Reforms can generate Tk 15 lakh crore additionally by 2035

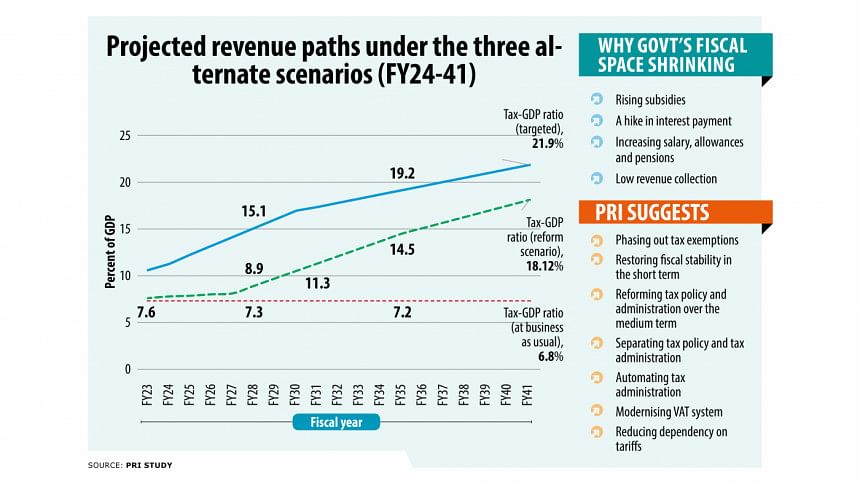

Reforming tax policy and administration will help the government generate an additional revenue of Tk 15 lakh crore by 2035, providing much-needed relief to a country struggling to expand its spending capacity, according to a new study.

In the study, the Policy Research Institute of Bangladesh (PRI) found that by 2035, the government would be able to raise 6.8 lakh crore at the current pace of collections. If reforms are carried out, it will go up to Tk 21.1 lakh crore.

The study -- Bangladesh's Domestic Resource Mobilisation: Imperatives and a Roadmap -- suggested phasing out tax exemptions.

Ahsan H Mansur, executive director of the PRI, presented the findings of the study at a programme at the Hotel Amari Dhaka yesterday.

"Improving tax revenue is urgently needed to restore fiscal credibility. However, serious reforms to tax policy and administration will take several years to implement," he said.

The suggestion comes as Bangladesh struggles to raise its tax collections to the desired level owing to non-compliance and a lower tax base. Currently, the country has one of the lowest ratios of revenue-to-GDP in the world.

According to the study, a gradual phase-out of many of the exemptions over a period of three to four years has the potential to raise Tk 60,000 crore.

The study said the current paper and territory-based tax administration is outdated and prone to corruption. The efforts to modernise the VAT administration have also failed.

The current system that requires face-to-face dealing between the officials of the National Board of Revenue (NBR) and the public also leads to harassment of honest taxpayers. This discourages many households and medium-sized businesses from registering as taxpayers, thereby reducing compliance.

It called for the separation of the tax policy and the administration as the NBR, with its exclusive focus on tax administration and achieving revenue targets, can't pay much attention to tax policy issues.

The study recommended automation of the tax administration, reducing dependency on tariffs, and making the direct tax system more progressive to address the growing income inequality.

Mansur said Bangladesh's per capita GDP, adjusted for inflation, at about $5,000 is good. However, the country's tax-to-GDP ratio is comparable to that of Congo, a country with a per capita GDP of $1,000.

"There are hardly any other countries in such dire fiscal circumstances. Being grouped alongside Somalia and Congo in terms of tax-to-GDP ratio is embarrassing for Bangladesh."

Between 1984 and 2012, the tax-GDP ratio increased slowly in Bangladesh. After 2012, the economy expanded at a faster clip whereas revenue collections failed to keep pace with the GDP growth.

"We have to get out of this situation and this is the major challenge. Part of the problem lies with the tax structure," Mansur said.

In Bangladesh, about two-thirds of the government's revenue come from indirect taxes and one-third from direct taxes. In previous decades, any increase in the collection had been driven by a rise in direct tax receipts while indirect tax had stayed stable.

In contrast, many countries have successfully increased the overall tax revenue, the PRI said.

The study identified the shrinking fiscal space as another major concern, which stems from rising subsidies, interest payments, wages and salaries, and pension payments.

The subsidies as a share of tax revenue increased from 8 percent in 2015-16 to 24 percent in 2022-23.

The interest on foreign debts in domestic currency climbed 654 percent over 12 years through FY23, while the payments on domestic loans surged 568 percent.

Over the same period, revenue increased 360 percent, indicating a significant loss of the fiscal space on account of interest payments, according to the study.

The total non-discretionary spending on pays, allowances, pensions, and gratuities accounted for more than 43 percent of the revenue in FY23.

The PRI said Bangladesh's capacity to service debt is limited due to low revenue collection.

Although the debt-to-GDP ratio is still reasonable at less than 40 percent, the ratio of public debt to revenue is high, at 380 percent.

It is close to the threshold of 400 percent for the highly indebted poor countries (HIPC) under the International Monetary Fund (IMF) and the World Bank's definition of HIPCs, it said.

"While the government's intentions to address the macroeconomic challenges are laudable, the results so far fall short of what is necessary," said Sadiq Ahmed, vice-chairman of the PRI.

"Inflation remains high, the availability of foreign exchange is severely constrained, GDP growth is on a downward trend, investment rates are down, and export growth is much below the long-term trend."

Abu Hena Md Rahmatul Muneem, chairman of the NBR, said he held a different view although the tax-GDP ratio is disappointing.

It's not reasonable to compare Somalia and Congo with Bangladesh solely based on the tax-GDP ratio. When making such comparisons, all parameters should be considered, he said.

Waseqa Ayesha Khan, state minister for finance, said there is no alternative to automation to boost revenue.

"Presently, everyone can file returns online. Given the considerable size of Bangladesh's informal sector, tax collections from the sector will be crucial. In this context, the private sector can lend us a hand."

She said the tax benefit should be withdrawn for the sectors that have been enjoying the benefit for a long time.

Ashraf Ahmed, president of the Dhaka Chamber of Commerce and Industry, said the government should not withdraw tax exemptions suddenly because the country might lose competitiveness in the global market.

"If you give exemptions to a growing industry, you will get a huge return after 10 years. However, without the tax waiver, the industry will not grow and thrive," he said, adding that the scrapping of the tax benefits may also lead to a spike in the cost of doing business.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments