Credit flows to private sector might slow on higher govt borrowing: BB

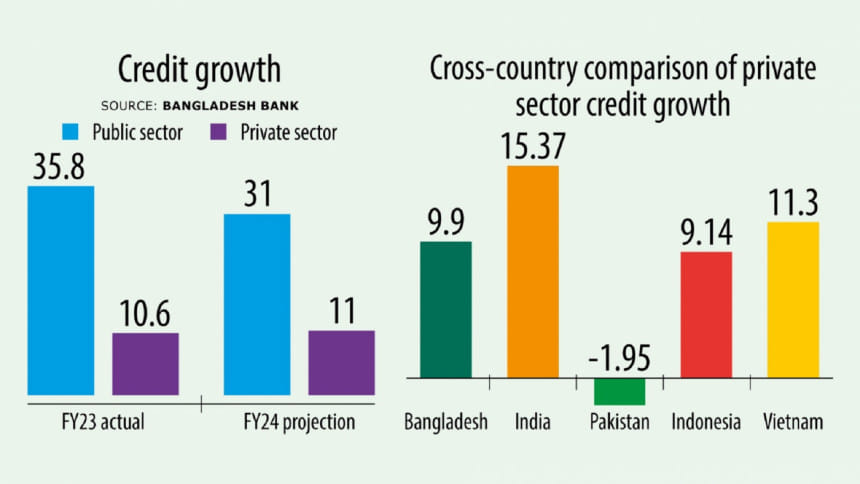

Credit flows to the private sector of Bangladesh might slow in the current financial year as interest rates could go up following the spike in the benchmark rate amid persisting higher borrowing by the public sector, said the central bank.

Confronted with higher consumer prices, the central bank implemented several policy measures in the first half of 2023-24 to alleviate the inflationary pressure.

The initiatives encompassed a cumulative 175 basis points increase in policy rates from July to December 2023, the removal of the lending rate cap, replaced it with a reference rate, known as SMART, and ceased lending to the government by creating money.

The actions aimed to elevate borrowing costs, restrict money and credit expansion, and anchor inflation expectations. Consequently, money supply and private sector credit growth rates moderated between July and November.

Additionally, the BB continued foreign currency sales, which functioned as automatic quantitative tightening measures in the money market, significantly absorbing liquidity from the system.

Thus, the private sector credit growth is forecast at 10 percent for June this year, down from 11 percent projected earlier, the BB said in its monetary policy statement for the second half of the financial year.

In its annual report for 2022-23 released last week, the central bank said the government's borrowing from the banking system, particularly from the BB, has increased tremendously in the past two years, which ultimately contributed to the inflation hike.

Higher government borrowing from the banking system could increase the SMART (Six-month Moving Average Rate of Treasury Bills), thus raising the lending rate in the coming months, it said.

"Resultantly, credit flows to the private sector might be slowed down in FY24."

Rising inflation, declining foreign exchange reserves, and the volatile exchange rate have negatively affected private investment as well as credit to the private sector. This was reflected in lower demand both from domestic and international markets, as indicated by negative import growth and a slow growth of exports.

The BB is providing a sufficient flow of funds for agriculture, cottage, micro, small, and medium enterprises (CMSMEs) and import-substituting industries from its pre-finance and refinance schemes.

However, for a smooth flow of funds to the private sector, banks need to strengthen the recovery drive of non-performing loans (NPLs), the report said.

"Otherwise, the increase in NPLs can limit credit to the private sector which may negatively affect the growth."

Higher inflationary and exchange rate pressures and NPLs and decreasing trend of reserves may pose severe challenges to the growth and inflation outlook, the BB said.

"An increase in investment in both the private and public sectors is crucial for the growth outlook."

Bangladesh experienced higher inflationary pressure in FY23, both from food and non-food items due mainly to fuel price adjustments, global commodity price hikes, exchange rate pass-through effects, and market failures.

Since global commodity prices are projected to decline in 2024, inflationary pressures on the economy are expected to decelerate in the coming months, though the easing of exchange rate pressure still remains a big challenge.

The report said due to import-limiting measures, the trade deficit narrowed in the last fiscal year, but the deficit in the financial account became larger.

"The continued import-limiting measures will further improve the trade balance, but the reduction of imports may affect overall economic activities in the economy negatively. To prevent the deficit in the financial account, all possible ways will have to be explored."

It said the ongoing price and exchange rate pressures and tight monetary policy may create some downside risks to achieving desired economic growth in the shorter to medium term.

In fact, the post-pandemic recovery of the economy could be challenged by several factors, like global commodity price hikes, higher inflation, exchange rate volatility, and the falling trend in reserves.

"Moreover, unusual change in climate and prolonged political unrest may also create some impediments to our ongoing growth trajectory."

BB's model-based exercises also find some moderation of inflation in the upcoming months both in terms of the 12-month average and the point-to-point basis. The 12-month average inflation, however, will take a longer time to fully moderate to an expected level, it said.

For FY24, the target for inflation has been revised upwards to 7.5 percent from 6 percent.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments