IMF approves 3rd tranche of $1.15b loans

The International Monetary Fund yesterday approved the third tranche of $1.15 billion loans in a boost to Bangladesh's foreign exchange reserves.

Mezbaul Haque, spokesperson for Bangladesh Bank, told The Daily Star, "The IMF board has approved the third instalment of our credit. We are expecting $1.15 billion to be released by the next two days."

The money would be added to the foreign currency reserves, he added.

"Periodic reviews of the crawling peg would be important to ensure its effectiveness."

The multilateral lender reviewed Bangladesh's progress in reaching the goals set in December last year and granted the instalment of its $4.7 billion loan programme for the country.

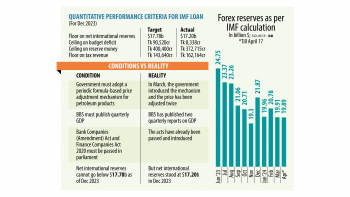

Bangladesh met all the conditions except for maintaining the foreign currency reserves at the IMF-set level.

As per the loan conditions, the target for net international reserves (NIR) in December last year was $17.78 billion. However, a recent IMF review mission found the NIR was $16.73 billion at that time.

"… The Executive Board granted a waiver of non-observance of a performance criterion for the floor on net international reserves on the basis of corrective actions," read an IMF statement issued early today.

The NIR is defined as reserves assets minus reserve liabilities. Reserve liabilities are all foreign exchange liabilities to residents and non-residents, including commitments to sell foreign exchange arising from derivatives and all credit outstanding from the IMF.

After the IMF Executive Board's discussion yesterday, its Deputy Managing Director Antoinette M Sayeh said, "Bangladesh's economy is navigating multiple macroeconomic challenges. Even in the difficult environment, programme performance has been broadly on track and the authorities remain committed to undertaking the necessary policy actions and reforms. The IMF-supported programme is helping to safeguard macroeconomic stability and protect the vulnerable, while helping to accelerate economic reforms to deliver strong, inclusive, and green growth.

"Near-term policies should focus on rebuilding external resilience and bringing down inflation. The authorities' recent actions to realign the exchange rate and implement the new exchange rate arrangement are welcome. Periodic reviews of the crawling peg would be important to ensure its effectiveness. Continued monetary and fiscal policy tightening would help to rein in inflation. Should external and inflationary pressures intensify, a further tightening in policies is warranted."

She said a flexible exchange rate regime and bolstering foreign exchange reserve buffers were necessary conditions for external resilience.

Sayeh also spoke about addressing vulnerabilities in the financial sector, and strengthening banking regulation, supervision and governance.

"Sustained structural reforms are required to achieve Bangladesh's goal of reaching upper middle-income country status by 2031. Diversifying exports, attracting more foreign direct investment, and strengthening governance are key."

In January last year, the IMF approved the $4.7 billion loan. Bangladesh has already received more than $1 billion in two instalments.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments