IMF pushes for more reforms to unlock additional $750m

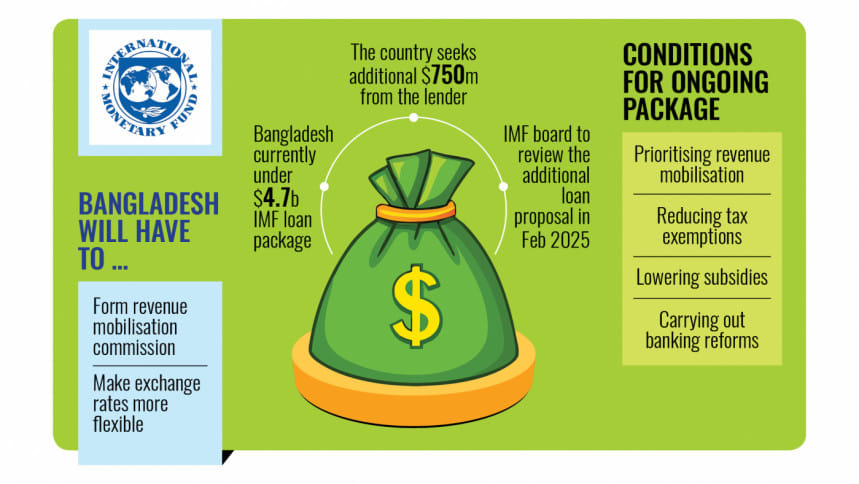

The International Monetary Fund (IMF) has proposed more reforms, including the separation of tax administration and tax policy and greater exchange rate flexibility, as conditions for an additional $750 million loan to Bangladesh.

The multilateral lender will present the proposal for the additional loan, along with the next instalment of the ongoing $4.7 billion package, to its executive board meeting in February 2025.

Before the board meeting, Bangladesh will have to implement the revenue mobilisation commission and adopt more flexible exchange rate policies, according to IMF official Chris Papageorgiou, who led a two-week mission to Dhaka.

At a press conference at the finance ministry yesterday, Papageorgiou said the formation of the revenue commission fulfils one of the conditions. Once the second condition is fulfilled, the proposal will be submitted to the IMF board meeting on February 5 next year.

The meeting will finalise the fourth tranche of the ongoing programme, totalling $645 million including $80 million from the additional loan.

In a statement on Wednesday, the IMF confirmed that the government had requested an additional $750 million from the fund, separate from the ongoing $4.7 billion programme approved in January 2023.

The mission chief also said that the IMF has already committed to the additional amount and will release $80 million of it with the regular fourth tranche.

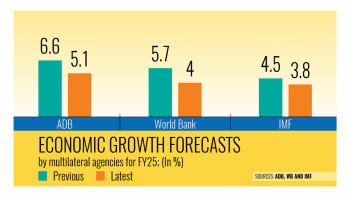

The IMF determined the additional amount in consultation with the Asian Development Bank (ADB) and the World Bank (WB).

After the IMF press conference, Finance Adviser Salehuddin Ahmed and Power and Energy Adviser Fouzul Kabir Khan spoke to journalists.

Salehuddin said that the IMF has prioritised revenue mobilisation to increase the country's tax-to-GDP ratio -- one of the lowest globally.

Another condition is about reducing tax exemptions. According to Salehuddin, the government has already taken steps to limit exemptions and will continue to scrutinise them further.

Regarding the separation of tax policy and administration, the adviser said they would place it before the Advisory Council meeting.

"Placing the proposal to the council is good enough," Salehuddin said, referring to the IMF.

Another IMF condition was to increase electricity prices to reduce subsidies.

However, Energy Adviser Fouzul Kabir Khan said that the government would not increase electricity prices this year due to high inflation.

Khan added that the IMF agreed to this and that the government would reduce power subsidies by lowering generation costs and increasing revenue.

REVENUE BOOSTING EFFORTS SLOWING DOWN

At the press conference, Papageorgiou said revenue mobilisation efforts of Bangladesh are slowing down instead of progressing.

He said the IMF supports structural changes at the National Board of Revenue (NBR), including the separation of tax policy and administration, which he described as a "big reform."

"It is going to bring very good things to the country, because, like many other countries, this should be the case, policy should be separated from administration," Papageorgiou said.

The IMF has also identified specific measures to increase revenue, specially addressing tax exemptions.

Papageorgiou said these exemptions have become a long-standing cultural issue, which needs massive effort and political will to change.

Another key area of focus for the IMF is exchange rate flexibility. While the central bank governor has made significant strides, the IMF is advocating for a more transitional system to reduce reliance on reserve sales to support exchange rate reform.

The final major issue is the banking sector, according to Papageorgiou as he said the IMF is working closely with authorities, the taskforce and bilateral development partners.

He said they have developed a matrix to assist authorities in addressing banking sector challenges.

The immediate focus will be on the 10-12 banks identified as the most distressed. The mission chief talked about a roadmap that includes legislative measures, human resource adjustments and administrative changes.

While the process is not expected to be completed by the end of 2025, said the mission chief, the IMF expects the implementation of key measures to ensure notable progress.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments