would stand at 11 percent year-on-year at this fiscal year's end, meaning next June.

The rising lending rate following a recent interest rate cap withdrawal, tight liquidity in a majority of banks and lacklustre performance in loan recovery were the major reasons for the slow credit growth, as per industry insiders.

Banks and borrowers have taken a go-slow strategy while the lending rate has started to rise following the withdrawal of the cap at 9 percent, Mirza Elias Uddin Ahmed, managing director of Jamuna Bank, told The Daily Star recently.

During the unveiling of a new monetary policy in June this year, Bangladesh Bank withdrew the cap and introduced a new system for fixing the lending rate.

As per the central bank's new formula, banks can impose a 3.50 percentage point margin on the "six-month moving average rate of treasury bills", abbreviated as SMART.

The SMART was 7.43 per cent in October and will be applicable for November.

Moreover, import financing has come down due to austerity measures amidst falling foreign exchange reserves, said Ahmed.

He, however, hopes for the credit demand to increase next year.

The credit growth will fall further in the upcoming months because the central bank raised the policy rate aimed to rein in skyrocketing inflation, said central bank officials.

The central bank last month raised the policy rate by 75 basis points to 7.25 percent to step up its fight against inflation.

Average inflation rose 9.63 percent in September, way above the central bank's target of 6 percent for the current fiscal year.

Banks' lending capacity has continued to decline due to record high non-performing loans (NPLs), said a private commercial bank's chief executive officer (CEO) wishing anonymity.

At the end of June this year, the NPLs stood at Tk 156,039 crore or 10.11 percent of the total amount of loans disbursed, as per the latest data available with Bangladesh Bank.

A good number of banks, including some Islamic ones, are now facing a liquidity crisis and are running their services availing liquidity support from the call money market and the central bank, said the CEO.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments