A rush to heal exposed banking wounds

In October, a video on social media showed the manager of Social Islami Bank's Agargaon branch breaking down in tears after enduring harsh verbal abuse from frustrated customers seeking to withdraw cash.

It didn't take long to go viral.

The severe cash crunch at Social Islami Bank was far from an isolated incident. Throughout October and November, protests erupted inside the branches of several banks, with angry clients blocking branch managers to recover their money.

The social media footage itself was a testament to the fragile state of the banking sector — a system teetering under the weight of corruption, mismanagement and a crisis of confidence.

At the heart of the turmoil were several Shariah-based banks heavily controlled by S Alam Group, a controversial business conglomerate whose governance failures and financial irregularities cast a shadow over the entire sector.

For years, the true state of Bangladesh's banking system remained obscured by political interference and flawed policies during Sheikh Hasina's 15-year rule.

After her fall in early August, the extent of the dysfunction became painfully clear.

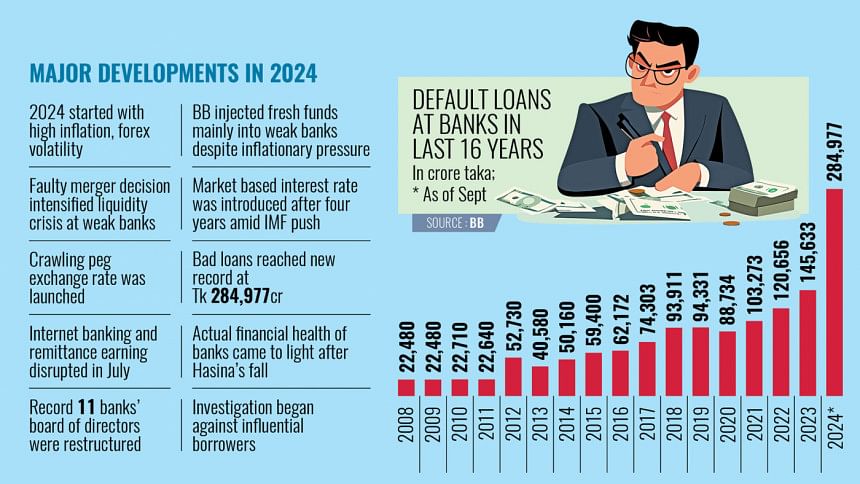

In 2024, the banking sector faced a perfect storm of challenges: liquidity shortages in Shariah-based lenders, foreign exchange instability, soaring inflation, ill-conceived mergers and a seismic increase in non-performing loans.

As part of its $4.7 billion loan programme for Bangladesh, the International Monetary Fund (IMF) made financial sector reforms a key condition.

While the previous government had resisted the demands for reform, the interim administration that came after Hasina's exit moved swiftly to address systemic irregularities and implement a broad reform agenda.

Towards the end of the year, a slew of steps had been taken, though the path to stability remained fraught with difficulty.

A GLOOMY START

The year began under a cloud of economic uncertainty.

Inflation surged to 11.66 percent in July -- the highest in 13 years. The price pressure has been hovering above the 9 percent mark since March 2023.

Despite the government and the central bank's efforts, including multiple policy rate hikes, inflationary pressures showed little sign of easing.

To make things worse, the foreign exchange market faced unrelenting volatility for months.

Over two years, the country's dollar stocks had halved and local currency Taka had depreciated by about 28 percent.

These burdens further strained the banking sector, specially for Shariah-based lenders already wrestling with governance failures and liquidity shortfalls.

BB's LIQUIDITY SUPPORT ALL THROUGH 2024

To protect the banking sector from a collapse, the Bangladesh Bank (BB) injected fresh funds into struggling banks throughout the year.

The lack of securities tied to these liquidity supports fueled inflation and drew criticism for making things difficult in the long run.

Critics argued that such measures merely postponed the reckoning, without addressing the structural flaws undermining the sector.

At the end of 2023, the central bank provided Tk 22,000 crore in emergency funds to seven beleaguered banks, including five Islamic ones, to dress up their balance sheets before the year closed.

Then, in January, the banking regulator provided Tk 12,000 crore to six banks against the special purpose treasury bond issued by the government to settle outstanding payments for fertiliser and power.

Economists came down heavily on these fund injections, arguing that those fueled inflation by "printing money".

Under the interim government, the central bank also extended Tk 22,500 crore as liquidity support to six crisis-hit banks in November.

FAULTY MERGER MOVE

As per the instruction of the previous government, Abdur Rouf Talukder, former governor of the central bank, took an initiative to merge five weak banks with sound ones.

The move prompted massive instability in the banking sector as depositors of the weak banks rushed to withdraw cash.

The decision to merge the weak and problematic Padma Bank with the EXIM Bank in March was the first merger initiative.

Later, names of a few more banks came to light for merger, which eventually caused the lenders to face a liquidity crisis due to massive deposit withdrawals.

However, after the political changeover, the merger decision was cancelled.

THE RETURN OF MARKET-BASED INTERESTS

In May this year, the BB was forced to reintroduce market-based interest rates after shelving it for four years.

The reintroduction was to meet the conditions of the IMF.

The central bank, in line with the government instruction in 2020, introduced a single-digit lending rate which allowed banks to charge a maximum 9 percent interest rate on lending.

Economists criticised the single-digit lending rate policy as it created an opportunity for bad borrowers to take funds at a cheap rate and launder it abroad. The single-digit lending rate also contributed to high inflation.

In July 2023, the central bank withdrew the 9 percent lending rate cap and introduced the Six-Months Moving Average Rate of Treasury bills (SMART) formula for setting the interest rate.

In May this year, the banking regulator scrapped the SMART formula to let the market decide interest rates on commercial lending.

At the same time, the BB introduced a crawling peg exchange rate system for buying and selling foreign currencies and allowed banks to buy and sell US dollars at around Tk 117.

BAD LOANS REACHED RECORD HIGH

At the end of September this year, non-performing loans (NPLs) in the banking sector reached Tk 2,84,977 crore.

The figure included a massive Tk 73,586 crore defaulted in just three months.

Between July and September, bad debts soared by 34.8 percent, according to the BB.

Industry insiders said that the actual scenario of the sector came to light less than two months after the fall of Sheikh Hasina on August 5.

The actual bad loans will likely cross Tk 5,00,000 crore when rescheduled and written-off loans are added, according to them.

BANKING HAMSTRUNG IN MASS UPRISING

Student-led nationwide movement in July and the anti-government campaign in August largely disrupted the banking services.

To quell the movement, the Awami League-led government suspended internet facilities nationwide for almost a week.

These internet outages crippled digital banking, internet banking and remittance earnings.

After the fall of the Awami League government in early August, there were also cash withdrawal restrictions throughout the month.

Besides, most of the automated teller machines (ATMs) were closed for a prolonged period due to security concerns.

BANKING SECTOR UNDER THE INTERIM GOVT

After the formation of the interim government, Ahsan H Mansur, a reputed economist, became the governor of the Bangladesh Bank by replacing Abdur Rouf Talukder.

After assuming office, new governor Mansur restructured the boards of eleven banks, six of which were dominated by the controversial S Alam Group.

The banking regulator also formed three taskforces on non-performing loan management, strengthening project and legal frameworks to continue and accelerate reforms.

Meanwhile, the interim government appointed a pool of experts to prepare a report on the state of the economy.

The expert team submitted their white paper on the economic state of Bangladesh to the chief adviser in December, which dedicated a chapter, titled "Deep into a Black Hole," elaborating on banking irregularities.

The BB initiated forensic audits in crisis-hit banks, efforts to bring back laundered money and strengthening the capacity of the central bank with the help of the World Bank and IMF.

Besides, a government taskforce was formed to investigate money laundering and other misdeeds allegedly carried out by 10 major business groups in the country: S Alam Group, Beximco Group, Summit Group, Bashundhara Group, Gemcon Group, Orion Group, Nabil Group, Nassa Group, Sikder Group and Aramit Group.

While these reform measures marked a critical point to restore public confidence and strengthen regulatory oversight, the road to recovery remains long and uncertain.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments