Renewed threats for economy as global recession looms

At the beginning of 2022, Bangladesh's economy seemed to be on course to grow at a faster clip buoyed by plummeting coronavirus infections, rebound in economic activities and the reopening of global economies.

But things began worsening in late February following the Russian invasion of Ukraine. Although neither Russia nor Ukraine is a large export destination or sourcing nation for Bangladesh, they are vital to the countries on which the country relies to drive its growth.

But as the Ukraine war, Covid-19 flare-ups in China, rising inflationary pressures, and continued disruptions in the global supply chain have raised the spectre of recession globally, Bangladesh might not escape unscathed if a global economic downturn hits.

With inflation at the highest level in 40 years and the central bank of the US taking increasingly aggressive action to cool consumer demand and prices, the risk of a global recession is on the rise, according to Morgan Stanley economists.

"We live in the most chaotic, hard-to-predict macroeconomic times in decades. The ingredients for a global recession are on the table."

Bank of America and Deutsche Bank are among the Wall Street firms predicting a recession in the next two years, largely because of the monetary policy tightening.

Wall Street tumbled toward its lowest point in more than a year on Monday amid concerns about rising interest rates, as well as a slowdown in China.

"For the moment, the odds of a recession in Europe, the US, and China are significant and increasing," wrote Kenneth Rogoff, professor of economics and public policy at Harvard University and a former chief economist of the International Monetary Fund, on April 26.

Bangladesh did not face a recession during the global financial crisis of 2007 and 2008 and even at the height of the pandemic, which brought global economies to their knees. But the economy has already come under pressure recently for a mix of factors.

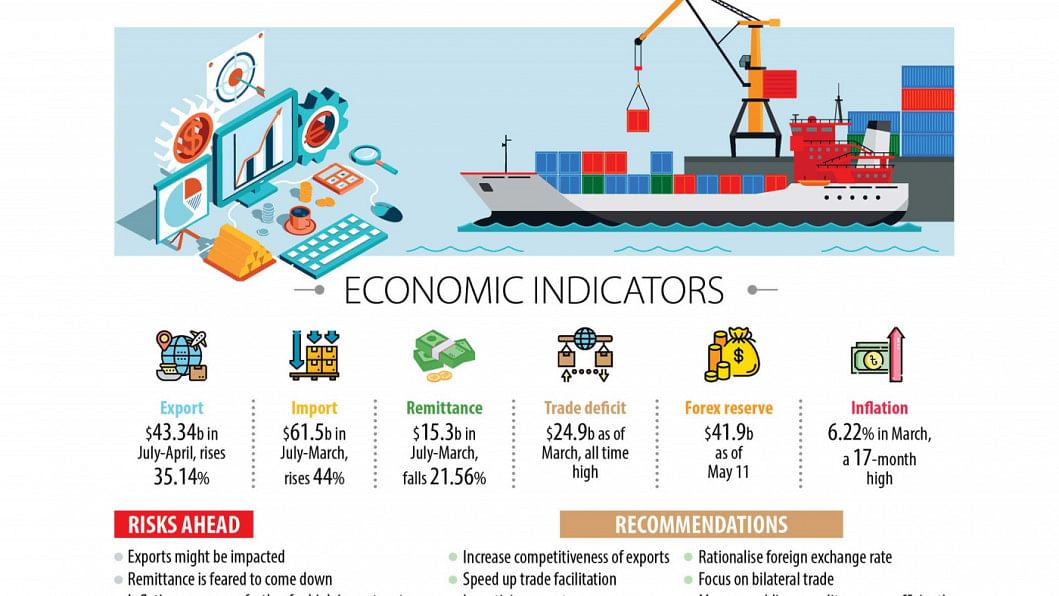

The trade deficit rocketed to an all-time high of $24.90 billion between July and March. Import payments increased 44 per cent year-on-year to $61.5 billion in the first nine months of the current fiscal year.

The higher import payments are now squeezing the reserves as it fell to $41.9 billion on May 11. The reserves are expected to fall further as the Bangladesh Bank's attempts to rein in international purchases have failed to yield any significant results.

Remittance, the cheapest form of US dollars for Bangladesh, dipped 21.56 per cent in the first nine months of the current fiscal year.

The exchange rate of the taka has remained volatile even though the Bangladesh Bank has depreciated the currency against US dollars four times this year. In a major blow to the households, inflation rose to 6.22 per cent in March, a 17-month high.

The only encouraging macroeconomic indicator is export earnings have been stellar. Between July and April, shipments rose 35.14 per cent.

The government is worried about the worsening situation and it was evident on Wednesday when it decided to stop foreign trips of its officials and postponed the implementation of less important projects.

This was not the first such step from the authorities.

In July 2020, the government decided against purchasing new vehicles for the rest of 2020 as part of the austerity measures in the face of falling revenues due to the pandemic. It followed curtailing of 50 per cent of budgetary allocation for expenses of tours at home and abroad of officials and banned all routine travels.

As per forecasts, a recession will come towards the end of 2022 and most of the European countries, dependent mostly on Russia for their energy, will suffer, said Zahid Hussain, a former lead economist at the World Bank's Dhaka office.

"As Bangladesh's export market is excessively dependent on Europe, the shipment, which has bounced back from the pandemic, may be affected."

In Western Europe, the demand for low-skilled labour rose, and many Bangladeshi people are using the opportunities. This also might be impacted.

Many economists are forecasting a recession in the developed economies as the US economy already saw negative growth in the first quarter of 2022, said Rizwanul Islam, a former special adviser for the employment sector at the International Labour Office in Geneva.

In the US, the gross domestic product unexpectedly declined at a 1.4 per cent annualised pace in the January-March quarter.

"Whether another recession will hit or not, the US growth is already stalled. So, it is bad enough to suspect that the major engine of the global economy is faltering," said Islam.

He says GDP growth in Europe was virtually nil and the growth in China also has dropped significantly.

"This will create ripple effects on the rest of the global economy and it will include Bangladesh."

China is Bangladesh's biggest trading partner and the EU and the US combined are the largest export destinations.

Islam said Bangladesh is already experiencing higher inflation and further price increases would make the situation more complex.

Prof Mustafizur Rahman, a distinguished fellow of the Centre for Policy Dialogue, said the fear of stagflation in Europe and the US is growing.

"If the fear translates into reality and stagflation persists, Bangladesh's economy will be impacted."

Stagflation is a situation in which the inflation rate is high, the economic growth rate slows, and unemployment remains steadily high.

Selim Raihan, executive director of the South Asian Network on Economic Modeling, thinks the economy will be impacted by the higher prices of import-based products and the plunge in demand for export goods.

"There are concerns about export growth."

As Bangladesh exports readymade garments in the lower segment in most cases and these are basic items, the shipment might not be hurt to a large degree, said Md Jashim Uddin, president of the Federation of Bangladesh Chambers of Commerce and Industry.

He, however, pointed out that export earnings rose in the recent months because of the adjustment of the prices in line with the costs of raw materials.

"So, if you analyse the quantity and value-addition, it is not much higher."

Amid the worsening global scenario, Kenneth Rogoff warned: "Clearly, emerging markets and poorer developing economies will suffer mightily in the event of a global recession….I am not sure politicians and policymakers are up to the task they may soon confront."

CPD's Rahman urged the government to rationalise the exchange rate and bring efficiency to public expenditure.

Zahid Hussain recommends increasing competitiveness and incentivising export through a floating exchange rate.

"We need to remain alert rather than being alarmed," added Rizwanul Islam.

Prof Raihan called for removing all supply chain flaws so that none can gain unethically.

"The prices of commodities have already gone up. So, if businesses take undue advantage as they did in the case of edible oil, the problem will intensify."

FBCCI's Jashim urged the policymakers to prepare the upcoming budget in light of the present situation of the global economy.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments