Private credit growth slows for contractionary monetary policy

Private sector credit growth slowed in January this year as the lending rate went up due to the central bank's contractionary monetary policy, according to experts and analysts.

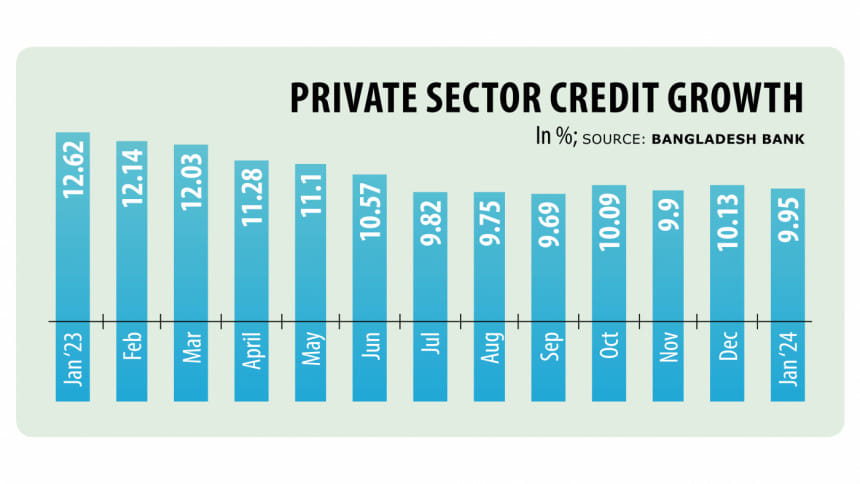

Private sector credit growth stood at 9.95 percent in January, down from 10.13 percent the month prior, showed the latest Bangladesh Bank data.

Industry people said the increasing lending rate, reduced imports due to the forex crisis, and liquidity shortage in the banking sector are the main reasons behind the slow growth.

Besides, private sector credit growth was 0.05 percentage points lower in January compared to the central bank's target for the current fiscal year.

As part of its tightening measures to control high inflation, the central bank in January lowered the credit growth target to 10 percent from 11 percent for fiscal year 2023-24.

Now, borrowers are less interested to avail bank loans as the lending rate has continued to rise due to the contractionary monetary policy, said Mohammad Ali, managing director and CEO of Pubali Bank.

In January, Bangladesh Bank hiked the policy rate, the rate at which the central bank lends to financial institutions, by 25 basis points to 8 percent.

It was the eighth consecutive spike in the policy rate since the monetary policy tightening cycle began in May 2022.

Meanwhile, the central bank continued to tighten the money supply by introducing the Six-month Moving Average Rate of Treasury bill (SMART).

The SMART rose to 8.14 percent in December and remained the same in January. Lenders can charge up to 3.50 percent as a margin on the SMART when lending.

Ali said that businesspeople are struggling to import capital machinery due to the US dollar crunch in banks, which slowed the demand for borrowing.

However, he said the central bank is now on the right track to rein in inflationary pressure.

The country witnessed inflation of more than 9 percent for the past several months, with the rate standing at 9.86 percent in January and 9.67 percent in February, as per data of the Bangladesh Bureau of Statistics.

On the other hand, M Khurshed Alam, deputy managing director of Eastern Bank, told The Daily Star that slower credit growth is not always due to higher lending rates.

He said a lot of industries are currently not running at full swing due to difficulties in opening letters of credit amid the US dollar shortage, thereby impacting credit growth.

Letters of credit for financing payments of about $39.25 billion collectively were opened during the July-January period of ongoing fiscal year, down 2.95 percent year-on-year, the central bank data showed.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments