Rural deposits fall for first time in five years as inflation bites

Banks in Bangladesh witnessed a sharp decline in deposits in rural areas in the last quarter of 2023, the first fall in five years, data from the central bank showed.

This was driven by an erosion of savings capacity for sustained higher inflation and a rush for cash withdrawals from scam-hit Islamic banks as savers' confidence took a beating after scams made the headlines.

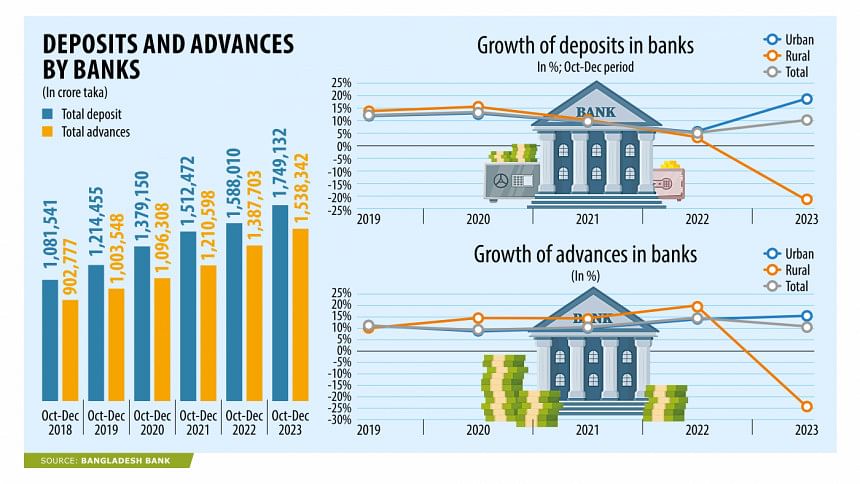

Deposits in the countryside slumped 21 percent year-on-year to Tk 266,415 crore in October-December though overall savings grew nationally on the back of higher inflows of funds to the banking system in cities and towns.

"I think inflation has chipped away at their savings," said Mashrur Arefin, managing director of City Bank.

"Even though they have the same disposable income, people have been forced to dip into their savings because of higher inflation in order to get by."

Since March 2023, consumer prices in Bangladesh have persisted by over 9 percent. Inflation was also at a higher level in the previous year.

Mohammad Ali, managing director of Pubali Bank, also thinks lingering higher inflation could be one reason behind the declining savings in rural areas.

Still, the private commercial lender managed to attract higher deposits from rural and urban customers.

"We opened a large number of sub-branches. This includes 150 sub-branches launched in rural areas," Ali added, adding that rural savings might have been diverted to agencies such as cooperatives that offer higher interest rates.

Ashikur Rahman, a senior economist at the Policy Research Institute of Bangladesh, said one possible explanation is that rural inflation had been slightly higher than urban inflation between October and December.

"This could relatively undermine the savings capacity of rural households in comparison to urban households."

In rural areas, the Consumer Price Index grew 9.99 percent, 9.62 percent, and 9.48 percent in October, November and December respectively, data from the Bangladesh Bureau of Statistics showed. This was 9.72 percent, 9.16 percent, and 9.15 percent in the identical months in urban areas.

Two bankers linked the deceleration in savings flow in rural areas to the ebbing of confidence among people in Shariah-based banks because of widespread allegations of loan scams.

Islamic banks' deposits slipped 11 percent to Tk 56,447 crore in the three months to December, according to the central bank. Thus, the share of rural savings to the total national deposits dropped to 15 percent at the end of 2023.

The gap was filled up by the spectacular growth in urban deposits: banks recorded a 19 percent year-on-year rise in fund inflows to Tk 14,82,717 crore, the highest pace of expansion in five years.

The overall deposit growth in the banking sector stood at 10 percent to Tk 17,49,132 crore, said the Scheduled Banks Statistics of the BB released last week.

"It seems that people, especially the well-offs, are becoming interested in parking money in banks as the interest rates are rising," said Md Mahiul Islam, deputy managing director at BRAC Bank.

The weighted average interest rate on deposits fell to as low as 3.97 percent in June 2022. Since then, banks have begun to raise the interest rate on deposits after liquidity availability was reduced for the purchase of US dollars from the central bank and for meeting credit demand.

In October, the weighted average interest rate grew to 4.55 percent. However, several banks are offering up to 11 percent interest on fixed deposits to attract savers, according to Islam.

"As there is an investment cap on national savings certificates, the higher interest on fixed deposits has encouraged savers to keep money in banks too."

The deposit is expected to grow in the coming months.

BB data also showed banks' loans and advances to the businesses in the rural part of Bangladesh declined 24 percent year-on-year in the final quarter of last year. In contrast, advances to enterprises grew 15 percent in cities.

In total, loans grew 11 percent to Tk 15,38,343 crore at the end of December.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments