Tax receipts rise 15% in July-March, close to IMF target

Tax collection by the National Board of Revenue (NBR) rose 15 percent in the first nine months of the current fiscal year (FY), which is expected to help the government meet the condition set by the International Monetary Fund (IMF) for its $4.7 billion loan.

Bolstered by rising value-added tax (VAT) collection and increased income tax receipts, the tax administrator logged Tk 259,866 crore in total revenue in the July-March period of the current fiscal year, according to the NBR's provisional estimates.

However, the revenue authority missed the target it had set for itself for the period by Tk 21,879 crore.

Still, it is on course to meet the revenue collection target set by the IMF, which it missed during the first review, a finance ministry official said.

Until December last year, the IMF set the goal for tax revenue at Tk 143,640 crore, which it met by collecting Tk 162,164 crore in tax revenue, according to the finance ministry.

The IMF set an indicative tax revenue collection target of Tk 276,170 crore for the first nine months of the fiscal year, including both NBR revenue and non-tax revenue. According to finance ministry officials, the data for non-tax revenue is not yet available, but it is likely to fulfil the condition.

The IMF has set a target for collecting a total of Tk 394,530 crore in revenue in FY24.

Meanwhile, the government initially tasked the NBR with the goal of collecting Tk 430,000 crore in tax revenue for the current fiscal year before revising it down to Tk 410,000 crore.

In the first nine months of the fiscal year, the tax authority managed to collect 63 percent of the total revised target, according to NBR data.

"Without any reforms in the tax system, 15 percent growth is not bad," said Ahsan H Mansur, executive director of the Policy Research Institute (PRI) of Bangladesh.

But if it continues at this rate, there will be a shortfall of around Tk 30,000 crore at the end of FY24, he said.

Mansur, also a former economist of the International Monetary Fund (IMF), opined that the government can generate additional revenue of Tk 30,000 crore in the next fiscal year if it reduces existing tax exemptions for various sectors.

"Raising the tax rate will not be a wise decision. It may have the reverse impact," he said, adding that targets set in the national budget have also been missed over the years.

"This year's target, even after being revised, is also likely to be missed," said Towfiqul Islam Khan, a senior research fellow at the Centre for Policy Dialogue, a think-tank.

The prevailing high level of commodity prices and the introduction of a new income tax law helped the NBR mobilise more tax revenue in the current fiscal year, he said.

On the flip side, revenue generation was constrained by adjustments that are required to stabilise the macroeconomic situation in the form of restrained imports and slowdown of economic growth, according to Khan.

Accelerating revenue mobilisation will be a priority for the upcoming national budget. The IMF has also emphasised this. However, the policy question is how the government would like to attain that, he said.

"Due to high commodity prices and a difficult economic situation, there will be demands for tax breaks," he added.

"Hence, improving institutional capacity in collecting taxes and ensuring good governance is critical. People often pay taxes that do not reach the government exchequer. This is not acceptable."

Khan also believes it is mandatory to ensure value for money in public expenditure and improve public service delivery.

"Only then will people be encouraged to pay taxes willingly," he said.

Mansur said reforms in the taxation system are crucial, adding that it is high time for the government to go for fiscal reforms.

Bangladesh's tax-to-GDP ratio stands at 8.4 percent, one of the lowest in the world, despite rising per capita income.

In its Fiscal Monitor published last week, the IMF said revenues are expected to improve in economies, including Bangladesh, through reduced VAT exemptions.

The multilateral lender projected that Bangladesh's revenue-GDP ratio would increase to 8.8 percent at the end of the FY24 from 8.3 percent a year ago.

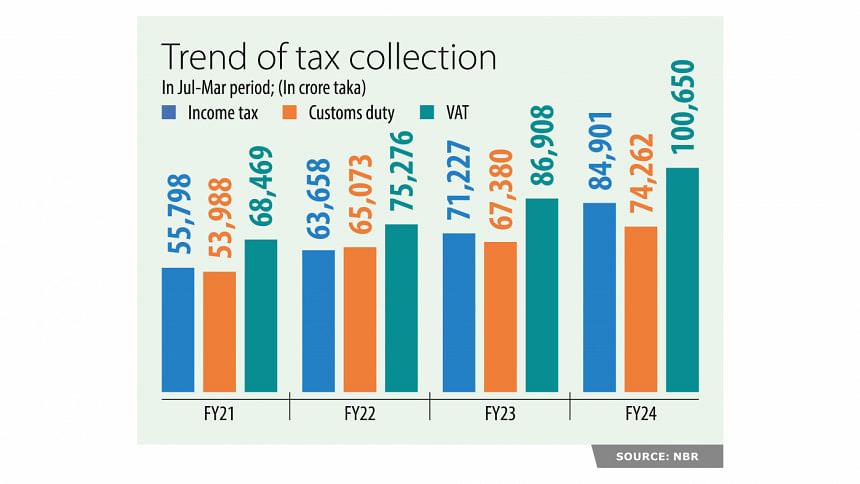

NBR data showed that customs tariff collection grew 10.21 percent year-on-year to Tk 74,262 crore in the July-March period of the current fiscal year as imports fell.

Collection of VAT, the largest source of revenue, soared nearly 16 percent to Tk 100,702 crore in the first nine months of FY24 compared to a year ago.

Income tax receipts stood at Tk 54,901 crore in the July-March period of FY24, jumping 16 percent year-on-year, data from the NBR showed.

Bangladesh would receive an additional Tk 65,000 crore in tax revenue if the tax revenue collection can be increased by 2 percentage points through expansion of the tax net and compliance with regard to personal income, according to a recent study by the PRI.

As a result, the country's tax-GDP ratio will stand at 10.4 percent, it said.

If the government invests this additional revenue in different sectors, it will increase GDP growth by 0.2 percent, the PRI said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments