IMF’s 3rd loan tranche on track despite repeated failure to hit reserve goal

Bangladesh has repeatedly failed to retain foreign currency reserves in line with the goals set under the International Monetary Fund's $4.7 billion loan since the programme was launched in January last year.

The minimum net international reserves (NIR) will also remain below the threshold when an IMF mission visits Dhaka next week to review the progress of the programme before releasing around $681 million in the third tranche in May.

Despite the shortfall, driven by lower-than-expected remittance and export receipts and foreign direct investments, the country managed to secure the first two instalments of the multi-year loan.

And Bangladesh Bank Governor Abdur Rouf Talukder told reporters that the country will receive the third instalment on time as well.

In 2022, Bangladesh turned to the global lender after its forex reserves plunged to a critically low level amid higher import bills, leading to a sharp depreciation of the taka and an unprecedented level of inflation, hurting the poor and derailing the economic growth trajectory.

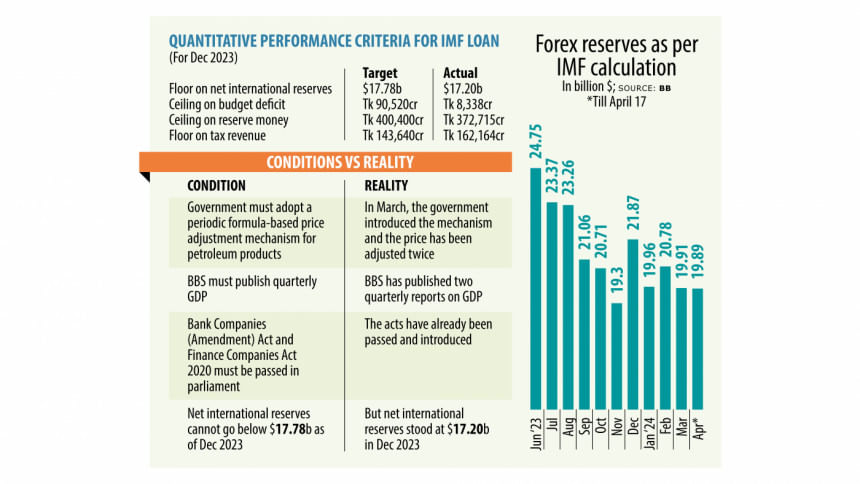

Initially, the government was given a target to keep a minimum NIR of $26.81 billion for December 2023. Later, it was revised downward to $17.78 billion since the reserve situation showed no signs of major improvements. Still, the country fell short of the target by $58 million.

The goal for NIR was $23.74 billion for June last year. However, the country had a reserve of $19.56 billion. Bangladesh also failed to meet the condition of the tax revenue at that time.

A central banker said this time the reserve shortfall will be comparatively low.

The NIR is defined as reserves assets minus reserve liabilities. Reserves liabilities are all foreign exchange liabilities to residents and nonresidents, including commitments to sell foreign exchange arising from derivatives and all credit outstanding from the IMF.

Officials at the finance ministry and the BB said except for the reserve-related criteria, all other conditions have been met.

During its visit, the IMF mission will review the government's performance against the targets set for December 2023.

Out of six quantitative targets set for the third tranche, the government has met five targets.

For December last year, the goal for tax revenue was set at Tk 143,640 crore. The government has already met the target.

According to the finance ministry, Tk 1,62,164 crore was collected in tax revenue in the first six months of the current fiscal year.

Another loan condition is that the budget deficit must not surpass Tk 90,520 crore. In December, the deficit stood at Tk 8,338 crore.

As per another target, the reserve money had to be within Tk 400,400 crore in December and it stood at Tk 372,715 crore in the last month of the year.

Besides, two of the loan conditions are that the government's social spending and capital investment had to be more than Tk 50,000 crore as of December.

The government spent around Tk 200,000 crore from the budget between July and December of 2023-24 and about Tk 100,000 crore was spent in these two segments, a finance ministry official said, adding that the government also met the condition on external payment arrears.

Apart from the quantitative and indicative targets, there are some structural conditions set by the IMF. The official said the structural conditions associated with the third tranche of the loan have been achieved.

As part of the structural conditions, the government adopted a periodic formula-based price adjustment mechanism for petroleum products in March and has adjusted it twice.

The Bangladesh Bureau of Statistics has begun publishing quarterly data on the gross domestic product (GDP) and released the economic growth figure for the first two quarters of FY24.

Besides, the parliament passed the Bank Companies (Amendment) Act and the Finance Companies Act and the laws have already been implemented, in line with the IMF recommendations.

Levi's now in Dhaka

Refayet Ullah Mirdha

Renowned American clothing company Levi Strauss & Co has opened a store in Dhaka offering its range of products under the third franchise deal secured by local conglomerate DBL Group following similar contracts with Nike and Puma.

Levi's is one of the world's biggest fashion retailers. Its products are sold in more than 110 countries through approximately 3,000 stores.

The 2,270 square feet store on Banani Road 11 opened on April 1, aiming to draw the rising middle-income population with an assortment of imported denim jeans, t-shirts, polo shirts, and formal and casual woven shirts for men and women.

Levi's will continue its expansion across key markets in Asia, with plans to open another store in Chattogram, said PR Newswire in a statement on April 17.

The company's focus are dynamic markets undergoing swift urbanisation, said Amisha Jain, senior vice president and managing director of South Asia-Middle East and Africa at Levi Strauss & Co.

"With a population exceeding 160 million, Bangladesh presents significant opportunities for retail expansion," she said.

The DBL plans to open Levi's stores in other parts of Dhaka, such as Dhanmondi, soon and eventually in Chattogram, said a senior official of the group asking not to be named.

"The response from consumers is good," said the official, adding that the country's economy has been growing and the purchasing power of consumers was also improving, enabling them to afford branded products.

Annual sales of clothes in Bangladesh are estimated to amount to over $15 billion.

Per capita consumption of apparels has been rising with a rise in income, for which the presence of international brands is also increasing gradually.

Three growth drivers, including farmers, remitters and garment workers, pushed the country's GDP to more than $460 billion in 2022. The nation is also set to graduate from least developed country (LDC) status in 2026.

Bangladesh's real GDP growth is projected to remain relatively subdued at 5.6 percent in FY24, compared to the average annual growth rate of 6.6 percent over the decade preceding the COVID-19 pandemic, according to World Bank (WB).

Persistent inflation is expected to weigh on private consumption growth, and shortages of energy and imported inputs combined with rising interest rates and financial sector vulnerabilities are expected to dampen investor sentiment.

Growth is expected to increase gradually over the medium-term as monetary, exchange rate, and financial sector policy adjustments are implemented, the WB said.

Stocks slip below 5,700 points after 35 months

Star Business Report

Stocks in Bangladesh suffered a massive setback yesterday with the benchmark index of the Dhaka Stock Exchange (DSE) falling below 5,700 points for the first time in 35 months as nervous investors sold their scrips.

This led to the price erosion of large-cap stocks, bringing down the benchmark index of the country's premier bourse by 77.08 points, or 1.33 percent, to 5,686 points, its lowest level since May 9, 2021.

Beacon Pharmaceuticals, the British American Tobacco Bangladesh Company, Renata, Olympic Industries, BRAC Bank, LafargeHolcim Bangladesh, Mercantile Bank and Pubali Bank were among the large-cap scrips that suffered the biggest losses.

Beacon Pharmaceuticals was the top dragger of the index, claiming 5 points, followed by British American Tobacco Bangladesh with 4 points, according to LankaBangla Securities.

The market dropped as investors panicked seeing the continuous fall of market indices, said a top official of a leading stock brokerage.

Foreign investors are still selling shares, so blue-chip stocks are falling even though these stocks are already traded at a very low price.

And as these stocks have been falling for the past few days, some brokerage houses are selling them by executing forced sales, he added.

If brokerage houses and merchant banks lend funds to investors to buy stocks and the stock price falls massively, then the brokers first call the investors to repay their loans or otherwise sell their shares in what is called forced sales.

The DSES, the index that represents shariah-compliant companies, shed 1.26 percent to close at 1,246 points yesterday while the DS30, which comprises blue-chip stocks, plunged 1.13 percent to 2,014 points.

However, daily turnover, which indicates the volume of shares traded during the session, increased 8.29 percent to Tk 522 crore compared to the previous trading session.

Almost all sectors closed in negative territory, with the non-bank financial institution, paper and printing and mutual fund sectors shedding the most, as per the daily market update of UCB Stock Brokerage.

The pharmaceuticals sector dominated the turnover chart, accounting for 18.98 percent of the total.

Of the issues traded at the DSE, the values of 29 increased, 342 decreased, and 24 did not see any price swing.

Asiatic Laboratories took pole position on the top gainers' chart with a rise of 9.96 percent followed by Dutch-Bangla Bank with 7.20 percent, Heidelberg Cement Bangladesh with 6.19 percent, Salvo Chemical Industry with 5.11 percent and IFAD Autos with 4.50 percent.

Best Holdings, HR Textile, Sikder Insurance Company, Shyampur Sugar Mills and First Janata Bank Mutual Fund also featured on the gainers' list.

Meanwhile, EXIM Bank 1st Mutual Fund shed the most, losing 6.81 percent, followed by IFIL Islamic Mutual Fund-1.

The two were followed by SEML FBLSL Growth Fund, Capitec Grameen Bank Growth Fund, Khulna Printing and Packaging, IDLC Finance, Apex Ternary, and Prime Bank 1st ICB AMCL Mutual Fund.

The Chittagong Stock Exchange saw a similar trend as the Caspi, the main index of the port city bourse, fell by 215 points, or 1.30 percent, to close at 16,244.52 points.

Rajesh Saha, chief executive officer of CAL securities, blamed the country's market situation for the abrupt ups and downs of stocks.

"Outsiders control the stock market in our country. Keeping them in the market, we can't expect a better situation. What is happening in the market, that's a normal thing. The market will not be well until we take back control of the market from outsiders," he said.

"Such things will happen until the market is structured. Look at our neighbouring countries, where markets are structured. Investors do not fear to invest there because no one can dare to earn in the wrong way," Saha added.

He also put forward a slew of suggestions to develop the market.

"We have to bring IPOs to the market in a proper way. So, we have to bring the companies under proper regulations. If any company breaches any rules, the regulatory body has to slap stiff punishments on them," Saha said.

"But in our market, we clearly understand what is happening and what will happen in such a situation. The shares we bought we are now selling out of fear," he added.

Saha pointed out that in developed countries, it is seen that there are some companies which are financially sound.

"So, investors pass their money to those companies if they get any indication of a bad situation. But we have no such places or companies in our market," he said.

"In our country, people see earning is tough through traditional ways. So, they choose poor stocks and try to chalk up more earnings. Our regulatory body knows well how to tackle the market and what needs to be done for the market's wellbeing," Saha added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments