Lending rate goes past 12% as tighter monetary policy kicks in

The lending rate of bank loans has gone past 12 percent on the back of the rising benchmark interest rate, sending the cost of funds for borrowers higher, as the central bank's contractionary monetary policy appears to have taken hold.

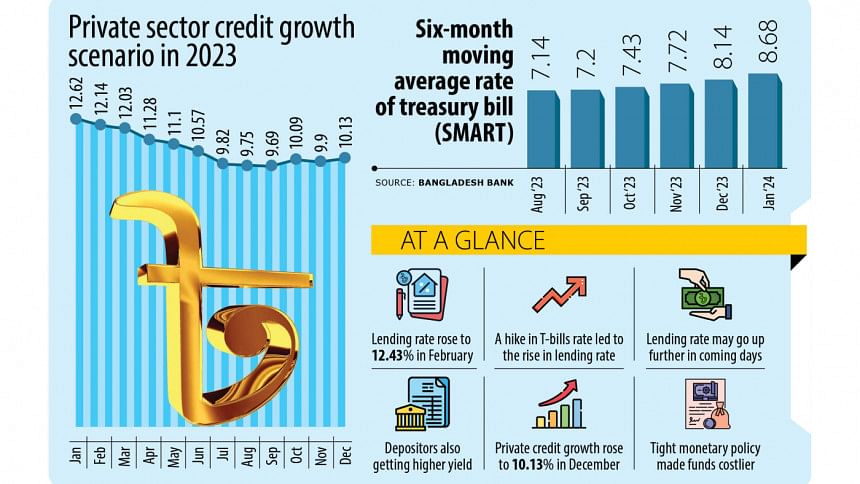

The Six-months Moving Average Rate of Treasury bills (SMART), which is used to price the interest rate of loan products, stood at 8.68 percent in January and it would be applied to fix the lending rates throughout February.

As a result, customers may see an interest rate of as high as 12.43 percent since banks are allowed to add 3.75 percentage points to the reference rate while disbursing loans.

This is the highest lending rate since the Bangladesh Bank introduced SMART in June. The maximum interest rate was 11.89 percent in January.

The SMART was launched by removing the interest rate cap in order to gradually allow market forces to determine the cost of funds and bring down demand-induced inflation. Since then, the benchmark interest rate has kept rising.

The lending rate is going up as the interest rates of government treasury bills are on the rise: the yield of treasury bills stands at a decade-high of more than 11 percent, which was 7 percent to 8 percent a few months ago, BB data showed.

The treasury bills rate has climbed since the government increased its borrowing from commercial banks after the BB suspended printing fresh money to avoid fanning inflation.

The tight monetary policy of the central bank has pushed up the borrowing cost, industry insiders say.

In its new monetary policy unveiled last month, the BB increased the policy rate, or repo rate, by 25 basis points to 8 percent, its eighth straight increase since the tightening cycle began in May 2022. The move is expected to increase the cost of funds.

Emranul Huq, managing director of Dhaka Bank, recently said the interest rate on loans is on an upward trend.

"The lending rate will rise further once credit demand picks up."

At a meeting with the chief executives of banks on Wednesday, Governor Abdur Rouf Talukder said the banking regulator will continue to tighten its monetary policy until inflation comes under control.

This signals that the lending rate is likely to move up further in the upcoming months as the inflation rate has stayed above 9 percent since March last year and shows no sign of slowing down.

In a negative development, credit growth to the private sector rose in December from the previous month.

Fund disbursement rose 10.13 percent in December, up from 9.90 percent a month earlier, according to the BB. Industry insiders, however, describe the rise as insignificant because the growth has hovered around 10 percent for the last few months.

The growing lending rate, the falling trend of imports due to central bank curbs aimed at saving the foreign currency reserves, and the contractionary monetary policy have been behind the slow credit growth.

The BB has lowered the private sector credit growth target to 10 percent from 11 percent for the January to June period of FY24.

Mohammad Ali, managing director of Pubali Bank, thinks the growth will not accelerate in the coming days due to the high-interest rate, which was capped at 9 percent between April 2020 and June 2023.

"There are even risks that unemployment may go up."

A central banker says the banking regulator has cut the private sector credit growth target as its current focus centres around combatting inflation.

"The slower credit growth and the higher lending rate are not a matter of concern for us now. Rather, the elevated level of inflation and the foreign exchange crisis currently matter the most."

The spike in the interest rate, however, will help savers as the returns on their deposits are going up since banks are offering better rates to attract funds amid the persisting liquidity crunch.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments