3rd Loan Tranche: IMF team to focus on four key areas

During its visit to Dhaka, the International Monetary Fund's review mission will focus on Bangladesh's foreign exchange reserves, inflation rate, banking sector, and revenue reforms.

The 10-member IMF mission is scheduled to reach Dhaka today, and from tomorrow, it will begin to hold meetings with the finance division, Bangladesh Bank, the National Board of Revenue, and other government bodies.

The mission will stay in Dhaka until May 8. The IMF has already sent more than 100 questions to the government officials.

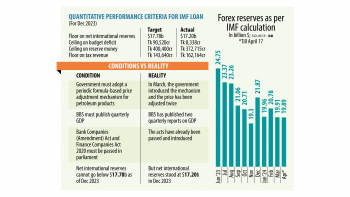

Since the IMF approved the $4.7 billion loan for Bangladesh in January last year, the multilateral lender has so far released $1.16 billion in two tranches.

Bangladesh sought the loan amid a crisis of forex reserves.

However, the reserves have not improved since the loan programme commenced. The country's gross forex reserves have been around $20 billion in recent months, as per an IMF calculation.

One of IMF's major conditions for the loan is that Bangladesh maintain a certain net international reserves (NIR). Bangladesh failed to meet it in the first review, and is going to fail this time again.

Besides, inflation has been over nine percent since March last year.

During a press briefing on the sidelines of the Spring Meetings of the World Bank Group and IMF in Washington, DC on April 18, IMF's Asia and Pacific Director Krishna Srinivasan said Bangladesh's reserve position has not improved much.

Referring to Bangladesh's elections, he said, when elections take place, there's always some uncertainty about prospects. This affected part of the financial account, he added.

"But also, I think it's important for Bangladesh to transition to a more flexible exchange rate regime. That will be important to build external resilience and build buffers and build reserves. So, I think that is the area where engagement and dialogue continues in terms of allowing the exchange rate to be more flexible so that reserves can be built up, so that, in a sense, will be a key priority for the country going forward," he said.

For macroeconomic stability, the visiting IMF mission will discuss matters related to fuel, power and energy subsidies, public debt, upcoming budget, and performance of the state-owned enterprises.

For over a decade, Bangladesh's revenue collection has been around eight to nine percent of the GDP. The IMF loan programme has several reform proposals for the revenue sector.

Also, several reform proposals for the banking sector and their progress including implementation of the bank company act will be discussed during the IMF mission's visit.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments